Why Boat Insurance Matters for Florida Boaters

Boat insurance for Florida is not legally required by state law for most private vessels, but it’s essential financial protection. While you won’t face state penalties for forgoing coverage, lenders typically require it if you’re financing your boat, and most marinas won’t let you dock without proof of liability coverage. Beyond these practical requirements, Florida’s unique risks—from hurricanes to heavy coastal traffic—make specialized boat insurance a smart investment to protect your watercraft.

Key facts about Florida boat insurance:

- Not state-mandated for private recreational vessels

- Required by lenders if you’re financing your boat

- Required by marinas for docking and storage (proof of liability)

- Homeowners policies don’t cover motorized boats or on-water use

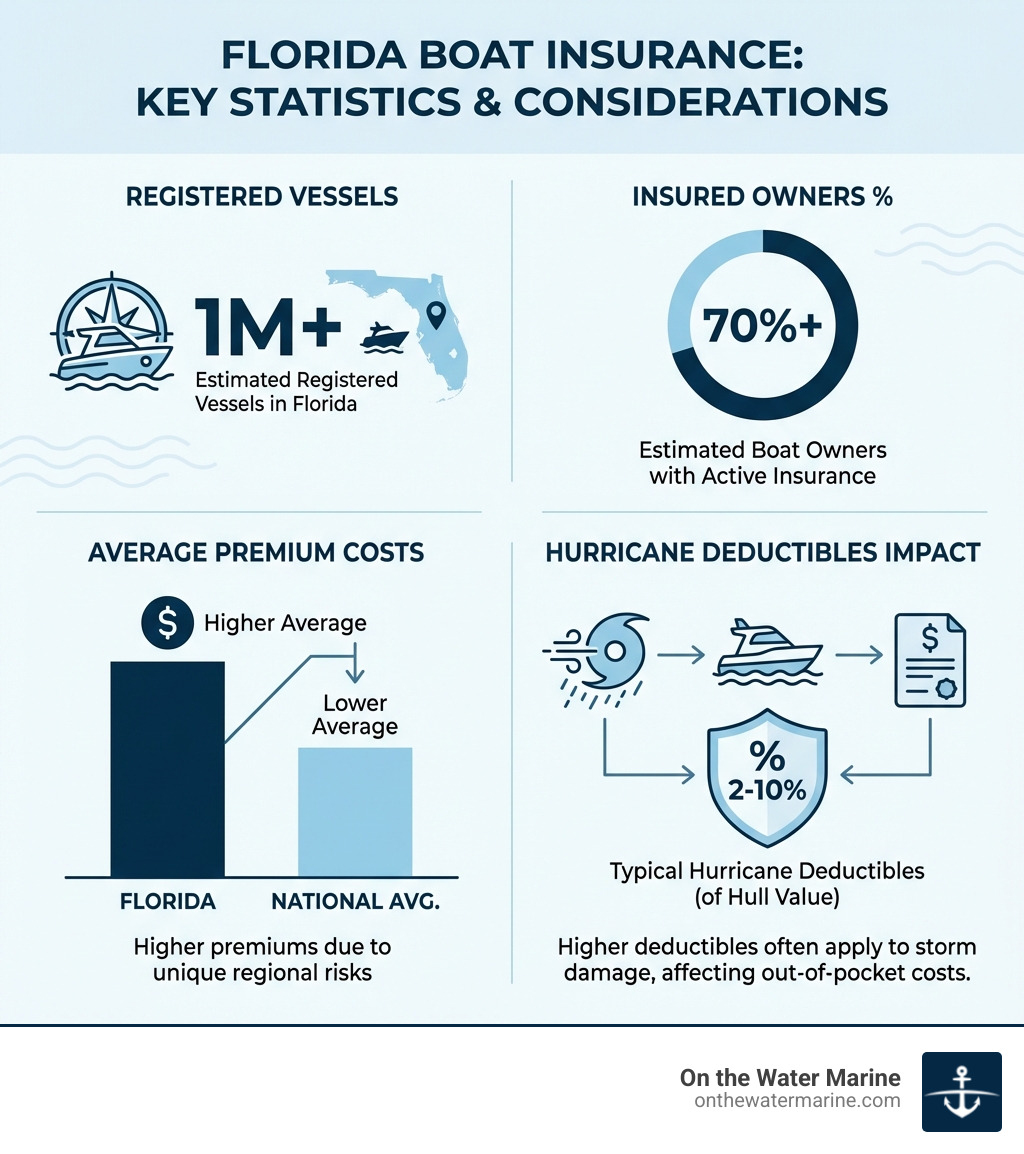

- Costs more in Florida than the national average due to hurricanes and high vessel density

- Core coverage types include hull damage, liability, medical payments, and uninsured boater protection

Florida’s year-round sunshine and thousands of miles of coastline make it a boater’s paradise, but these waterways also bring serious risks like hurricane threats and congested traffic. The average cost of boat insurance in Florida is higher than in most states as a direct result of these regional hazards.

