Why Boat Detailing Businesses Need Specialized Insurance Coverage

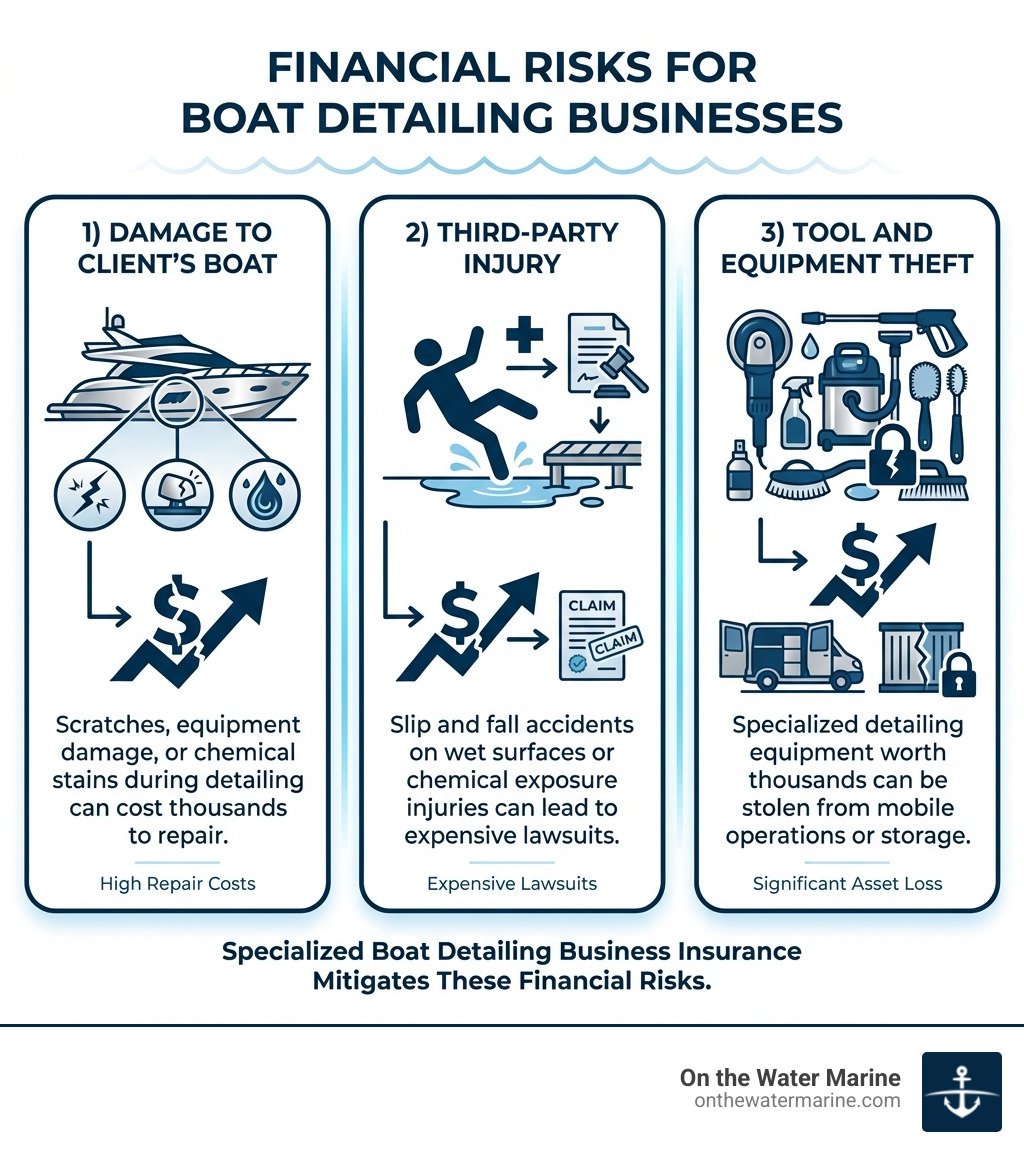

Boat detailing business insurance protects your company from unique risks, from damaging a client’s yacht to liability claims for slips on a wet deck. Without the right coverage, a single mistake could sink your business financially.

