Why Standard Policies Often Miss the Mark in Florida Waters

Boat insurance coverage Florida is not as straightforward as many vessel owners assume. While Florida law does not mandate marine insurance for recreational use, lenders and marinas typically do—and the policy they require may not align with the protection your vessel actually needs.

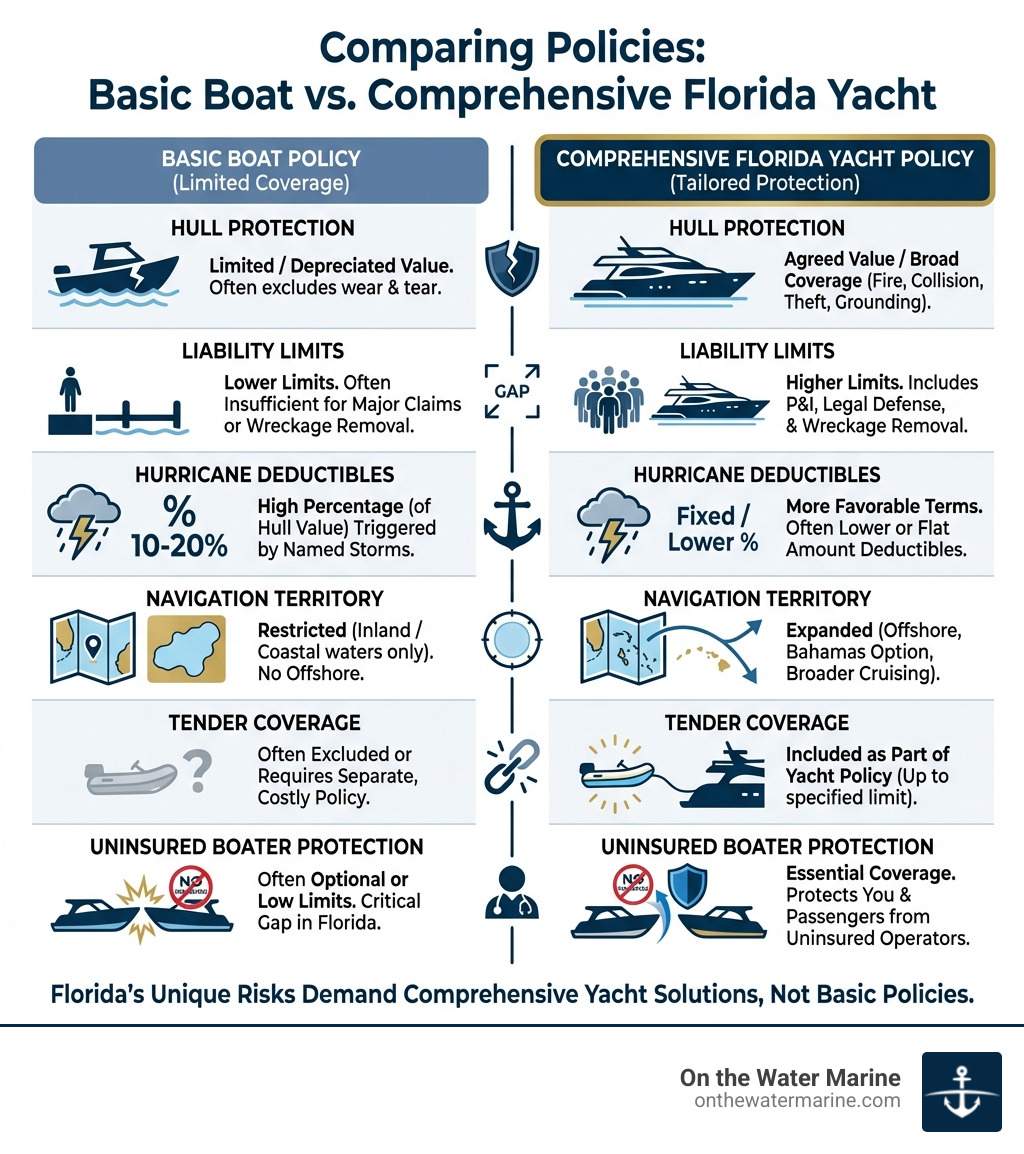

Key Coverage Types for Florida Boat Owners:

- Hull Insurance – Covers physical damage to your vessel from storms, collisions, fire, theft, and grounding

- Protection & Indemnity (P&I) Liability – Protects you from bodily injury claims, property damage to others, legal defense costs, and wreckage removal

- Uninsured/Underinsured Boater Coverage – Critical in Florida, where many boaters operate without adequate insurance

- Named Storm/Hurricane Coverage – Often includes percentage-based deductibles triggered when a storm is officially named

- Medical Payments – Covers medical expenses for you and your passengers, regardless of fault

Florida-Specific Considerations:

- No state-mandated minimum coverage requirements

- Geographic location affects premiums (South Florida vs. Panhandle vs. inland lakes)

- Navigation territory limits may restrict offshore or Bahamas cruising

- Hurricane season and storage location significantly impact coverage terms and cost

The problem is not a lack of available policies. It is that many boat owners find gaps in their coverage only after something goes wrong—when a claim is denied, a deductible is far higher than expected, or a named storm exclusion applies.

