Why Best Florida Boat Insurance is Essential for Every Boater

Best Florida boat insurance provides protection custom to the unique risks of boating in the Sunshine State, from hurricanes and crowded waterways to year-round saltwater exposure.

Key Coverage Types to Consider:

- Liability Coverage – Protects against damage you cause to others

- Hull Insurance – Covers physical damage to your vessel

- Medical Payments – No-fault coverage for injuries ($1,000-$25,000)

- Emergency Towing – Essential for Florida waters ($50-$100/year)

- Hurricane Protection – Named storm coverage with percentage-based deductibles

Owning a boat in Florida offers access to pristine waters, but it comes with responsibility. In 2024, Florida led the nation in boating accidents according to the U.S. Coast Guard, and insurance rates have been impacted by recent hurricanes like Idalia in 2023.

While Florida law doesn’t require boat insurance for most watercraft, going without it is risky. A single accident can lead to thousands in repairs and liability claims, with ER visits costing $5,000 or more and a basic tow running up to $1,200.

In Florida, boat insurance is among the most expensive in the country. You should expect to pay at least about 1% of your boat’s hull value each year for coverage, and in higher-risk areas like South Florida, that can climb to 4%. The challenge is making sure you get protection that matches Florida’s unique risks without paying for coverage you do not need.

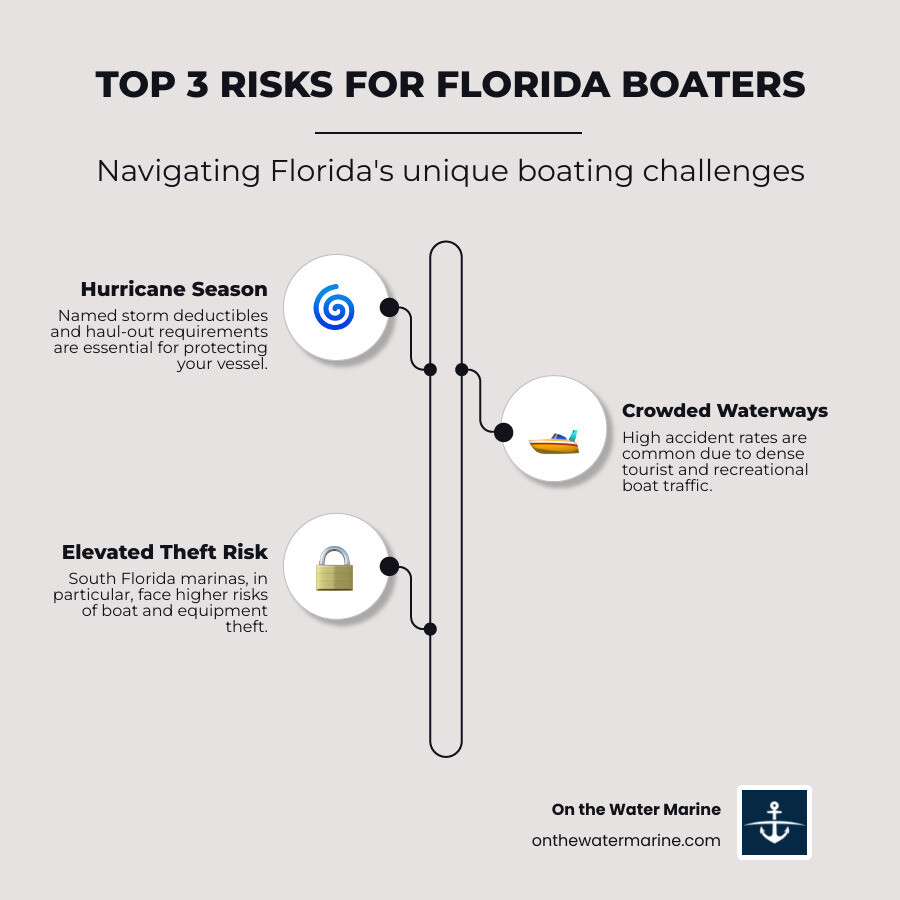

Why Florida Boat Insurance is Unique

Boating in Florida presents a unique set of challenges that demand specialized insurance. A generic policy is often insufficient for the state’s unpredictable weather, busy waterways, and specific marine environment. Understanding these distinctions is the first step toward securing comprehensive protection for your vessel.