Your boat is a significant investment. The right insurance policy protects that investment and provides financial security when the unexpected happens. Many boat owners mistakenly believe their homeowners or auto insurance covers their watercraft. It doesn’t. Standard policies offer only minimal coverage for small, non-motorized boats stored on your property and won’t protect you from on-water damage or liability claims. Specialized boat insurance provides custom coverage that understands the unique risks boaters face.

Understanding Florida’s Boat Insurance Requirements

While Florida offers unparalleled boating, it also presents unique insurance considerations. Many boaters are surprised to learn that their home or auto policies offer little to no protection for their watercraft. Understanding why specialized marine insurance is your anchor for peace of mind is crucial. Why boat and yacht insurance should be your anchor

Is Boat Insurance Legally Required in Florida?

The answer for most private recreational vessels is no. Unlike auto insurance, boat insurance for Florida is generally not required by state law. However, “not legally required” doesn’t mean “not necessary.” You will likely still need coverage for these reasons:

- Lender Requirements: If you finance your boat, your lender will almost certainly require comprehensive coverage to protect their investment.

- Marina and Docking Rules: Most marinas, private docks, and storage facilities in Florida insist on proof of liability coverage before allowing you to dock or store your vessel.

- Personal Responsibility: Without insurance, you are personally liable for any damages or injuries you cause. Responsible boat ownership means protecting yourself and others.

For more details, see our FAQ: Is boat insurance required by law?

Why Your Homeowners Policy Isn’t Enough

Many boat owners mistakenly assume their homeowners policy covers their boat. This misconception can lead to significant financial trouble.

Homeowners insurance typically offers extremely limited coverage, perhaps for a small, non-motorized vessel like a canoe while it’s stored on your property. It almost never covers motorized boats or any incidents that occur on the water. This means no coverage for collisions, sinking, theft away from home, or liability if someone is injured on your boat. Auto insurance provides virtually no coverage for your watercraft.

The specialized risks of boating require a dedicated boat insurance policy designed to address the unique challenges and liabilities of owning and operating a boat. Learn more in Your First Boat: Your Guide on Boat Insurance.

Core Components of a Florida Boat Insurance Policy

Understanding the components of a boat insurance for Florida policy is key to getting the right protection. A comprehensive policy includes hull coverage, liability, medical payments, and uninsured boater protection. For a general overview, see What does boat insurance typically cover?.

Choosing Your Hull Coverage: Agreed Value vs. Actual Cash Value

When insuring the physical structure of your boat (the “hull”), you have two main options:

- Agreed Hull Value: You and your insurer agree on a specific value for your boat. In a total loss, the insurer pays that agreed-upon amount, without depreciation. For partial losses, parts are often replaced “new for old.” This is the preferred option for newer or high-value boats.

- Actual Cash Value (ACV): This pays the boat’s current market value at the time of loss, after depreciation. ACV policies have lower premiums and are often suited for smaller, older boats or personal watercraft (PWC).

A third option, Liability Only coverage, protects your assets from claims you cause but does not cover damage to your own boat. It’s the lowest-cost option, typically for older, lower-value vessels. For a deeper dive, read Demystifying Boat Insurance.

Essential Coverage Types for Every Boater

A robust policy includes critical protections for liability and personal well-being:

- Bodily Injury & Property Damage Liability: Covers costs if you injure someone or damage their property with your boat.

- Wreckage Removal: Pays for the often legally required and expensive cost of removing your boat if it sinks.

- Pollution Liability: Covers cleanup costs if your boat leaks fuel or oil after an accident.

- Medical Payments: Helps pay medical expenses for you or your passengers, regardless of who is at fault.

- Uninsured/Underinsured Boater: Protects you if you’re injured by a boater with little or no insurance.

For more on liability, see What does liability boat insurance cover?.

Popular Add-Ons and Endorsements

Customize your policy with popular add-ons to improve your boat insurance for Florida:

- On-Water Towing and Roadside Assistance: Covers towing your disabled boat back to shore and can include assistance for your trailer.