Florida’s unique risks make this especially consequential. Year-round boating activity, crowded waterways, tropical weather systems, and saltwater exposure create a different risk profile than most other states. A policy designed for a freshwater lake in the Midwest may leave a coastal cruiser in Fort Lauderdale significantly underprotected.

I’m Eric Fisher, founder of On The Water Marine Insurance, and I’ve spent over a decade specializing in boat insurance coverage Florida for owners of larger vessels navigating the state’s complex marine insurance landscape. After years managing national yacht insurance divisions for major carriers, I launched On The Water Marine to provide custom coverage solutions that address the real exposures Florida yacht owners face.

Florida’s Insurance Landscape: Legal Mandates vs. Practical Necessities

When discussing boat insurance coverage Florida, one of the most common misconceptions we encounter is the belief that because the state does not legally mandate insurance for recreational vessels, it is an optional expense. This is a critical point of misunderstanding. Florida is one of only a few states, alongside Arkansas, Utah, and Hawaii, that do not have state-mandated minimum boat insurance requirements for recreational use. This means you generally won’t face legal penalties from the state for operating without a policy.

However, the absence of a state law does not equate to an absence of requirements. Many external factors often necessitate coverage, especially for owners of larger, higher-value vessels.

Why Marinas and Lenders Mandate Coverage

While the state of Florida may not require you to carry boat insurance, other entities often do. If you have financed your vessel, your lender will almost certainly require you to maintain comprehensive boat insurance coverage Florida. This protects their financial interest in the asset. They will typically specify minimum coverage levels, which may include hull coverage, comprehensive and collision protection, and liability insurance. Without proof of such coverage, your loan agreement could be in default, leading to potential financial complications.

Similarly, if you plan to dock your vessel at a marina, yacht club, or use storage facilities, they will almost invariably require proof of insurance. This is primarily to protect them from liability if your vessel causes damage to their property or other vessels, or if an incident occurs involving your boat while it is on their premises. Marinas typically request a Certificate of Insurance (COI) annually, detailing your liability limits and often including specific clauses like wreck removal coverage. These requirements are put in place to mitigate their own financial risk and can prevent you from securing a slip or accessing services if not met.

The Limited Scope of a Homeowners Policy

Another common area of confusion is the extent to which a homeowners insurance policy might cover a boat. For most large vessels and yachts, relying solely on a homeowners policy for boat insurance coverage Florida is a significant oversight, and usually, an insufficient approach.

Homeowners insurance typically offers very limited, if any, coverage for boats. This limited coverage usually applies only to small, non-motorized boats, such as canoes or kayaks, and often only when they are stored on your property. The moment your vessel hits the water, or if it is a motorized boat of any significant size or value, the coverage provided by a homeowners policy is likely to be minimal or entirely absent. Critically, it generally does not provide liability coverage for incidents that occur while your boat is in use on the water. This means if your vessel causes bodily injury to another person or damages another boat or property, your homeowners policy may offer no protection, leaving you personally exposed to potentially substantial financial and legal repercussions. A dedicated boat insurance policy is designed to address these specific marine risks, providing the specialized protection a valuable vessel and its owner truly need.

To dig deeper into the nuances of marine coverage, you might find our guide on Demystifying Boat Insurance helpful. For a comprehensive understanding of why specialized insurance is your anchor, visit Why Boat and Yacht Insurance Should Be Your Anchor.

Deconstructing Core Coverages for Florida Boaters

Understanding the core components of boat insurance coverage Florida is paramount for any vessel owner, especially those with larger, higher-value yachts. These coverages are designed to protect against the most common and potentially costly risks associated with marine ownership and operation.

Hull Insurance: Protecting the Vessel Itself

Hull insurance is a foundational element of any comprehensive marine policy. This coverage is designed to protect the physical structure of your vessel—the hull, machinery, and permanently attached equipment—from a wide array of potential damages. In the dynamic Florida marine environment, your vessel faces risks from storms, collisions with other vessels or objects, fire, theft, and even grounding or striking submerged objects. Hull insurance may provide financial protection for repairs or replacement in the event of such a loss.