Quick Answer: Essential Coverage Types

- Marine General Liability (MGL) – Covers third-party injuries and property damage ($400-$1,100/year for $1M coverage)

- Marine Operators Legal Liability (MOLL) – Protects you when a client’s boat is damaged while in your care

- Workers’ Compensation – Required by law in most states if you have employees

- Commercial Auto Insurance – Covers your vehicles and equipment during mobile detailing jobs

The booming marine industry means more business but also more risk. You work with harsh chemicals, expensive equipment, and high-value vessels on slippery docks. These factors create significant liability exposure.

Most marinas and high-value clients won’t let you work without proof of insurance, locking you out of profitable jobs. The challenge is that generic small business insurance isn’t enough. You need specialized marine coverage that understands the unique risks of working on and around watercraft.

Why Your Boat Detailing Business Needs Insurance

Running a boat detailing business means navigating a sea of potential risks, making the right boat detailing business insurance a necessity, not a luxury. This coverage is indispensable for several core reasons.

First, insurance provides crucial financial protection. Accidents are a part of business, and working with expensive vessels and potent chemicals increases the stakes. A scratched hull, damaged electronics, or a client slipping on a wet deck can lead to devastating out-of-pocket expenses for repairs, medical bills, and legal settlements. Insurance also covers legal defense costs, which can be astronomical even for baseless claims.

Furthermore, client requirements and access to marinas and shipyards often mandate specific insurance. High-net-worth individuals and most marine facilities will require a Certificate of Insurance (COI) before allowing you on their property or near their vessels. Without it, you’re barred from lucrative jobs and prime locations. It’s common practice to list marinas as “additional insureds” on your policy, which we can help arrange.

Finally, carrying comprehensive boat detailing business insurance builds professional credibility. It signals to clients that you are a responsible, well-managed business, differentiating you in a competitive market and providing them with peace of mind.

Common Risks in the Detailing Industry

The marine environment creates a specific set of common risks in the detailing industry that your insurance must address.

- Accidental Damage to Vessels: This is a primary concern, ranging from minor scratches and cosmetic damage to severe issues like damage to electronics or equipment. A slip with a buffer or using the wrong chemical can lead to costly repairs. Marine Operators Legal Liability (MOLL) is designed for these incidents.

- Third-Party Bodily Injury: Docks are wet and busy. A client or passerby could suffer slips and falls on wet surfaces you’ve created or be injured by your equipment. General Liability is your first line of defense here. Knowing What should I do immediately after a boat accident? is crucial, even if it’s not your boat.

- Chemical Spills and Environmental Liability: An accidental leak of industrial-strength cleaners into the water can result in hefty fines and cleanup costs. Specialized pollution liability coverage is vital to protect against this risk.

The Importance of a Certificate of Insurance (COI)

A Certificate of Insurance (COI) is your passport to opportunity and a badge of professionalism.

A COI is a document from your insurer that summarizes your coverage, proving you have active policies with specific limits and dates. It’s essential for:

- Proving You Are Insured: A COI instantly builds trust with clients, especially owners of high-value vessels.

- Gaining Access to High-Value Jobs: Many marinas, boatyards, and discerning clients have strict insurance requirements. A COI is your key to accessing these profitable market segments.

- Meeting Contractual Obligations: Service agreements often specify required insurance coverage. A COI confirms your compliance, and obtaining one can be remarkably fast for last-minute jobs.

Essential Policies for Boat Detailing Business Insurance

Building a robust boat detailing business insurance portfolio requires specialized marine policies, as generic business insurance won’t cover the unique environment we operate in. It’s about building a comprehensive insurance package with the right coverage types. While it’s useful to know What does boat insurance typically cover? broadly, a detailing business needs specific adaptations.