The Hurricane Factor

As the hurricane capital of the U.S., Florida’s boat insurance policies are profoundly shaped by storm risk. During hurricane season, the danger to vessels skyrockets, making it a critical insurance consideration.

Most Florida boat insurance policies include a “named storm deductible,” which is typically a percentage (1% to 10%) of your boat’s insured value. For a vessel valued at $50,000, a 5% hurricane deductible means you’d pay $2,500 out of pocket before coverage applies. This can lead to significant costs after a major storm.

After events like Hurricane Idalia in 2023, insurance rates climbed due to the volume of claims. Some carriers may require boat owners to execute a hurricane preparedness plan by moving their vessel to a secure location. Failing to comply could impact your coverage. A robust hurricane plan is essential for both safety and insurance compliance.

Year-Round Use and Crowded Waters

Unlike in many states, Florida’s year-round boating season means increased wear and tear and a higher probability of incidents. More time on the water naturally translates to more risk.

Florida’s popular waterways are also often crowded, especially with tourist boaters who may be inexperienced. This high traffic contributes to Florida leading the nation in boating accidents in 2024 and increases the risk of collisions and other liability incidents.

Add the corrosive effects of saltwater, and it’s clear why robust Florida boat insurance is necessary. Your policy must account for these heightened risks, protecting you from natural disasters and the everyday realities of Florida’s busy waters.

Decoding Your Policy: Essential Coverage for Florida Waters

Understanding your boat insurance policy is key to ensuring you have the right protection for Florida’s unique environment. Let’s break down the essential coverages, policy structures, and critical add-ons for Florida boaters.

Core Protections Every Boater Needs

These are the foundational coverages that shield you from the most common and costly boating incidents:

- Liability Coverage: Protects you financially if you’re responsible for damage to another boat or property, or injury to another person. With Florida’s crowded waters, the risk of a costly accident is high. Without it, you could face significant out-of-pocket expenses, including legal fees.

- Hull Insurance (Physical Damage): Covers damage to your own boat, including the hull, motor, and attached equipment from events like collision, fire, theft, or storms. This is a must-have in Florida, where storm damage can be extensive.

- Medical Payments (Med-Pay): Helps pay for medical expenses for you or your passengers after an accident, regardless of fault. It’s an affordable layer of protection, with an ER visit in Florida potentially costing $5,000 or more.

- Uninsured/Underinsured Boater Coverage: Protects you if you’re in an accident with a boater who has insufficient or no insurance. Since Florida doesn’t mandate boat insurance, this is a sensible coverage to have.

For a deeper dive, check out our guide: What does boat insurance actually cover?

Policy Structures: Agreed Value vs. Actual Cash Value

When insuring your boat’s hull, you’ll choose between two valuation methods:

- Agreed Value: You and the insurer agree on the boat’s value when the policy is written. In a total loss, you receive that amount, regardless of depreciation. This is preferred for newer or custom boats to protect your full investment.

- Actual Cash Value (ACV): This pays the boat’s current market value at the time of loss, including depreciation. Premiums are often lower, but the payout can be significantly less. This is typically for older or lower-value boats.

Some policies also offer Replacement Cost Coverage for new boats, which buys you a brand-new replacement if your boat is totaled within a specific timeframe. Learn more in Demystifying Boat Insurance.

Must-Have Add-Ons for Florida Boaters

These specialized coverages address risks common to our state:

- Emergency Towing & Assistance: A basic tow in Florida can cost $500 to $1,200. This affordable add-on covers towing, jump starts, fuel delivery, and soft ungroundings.

- Fishing Gear & Electronics Coverage: Standard hull policies often don’t fully cover expensive rods, reels, and marine electronics. This add-on protects your investment in your gear.