A key distinction within hull insurance, particularly for higher-value vessels, is between “Agreed Value” and “Actual Cash Value” policies. An Agreed Value policy typically pays a fixed amount for your vessel in the event of a total loss, as determined at the time the policy was issued. This approach often replaces parts “new for old,” without deducting for depreciation. Conversely, an Actual Cash Value (ACV) policy factors in depreciation due to age and wear, potentially paying out less than the original value or replacement cost. For owners of well-maintained or custom-equipped yachts, an Agreed Value policy may offer a more predictable and comprehensive level of protection. To explore these options further, please see our detailed explanation of Agreed Value vs. Actual Cash Value Boat Insurance.

Protection & Indemnity (P&I): Your Liability Shield

Protection & Indemnity (P&I) coverage is arguably one of the most critical aspects of boat insurance coverage Florida, particularly in a state known for its crowded waterways and frequent boating activity. This is your liability shield, designed to protect you financially if you are found responsible for causing bodily injury to other individuals or damage to their property.

P&I coverage may extend to various scenarios, including:

- Bodily injury to passengers on your vessel or on other vessels

- Property damage to other boats, docks, or marine structures

- Legal defense costs incurred if you are sued as a result of an accident

- Pollution liability, which can arise from fuel spills or other environmental damage

- Wreckage removal expenses, which can be substantial after a serious incident

Considering Florida’s high number of boating accidents—836 in 2020, resulting in 79 deaths and 534 reported injuries—the potential for liability is a serious concern. A strong P&I policy can provide essential protection against the significant financial and legal consequences that may arise from such incidents. For more in-depth information, you can review What does liability boat insurance cover?.

Uninsured/Underinsured Boater Coverage in Florida

Given that boat insurance coverage Florida is not legally mandated, the risk of encountering an uninsured or underinsured boater is a very real concern. This coverage is designed to protect you, your passengers, and your vessel if you are involved in an accident with another boater who either has no insurance or insufficient coverage to pay for the damages and injuries they cause.

Uninsured/underinsured boater coverage may extend to:

- Bodily injury expenses for you and your passengers

- Property damage to your vessel

In a busy marine environment like Florida, where many boaters may choose to operate without adequate protection, this coverage can be a vital safeguard. Without it, you could be left to cover significant medical bills or repair costs out of pocket, even if you were not at fault. Matching your uninsured boater limits to your hull value can be a prudent strategy to ensure comprehensive protection.

Key Factors That Shape Your Boat Insurance Coverage Florida

The cost and scope of your boat insurance coverage Florida are not determined by a single factor, but rather a complex interplay of various elements related to your vessel, your boating habits, and the environment in which you operate. Understanding these influences can help you make more informed decisions about your policy.

How Navigation Limits and Storage Affect Your Policy

Where you intend to use and store your vessel significantly impacts your insurance policy. Navigation limits define the geographical area where your vessel is covered. A policy designed for inland lakes, for instance, may not provide coverage for coastal waters, let alone offshore cruising or international voyages to destinations like the Bahamas or Caribbean. If your cruising plans extend beyond typical coastal limits, we would review your policy to ensure it includes the necessary endorsements for extended navigation.

Storage location also plays a crucial role. Premiums may vary depending on whether your vessel is kept in-water at a marina, stored in a dry-stack facility, or kept on a trailer. For Florida boaters, hurricane season lay-up plans are particularly important. Some policies may offer credits for removing your vessel from the water or moving it to a hurricane-rated facility during named storms.

The specific location within Florida can also influence rates. For example, South Florida often sees higher premiums due to year-round boating activity, a higher density of vessels, and increased exposure to tropical weather risks. Central Florida, with its numerous lakes, may have different risk profiles, often resulting in more moderate premiums, while rates in the Panhandle can vary based on specific hurricane exposure and marina locations. These regional differences highlight the importance of a policy custom to your vessel’s home port and typical cruising grounds. Having a robust Hurricane Plan is Essential for any Florida boater.

Understanding Cost-Influencing Factors and Potential Credits

Several other factors contribute to the cost of your boat insurance coverage Florida:

- Vessel Type, Size, and Value: Larger, more powerful, or higher-value vessels typically incur higher premiums. Small boats (under 26 feet) may see annual costs in the range of $250–$500 for basic coverage, while larger vessels or coastal cruisers can range from $600–$2,000+ annually, depending on their value, size, and mooring location.

- Intended Use: Whether your vessel is used for private pleasure, charter, or commercial purposes will significantly affect your policy structure and cost.

- Operator Experience: Boaters with extensive experience or advanced certifications may qualify for certain credits.

- Deductible Choices: Opting for a higher deductible can often lower your annual premium, though it means a larger out-of-pocket expense if a claim arises.

- Claims-Free History: A history of no claims may lead to premium reductions.

- Safety Courses: Completing an approved boating safety course can often qualify you for discounts. Many providers offer credits for this proactive approach to safety. Consider taking a Free Online Safety Course to potentially reduce your premiums.

- Protective Devices: Features like alarm systems, fire suppression systems, or advanced navigation equipment may also lead to credits.