Marine General Liability (MGL)

Marine General Liability (MGL) is the foundational policy for any marine business. It protects you from third-party claims for bodily injury, property damage, and personal/advertising injury resulting from your operations.

For example, if a client slips and falls on a wet surface you created, MGL would cover their medical expenses and your legal defense. If you damage property other than the boat you’re detailing (e.g., a dock sign), MGL covers the repairs. It also covers bodily injury to non-employees and provides premises liability for your workshop or office. This essential coverage is affordable, with a typical $1 million policy costing a sole proprietor around $1,000 per year. This is the core of what What does liability boat insurance cover? means for your operations.

Marine Operators Legal Liability (MOLL)

While MGL covers general risks, Marine Operators Legal Liability (MOLL)—also known as Ship Repairers Legal Liability—is essential for detailers. It protects you when a client’s boat is in your care, custody, and control.

If you accidentally gouge a gelcoat with a buffer or use a chemical that discolors paint, MOLL is designed specifically for covering damage to the client’s boat for which you are legally liable. This protection is essential for hands-on work and may also cover damage that occurs if you need to move the vessel or perform sea trials. Without MOLL, any damage to a client’s boat could come directly out of your pocket.

Other Key Coverages to Consider

A truly comprehensive plan requires additional layers of protection:

- Workers’ Compensation Insurance: Required by law in most states if you have employees, this covers medical expenses and lost wages for work-related injuries.

- Commercial Auto Insurance: This is non-negotiable for mobile detailers. It covers your work vehicles, trailers, and equipment in transit, as personal auto policies won’t cover business use.

- Inland Marine for tools and equipment: This protects your valuable assets (buffers, polishers, vacuums) from theft, loss, or damage, whether in transit, at a job site, or in storage.

- Fuel Spill Liability Coverage: This is critical if you work near fuel systems, protecting you from costly cleanup and environmental penalties.

- Commercial Umbrella Insurance: This policy provides extra liability coverage that kicks in once the limits of your primary policies (like MGL) are exhausted, offering peace of mind when working on high-value vessels.

Understanding the Cost and Policy Limits

When it comes to boat detailing business insurance, one of the first questions we hear is, “How much does it cost?” The simple truth is, there’s no one-size-fits-all price. Insurance premiums are as unique as our business, influenced by a multitude of factors.

Understanding how premiums are calculated is key to finding the right balance between cost and comprehensive protection. It’s a complex formula that takes into account our specific risks, the services we offer, and our operational footprint. For those wondering if Are you overpaying for boat insurance?, delving into these factors is the first step.

How Much Does Boat Detailing Insurance Cost?

Let’s talk numbers. Based on industry statistics, average cost statistics for general liability coverage for boat cleaning services in America range between $400 and $1,100 per year for $1 million in coverage. For a single owner with no employees, a basic $1 million policy will typically run us about $1,000 per year, or roughly $80 per month. This gives us a ballpark figure, but our actual premium will depend on several factors influencing our premium:

- Number of Employees: More hands on deck generally means more potential for accidents or claims. Insurance providers will adjust premiums based on our crew size.

- Annual Revenue: Higher revenue often indicates a larger volume of work, which can correlate with increased exposure to risk.

- Location and Service Area: Insurance costs can vary significantly by state, county, and even specific zip code due to differing legal environments, local regulations, and regional risk assessments. Working in hurricane-prone areas, for example, might influence certain aspects of coverage.

- Types of Services Offered: Do we offer basic washes, or do we dig into complex oxidation removal, ceramic coatings, or engine bay detailing? Services that involve more aggressive chemicals, specialized machinery, or operating client vessels will likely incur higher premiums due to the increased risk profile.

- Policy Length and Limits: Opting for higher coverage limits or longer policy terms (e.g., annual vs. monthly) can also impact the overall cost.

Choosing the Right Policy Limits for your boat detailing business insurance

Selecting the appropriate policy limits for your boat detailing business insurance is a critical decision that balances cost with adequate protection. While typical limits often start at $1 million, a $2 million option is also common. The choice isn’t just about what’s affordable, but what truly safeguards our business.