- Fuel Spill & Wreckage Removal: If your boat sinks or leaks fuel, you are liable for cleanup and removal costs. This coverage handles those potentially astronomical expenses.

- Bahamas & Caribbean Navigation Endorsements: If you plan to cruise beyond U.S. waters, you’ll need an endorsement to extend your coverage to international destinations.

Navigating the Costs and Requirements for the Best Florida Boat Insurance

The cost of boat insurance in Florida varies widely. Understanding the key cost factors, legal requirements, and how you use your boat is crucial for finding a policy that fits your budget and needs.

Key Factors That Determine the Cost of the Best Florida Boat Insurance

Several variables influence your premiums:

- Boat Type: High-performance boats, PWCs, and large yachts typically cost more to insure than fishing boats or sailboats.

- Boat Value and Length: More expensive and larger boats have higher premiums due to higher replacement costs.

- Engine Horsepower: High-horsepower engines are associated with higher risk, leading to increased rates.

- Boating Experience & Claims History: Experienced operators with a clean record often get better rates. A history of claims will likely increase premiums.

- Navigation Area: Boating in crowded or storm-prone areas can increase rates compared to sheltered inland waters.

- Storage Location: Secure storage (dry-dock, secure marina) can sometimes lead to discounts.

Average premiums for many Florida boats often start around $1,000 per year and frequently run higher, especially as you move farther south or insure larger, more powerful, or higher-value vessels. For more details, see How much does boat insurance cost?.

Is Boat Insurance Legally Required in Florida?

For most recreational boats, Florida law does not mandate boat insurance. However, you’ll likely still need it for these reasons:

- Marina Requirements: Most marinas require proof of liability insurance to dock your vessel, protecting them from damage.

- Lender Mandates: If you have a boat loan, your lender will require you to carry comprehensive coverage to protect their investment.

- Personal Risk: Without insurance, you are fully exposed to the massive financial costs of an accident, theft, or natural disaster.

How Boat Usage Impacts Your Policy

How you use your boat is a major factor in your policy and cost:

- Personal Recreational Use: This is the most common category, covering pleasure boating and fishing. Policies are designed for this standard usage.

- Charter and Guide Operations: If you take paying passengers, you need commercial marine insurance. A personal policy will not cover business use.

- Tournament Fishing Coverage: Competitive anglers may need add-ons to cover specialized equipment or tournament entry fees.

- Commercial Use Exclusions: Be aware that any for-profit activity, even if occasional, can void your personal policy if you don’t have the proper commercial endorsement.

Your Strategy for Finding Comprehensive Protection

Finding the best Florida boat insurance is about securing comprehensive protection, not just the cheapest quote. This requires a strategic approach, using discounts, and understanding the value of a specialized marine insurance agent.

How to Find the Best Florida Boat Insurance for Your Needs

Follow these strategies to find the right balance of coverage and cost:

- Compare Quotes, Not Just Premiums: A cheaper policy might have coverage gaps or high deductibles. Always compare what each policy covers.

- Take a Boater Safety Course: Completing an approved course makes you a safer boater and often qualifies you for a premium discount. You can take a Free Online Safety Course to get started.

- Bundle Your Policies: Ask about bundling your boat insurance with your home or auto provider for multi-policy discounts.

- Install Safety Gear: Equipping your boat with safety features like fire suppression or theft deterrents can sometimes earn you discounts.

- Maintain a Clean Record: A good driving and boating history can help lower your rates.

The Advantage of a Specialized Marine Insurance Agent

While you can get quotes online, an expert makes navigating the complexities of Florida boat insurance much easier. As independent marine insurance brokers, we work for you, not a single insurance company.

- Florida Market Expertise: We understand the unique risks and regulations in Florida, knowing which carriers offer the best hurricane clauses or offshore navigation coverage.

- Access to Multiple Carriers: We shop multiple top-rated and specialized carriers to find the best coverage and price, including policies not available to the general public.

- Custom Policies: We provide personalized service to craft a policy that fits your specific boat, lifestyle, and risk tolerance.