- Personal Effects Coverage: Protects belongings like fishing gear, electronics, and clothes from theft or damage.

- Fishing Equipment Coverage: Specialized protection for expensive rods, reels, and tackle.

- Trailer Coverage: Covers damage to your boat trailer.

- Mechanical Breakdown Coverage: Helps cover repairs for a covered mechanical failure, similar to an extended warranty.

- Lower Deductibles for Electronics: Reduces your out-of-pocket cost for damage to expensive navigation or entertainment systems.

The Cost of Boat Insurance in Florida: Factors and Savings

The cost of boat insurance for Florida is often higher than the national average. This is due to the state’s year-round boating season, high number of vessels, and greater exposure to risks like hurricanes and theft. However, understanding the factors that influence your premium can help you find savings. For a general idea of costs, see How Much Does Boat Insurance Cost?.

What Influences Your Premium for boat insurance for florida?

Several factors determine your premium for boat insurance for Florida:

- Type, Age, and Value of Your Boat: Newer, larger, and more valuable boats cost more to insure.

- Boat Length and Horsepower: Larger boats and high-horsepower vessels signify higher risk and have higher premiums.

- Navigation Area and Usage: Boating in coastal waters, especially in hurricane-prone South Florida, costs more than on inland lakes. Commercial use like charters also increases rates.

- Boating Experience and Claims History: A clean record can lower your premiums, while a history of claims can increase them.

- Storage Location: Secure, indoor storage can lower your premium compared to keeping it outdoors.

Knowing these variables helps us find the most competitive rates. If you’re wondering if you’re overpaying, check out Are You Overpaying for Boat Insurance?.

Understanding Deductibles and Coverage Limits

Deductibles and coverage limits directly impact your policy’s cost and protection.

- Deductibles: This is the out-of-pocket amount you pay on a claim. A higher deductible lowers your premium, while a lower deductible increases it.

- Coverage Limits: This is the maximum amount your insurer will pay for a covered loss. It’s crucial to select limits that adequately protect your assets.

Hurricane Deductibles are a critical consideration for Florida boaters. Most policies include a separate, higher deductible for damage from named storms, typically a percentage of your boat’s insured value (e.g., 1-5%). Understanding this is vital as you prepare for each Atlantic hurricane season. Learn more in Boat Insurance 101: Don’t Let Hurricane Season Sink Your Boat.

How to Lower Your Florida Boat Insurance Costs

You can lower your premiums without sacrificing essential coverage:

- Take a Boating Safety Course: Completing an approved course, like the free one from BoatUS, often earns a discount. Take a Free Online Safety Course.

- Maintain a Good Record: A clean driving and boating history signals lower risk.

- Install Safety Equipment: GPS, depth finders, and fire extinguishers can qualify you for discounts.

- Bundle Policies: Bundling boat insurance with your home or auto policy can lead to savings.

- Choose Secure Storage: A secure, indoor facility can reduce premiums.

- Opt for a Higher Deductible: This will lower your premium, but ensure you can cover the out-of-pocket cost.

- Consider Lay-Up Periods: If you don’t use your boat year-round, a “lay-up” credit for when it’s stored can reduce your rate.

Your Guide to Quotes, Claims, and Florida Boating Resources

Getting a quote, filing a claim, and finding boating information are vital parts of responsible boat ownership. We guide you through each step, which is The Smarter Way to Shop for Boat Insurance.

How to Get a Quote for boat insurance for florida

Getting a personalized quote for boat insurance for Florida is straightforward. As an independent broker, we shop multiple carriers to find you the best coverage and price. We’ll need some key information:

- Your Personal Information: Name, address, date of birth, and boating experience.

- Boat Details: Make, model, year, length, hull ID number (HIN), engine type, horsepower, and value.

- Usage and Navigation: How and where you use your boat (e.g., recreational, coastal waters).

- Storage Location: Where your boat is kept when not in use.

- Desired Coverage: The coverage types and limits you’re looking for.

Working with an independent agent gives you access to policies not always available online. We review each application to find credits that lower your premium while maximizing coverage. Ready to start? Get a Quote.

Filing a Claim: A Step-by-Step Guide

If an accident occurs, knowing the claims process can reduce stress. Here’s a general guide for filing a boat insurance for Florida claim:

- Ensure Safety: Make sure everyone is safe and contact emergency services if there are injuries.

- Report the Incident: Contact the U.S. Coast Guard or local authorities (FWC, sheriff) for serious accidents.

- Document Everything: Take photos/videos of the damage and get contact information from all parties and witnesses.