We need to start by assessing our business’s unique risks. Consider the value of the vessels we typically work on. Are we detailing small fishing boats or million-dollar luxury yachts? A scratch on a modest vessel is one thing; a mistake on a high-value yacht could lead to a claim far exceeding a basic $1 million policy. This is where working on high-value yachts necessitates higher limits. The potential cost of repairs or even replacement of damaged components on such vessels can quickly escalate.

Furthermore, marina requirements for limits often dictate our minimum coverage. Many marinas, especially those catering to larger or more expensive boats, will mandate that contractors carry liability limits of $2 million or even higher. Failing to meet these requirements means we simply won’t be allowed to work there.

Finally, we should consider when to consider an umbrella policy. If our primary liability policies (MGL, Commercial Auto) have limits of $1 million, but the potential for a catastrophic claim (e.g., a severe injury or extensive damage to a very expensive boat) could reach $3 million or more, a Commercial Umbrella policy provides that crucial extra layer of protection, extending our liability coverage beyond the limits of our underlying policies. It’s an affordable way to add significant peace of mind.

Beyond Insurance: Additional Ways to Protect Your Business

While boat detailing business insurance is our financial safety net, it’s just one piece of the puzzle. We believe in proactive risk management and fostering creating a culture of safety within our operations. This not only minimizes the chance of accidents and claims but also improves our reputation and efficiency.

Legal and Operational Safeguards

Beyond the insurance policy itself, several legal and operational safeguards can significantly strengthen our business’s resilience.

One of the first steps we recommend is forming an LLC or corporation. While general liability insurance protects our business assets, an LLC (Limited Liability Company) or corporation creates a legal barrier between our business and our personal assets. This means that in the event of a lawsuit, our personal savings, home, and other assets are typically protected from business liabilities. As one source noted, an LLC protects personal assets, but we still need business insurance to protect business assets from lawsuits.

Equally important is using legally robust client contracts. These documents should clearly define the scope of work, pricing, payment terms, and explicitly outline responsibilities and liabilities. Good contracts minimize misunderstandings and provide a clear framework for dispute resolution, potentially preventing lawsuits before they even start.

We must also commit to staying current on licenses and permits. Operating legally is non-negotiable. This includes general business licenses and any specific permits required for working in marinas, using certain chemicals, or operating in particular jurisdictions. We recommend that you Check what your local area requires as requirements vary widely. Non-compliance can lead to fines, operational shutdowns, and damage to our reputation.

Finally, maintaining safety protocols and training is paramount. This includes proper handling and disposal of chemicals, training on safe operation of buffers and pressure washers, wearing appropriate personal protective equipment (gloves, eye protection, respirators), and establishing clear procedures for working on wet surfaces. A culture of safety not only protects our team and clients but also demonstrates due diligence, which can be favorable if a claim ever arises.

Creating a Disaster-Ready Business

In the marine industry, we’re all too familiar with the unpredictable nature of weather and other unforeseen events. That’s why creating a disaster-ready business is a critical component of our overall risk management strategy.

The importance of a continuity plan cannot be overstated. Statistics show that 25% of all businesses fail after experiencing a disaster. A well-thought-out plan helps us quickly recover from disruptions, whether it’s a hurricane, a fire, or even a major equipment breakdown. This plan should include steps for emergency operations, client communication, and financial recovery. As we know, Having a Hurricane Plan is Essential for any business operating in coastal regions.

Part of this readiness involves protecting your equipment and data. This means having secure, off-site storage for our valuable detailing equipment when not in use, and backing up all critical business data (client lists, invoices, scheduling information) to cloud-based services. If our mobile detailing rig is damaged or stolen, having our client contacts safe means we can still operate. FEMA provides excellent guidance on How to stay in business after a disaster, emphasizing proactive planning.