Overall, Florida boat insurance rates tend to be higher than the national average due to the year-round boating season, significant storm exposure, and the inherent risks of saltwater environments. By carefully considering these factors and discussing them with your broker, we can work to identify potential credits and structure a policy that aligns with your specific needs.

Essential Endorsements for the Florida Yacht Owner

For yacht owners in Florida, standard boat insurance coverage Florida often needs to be augmented with specialized endorsements to adequately address the unique risks of the region. These additions provide critical protection that may not be included in a basic policy.

Understanding Your Hurricane Deductible

One of the most critical endorsements for any Florida boater is named storm or hurricane coverage. Given that Florida experiences more named storms than any other state, understanding how your policy responds to these events is paramount. Most policies will include a separate “hurricane deductible,” which is triggered when a named storm impacts your vessel.

This deductible is often percentage-based, commonly 1%, 2%, or even 5% of your vessel’s insured value, rather than a flat dollar amount. For a vessel insured for $500,000, a 2% hurricane deductible would mean a $10,000 out-of-pocket expense before coverage begins. This can be significantly higher than your standard deductible.

Key considerations for your hurricane deductible include:

- Trigger Events: When is the deductible activated? Typically, it’s when a named storm warning is issued for your vessel’s location.

- Haul-Out Agreements: Some policies may offer a reduced hurricane deductible, or even require, that your vessel be hauled out and secured at an approved facility before a named storm.

- Preparedness Plans: Having a documented hurricane preparedness plan for your vessel can be beneficial.

It is crucial to review the specific language in your policy regarding named storm coverage, as terms and conditions can vary significantly by carrier. Our guide, Boat Insurance 101: Don’t Let Hurricane Season Sink Your Boat, offers further insights into this vital aspect of coverage.

Specialized Add-ons for Your Florida Boat Insurance Coverage

Beyond hurricane coverage, several other endorsements are highly recommended for comprehensive boat insurance coverage Florida:

- Towing and Emergency Assistance: While not always included in standard policies, this add-on can be invaluable. Breaking down on the water, especially in remote or offshore areas, can lead to substantial towing fees—potentially $1,000 or more for a single tow. This coverage may provide for on-water towing, jump starts, fuel delivery, and other emergency services.

- Tender/Dinghy Coverage: If you carry a tender or dinghy, it may not be automatically covered under your main policy. An endorsement can provide physical damage and liability coverage for this smaller vessel.

- Personal Effects and Electronics: Your main policy may have limited coverage for personal belongings and valuable marine electronics. An endorsement can provide broader protection for items like fishing gear, navigation equipment, cameras, and other personal property that you keep on board. Fishing gear and electronics, in particular, can represent thousands of dollars in value and are susceptible to theft or damage in Florida’s active boating environment.

- Mechanical Breakdown Coverage: This can provide protection against the cost of repairs for mechanical or electrical failures not caused by an external peril, similar to an extended warranty.

- Dock Contract Liability: For owners who keep their vessel at a marina, this endorsement can provide specialized liability coverage required by some dockage agreements.

These specialized add-ons allow us to tailor your boat insurance coverage Florida to the specific needs and usage patterns of your vessel, ensuring more robust protection. For a broader overview of what a comprehensive policy might cover, refer to What Does Boat Insurance Actually Cover?.

Conclusion: Securing a Policy Built for Your Vessel

Navigating the complexities of boat insurance coverage Florida requires more than just a basic understanding of policy types. For owners of 35’+ vessels, the unique risks posed by Florida’s vibrant yet challenging marine environment demand a deeply customized approach. We have explored why state mandates differ from practical necessities, the critical role of core coverages like Hull and P&I, and the importance of specialized endorsements, particularly those addressing named storms and specific equipment.

The true value in marine insurance lies not in finding the cheapest option, but in securing a policy that accurately reflects your vessel’s value, your cruising habits, and the specific exposures you face. A generic policy, or one not expertly custom, may leave you vulnerable to significant financial loss when you need it most.

As an independent marine insurance broker, we specialize in understanding these nuances. We work with multiple top-rated carriers, including those offering highly specialized policies, to craft solutions that align with the sophisticated needs of yacht owners. For owners of 35’+ vessels seeking a detailed policy review, a professional consultation can clarify your options and ensure your coverage aligns with your specific risks.

Related Articles

Why Understanding Boat Rental Insurance Coverage Matters Boat rental insurance coverage typically includes liability protection, damage to the vessel, medical payments, and fuel spill liability, with [...]

Understanding What Drives Marine Insurance Costs for Professional Guides How much does fishing guide insurance cost is one of the most common questions from guides starting [...]

Why Marine Repair Business Insurance is the Foundation of Your Operation Marine repair business insurance is specialized coverage designed to protect boat repair shops, shipyards, and [...]