- Prevent Further Damage: Take reasonable steps to protect your boat from more damage and keep receipts for emergency repairs.

- Contact Your Insurer: Notify your insurance provider as soon as possible. We can help guide you.

- Claims Adjuster Review: An adjuster will assess the damage and determine coverage.

- Repair Process: Once approved, you can proceed with repairs at an authorized facility.

We can help you with Navigating a Boat Insurance Claim, and you can always File a Claim directly through our website. For immediate steps, see our FAQ: What should I do immediately after a boat accident?.

Essential Resources for Florida Boaters

Staying informed is key to responsible boating. Here are some invaluable resources:

- Boat Registration: Most vessels must be registered with the Florida Highway Safety and Motor Vehicles (FLHSMV).

- Boating Safety and Regulations: The Florida Fish and Wildlife Conservation Commission (FWC) is the source for rules, safety courses, and regulations.

- Hurricane Preparedness: A robust Hurricane Preparedness Plan is non-negotiable.

- On-Water Training Courses: Improve your skills with a hands-on course. You can Find an On-Water Training Course through organizations like BoatUS.

Frequently Asked Questions about boat insurance for florida

Here are answers to some of the most common inquiries we receive about boat insurance for Florida.

What types of watercraft can be insured in Florida?

A wide range of watercraft can be insured in Florida. We can find coverage for almost any motorized water vehicle, including:

- Powerboats and cruisers

- Sailboats

- Pontoon boats

- Fishing boats (bass boats, center consoles)

- Yachts and megayachts (including liveaboards)

- Personal Watercraft (PWC) like Jet Skis

- Houseboats

- Charter boats

- High-performance boats

How does hurricane season affect my boat insurance?

Hurricane season (June 1 – Nov 30) is a major factor for boat insurance for Florida. Here’s how it impacts your policy:

- Increased Premiums: The high risk of severe weather leads to higher average premiums for Florida boaters.

- Hurricane Deductibles: Policies almost always include a separate, higher deductible for damage from a named storm, usually a percentage of your boat’s insured value.

- Haul-Out Requirements: Your policy may require you to haul your boat out of the water or move it to a safe harbor when a named storm threatens. Failure to comply could affect your coverage.

- Coverage Suspensions: Insurers may temporarily restrict new coverage or policy changes in areas under a hurricane watch. It’s best to secure your policy well before a storm threat.

Understanding these policy aspects is key to navigating each hurricane season with confidence.

Can I get insurance for an older boat in Florida?

Yes, you can get boat insurance for Florida for an older vessel, but it may require extra steps:

- Marine Survey: For older boats (often 10-15+ years), insurers usually require a professional marine survey to assess the boat’s condition, seaworthiness, and value.

- Condition Assessment: A well-maintained older boat is much easier to insure.

- Specialized Carriers: As independent brokers, we have access to carriers that specialize in older or classic boats.

- Actual Cash Value (ACV) Policies: Coverage for older boats is often on an ACV basis, which reflects the boat’s depreciated market value.

We can help you find suitable coverage for your treasured older boat.

Conclusion: Secure Your Peace of Mind on the Water

Boat insurance for Florida is more than a piece of paper; it’s essential for smooth sailing. It provides financial security against accidents and hurricanes and is often required by marinas and lenders. While not mandated by state law, the unique risks of Florida boating make a comprehensive policy non-negotiable for responsible owners.

Understanding your coverage options—from Agreed Value vs. Actual Cash Value to liability protections and valuable add-ons—transforms a basic policy into a true safety net. While Florida insurance can be costly, managing deductibles and using discounts can help you find an affordable plan that fits your needs.

At On The Water Marine, we are an independent marine insurance broker. We don’t work for one company; we work for you. We shop multiple top-rated carriers to find the best coverage and price, offering personalized service and access to policies not always available online. We create a plan customized to your vessel and Florida boating lifestyle.

Don’t let insurance complexities overshadow the joy of boating. Let us handle the details so you can focus on the water.

Get your personalized Florida Boat Insurance plan today and secure your peace of mind.

Related Articles

Why Best Florida Boat Insurance is Essential for Every Boater Best Florida boat insurance provides protection custom to the unique risks of boating in the Sunshine [...]

Why Commercial Fishing Insurance is Your Lifeline Commercial fishing insurance is specialized coverage designed to protect fishing vessel owners and operators from the unique risks of [...]

Why Canal Cruiser Insurance Matters for Every Boat Owner Canal cruiser insurance is specialist coverage designed to protect narrowboats, barges, widebeams, and other inland waterway vessels [...]