- Claims Assistance Advocacy: If you need to file a claim, we act as your advocate, guiding you through the process to ensure a fair and timely resolution.

- Marine Survey Guidance: We can advise on the need for a marine survey, which is often crucial for securing coverage and accurately valuing your boat.

Choosing an expert agent is the smarter way to shop for boat insurance.

Best Practices for Filing a Claim

Knowing how to file a claim can make a stressful situation smoother:

- Ensure Safety First: Prioritize the safety of everyone involved and address any immediate hazards.

- Document Everything: Take photos and videos of all damage and the scene. Collect contact information from witnesses and other parties.

- Mitigate Further Damage: Take reasonable steps to prevent more damage, like pumping out water. Keep receipts for any emergency services.

- Contact Your Agent Immediately: Notify us as soon as possible. We can guide you on the next steps and explain your coverage.

- Keep Detailed Records: Maintain a log of all communications with your agent, the insurer, and repair shops.

Frequently Asked Questions about Florida Boat Insurance

Here are answers to some of the most common questions we receive about boat insurance in Florida.

Does my homeowners insurance cover my boat in Florida?

Typically, no. A homeowners policy may offer minimal coverage for very small, low-powered boats like canoes, but it’s inadequate for most vessels. It usually excludes liability away from your property, on-water collisions, and the full value of your boat and equipment. A separate marine policy is necessary for comprehensive protection against boating-specific risks.

How does a hurricane deductible work?

A hurricane deductible is separate from your standard deductible and applies only to damage from a named storm. It is usually a percentage (1% to 10%) of your boat’s insured hull value. For example, on a $100,000 boat with a 5% hurricane deductible, you would be responsible for the first $5,000 of damage. It’s crucial to understand this potential out-of-pocket cost when planning for storm season.

What happens if I don’t have boat insurance in Florida?

While not always legally required, going without boat insurance is a major financial risk. You would be personally responsible for:

- Full Liability: All costs if you cause an accident, including property damage, medical bills, and legal fees.

- Repair Costs: The full cost to repair or replace your boat if it’s damaged, stolen, or destroyed.

- Salvage and Removal: The expensive cost of removing your boat if it sinks.

- Limited Access: You may be denied access to marinas or boatyards that require proof of insurance.

- Loan Default: If your boat is financed, you would be in breach of your loan agreement, which requires insurance.

Conclusion: Secure Your Peace of Mind on the Water

Boating in Florida is a privilege, offering unparalleled access to some of the world’s most beautiful waterways. But this privilege comes with unique responsibilities and risks that demand specialized insurance protection. From the ever-present threat of hurricanes and the challenges of navigating crowded waterways to the specific needs of different boat types and usage, Florida boaters face a distinct set of circumstances.

The best Florida boat insurance isn’t a one-size-fits-all product; it’s a carefully constructed shield custom to your vessel, your lifestyle, and the unique marine environment of the Sunshine State. Understanding essential coverages like liability, hull, and medical payments, knowing the difference between Agreed Value and Actual Cash Value, and recognizing the importance of Florida-specific add-ons like emergency towing and hurricane deductibles are all vital steps.

As independent marine insurance brokers, we specialize in navigating these complexities. Our expertise in the Florida market, combined with access to a wide network of top-rated carriers, means we can offer you personalized service and custom policies that truly meet your needs. We’re here to ensure you get comprehensive coverage without overpaying, allowing you to focus on what you love most: enjoying the water.

Ready to find the right protection for your vessel? Explore your Florida Boat Insurance options and get a personalized quote today.

Related Articles

Why Boat Insurance Matters for Florida Boaters Boat insurance for Florida is not legally required by state law for most private vessels, but it’s essential financial [...]

Why Commercial Fishing Insurance is Your Lifeline Commercial fishing insurance is specialized coverage designed to protect fishing vessel owners and operators from the unique risks of [...]

Why Canal Cruiser Insurance Matters for Every Boat Owner Canal cruiser insurance is specialist coverage designed to protect narrowboats, barges, widebeams, and other inland waterway vessels [...]