How to Get the Right Coverage for Your Detailing Business

Finding the right boat detailing business insurance can feel like navigating the insurance market through a dense fog. With so many options and specialized terms, it’s easy to get lost. Our goal is to help you in understanding your options and finding the clearest path to comprehensive protection. For a broader perspective on how we approach this, consider The Smarter Way to Shop for Boat Insurance.

Finding the Best Policy for Your Needs

When it comes to finding the best policy for your needs, you essentially have two main options for purchasing insurance: going directly to an insurance carrier or working with an independent marine insurance broker like us.

While some online providers offer quick quotes and immediate policy issuance, especially for general liability, the unique needs of boat detailing often require a more custom approach. This is where the advantage of working with a marine insurance specialist comes into play. We are independent brokers, which means we don’t work for a single insurance company. Instead, we shop multiple top-rated carriers, including specialized ones, to find the best coverage and price for our clients.

Our expertise means we understand the nuances of marine liability, the specific risks associated with detailing, and the requirements of marinas and high-value clients. We have access to multiple coverage options custom for marine businesses that might not be readily available online or through generalist insurance agents. Our personalized service and expert guidance ensure that we craft an insurance package that truly fits our unique business, rather than a generic, one-size-fits-all solution.

What to Look for in a Boat Detailing Business Insurance Policy

Once we’re exploring options, it’s important to know what to look for in a boat detailing business insurance policy.

First and foremost, prioritize custom coverage. Our policy should specifically address the risks inherent in boat detailing, such as Marine General Liability for third-party claims and Marine Operators Legal Liability for damage to vessels in our care. A generic business policy simply won’t offer this specialized protection.

We must also ensure there’s a clear explanation of what’s covered. Don’t hesitate to ask questions. We’ll help you understand the policy wording, including all endorsements and conditions, so you know exactly what to expect.

A responsive claims service is incredibly important. If an accident happens, we want an insurer that processes claims efficiently and professionally. A slow or difficult claims process can lead to significant downtime and financial strain for our business. Understanding Navigating a Boat Insurance Claim before a claim ever happens can save us a lot of stress.

Finally, equally important is understanding exclusions. Every insurance policy has limitations—things it doesn’t cover. We’ll help you identify any gaps in coverage that might leave your business vulnerable, allowing you to make informed decisions about additional policies or risk management strategies.

Conclusion: Secure Your Business and Sail with Confidence

Navigating the waters of boat detailing business insurance can seem complex, but with the right guidance, it becomes a straightforward journey to peace of mind. We’ve explored why this specialized coverage is non-negotiable for our business, protecting us from the unique risks of accidental damage, third-party injuries, and environmental liabilities.

Remember the key coverages we discussed: Marine General Liability (MGL) to shield us from general third-party claims, Marine Operators Legal Liability (MOLL) for those critical moments when a client’s vessel is in our care, and essential additions like Workers’ Compensation, Commercial Auto, Inland Marine for our valuable equipment, and Commercial Umbrella for an extra layer of protection. These policies aren’t just expenses; they are an investment in our business’s future, safeguarding our hard-earned reputation and bottom line.

At On the Water Marine, we pride ourselves on being independent marine insurance brokers. We understand that our detailing business isn’t one-size-fits-all, and neither should our insurance be. We can help you steer the complexities of marine insurance by shopping multiple top-rated carriers, including specialized ones, to find the best boat insurance coverage and price custom specifically for your needs. Our personalized service, expert guidance, and access to policies not typically available online mean you get comprehensive protection designed for the unique demands of boat detailing.

Don’t let the fear of the unknown leave your business vulnerable. Secure your business and sail with confidence, knowing you’re fully protected.

Related Articles

Why Best Florida Boat Insurance is Essential for Every Boater Best Florida boat insurance provides protection custom to the unique risks of boating in the Sunshine [...]

Why Boat Insurance Matters for Florida Boaters Boat insurance for Florida is not legally required by state law for most private vessels, but it’s essential financial [...]

Why Commercial Fishing Insurance is Your Lifeline Commercial fishing insurance is specialized coverage designed to protect fishing vessel owners and operators from the unique risks of [...]