Why Most Miami Boat Owners Don’t Find Coverage Problems Until It’s Too Late

Boat insurance Miami Florida is often misunderstood until the moment a claim is filed. Many yacht owners assume their policy provides clear protection, only to find gaps, exclusions, or unexpected deductibles after damage has already occurred.

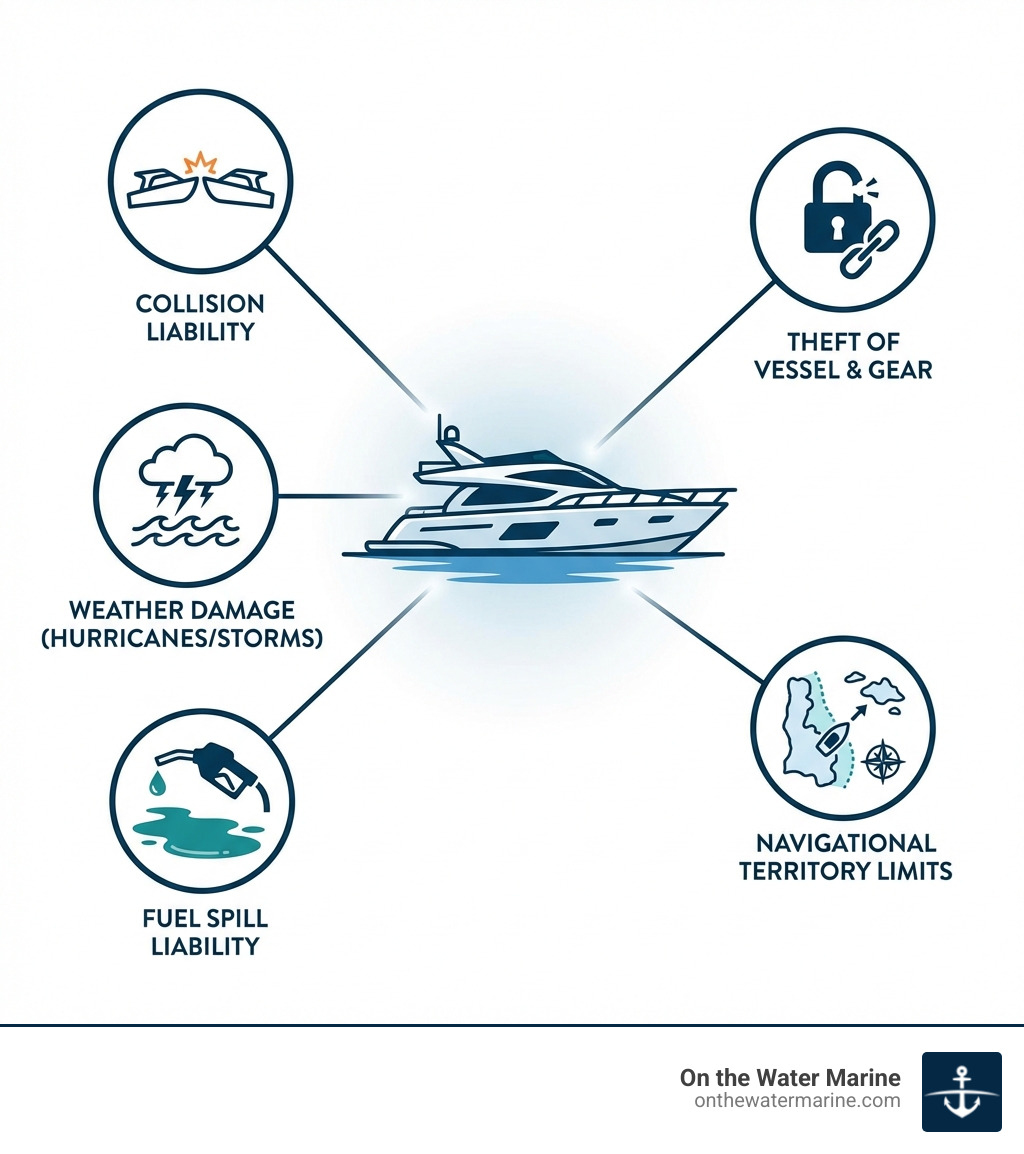

Most insurance problems don’t appear when a policy is bound. They appear when something goes wrong — a collision in Biscayne Bay, storm damage during hurricane season, or a fuel spill that triggers environmental liability. Miami’s dense waterways, hurricane exposure, and proximity to the Bahamas create a risk environment that generic policies often fail to address.

I’m Eric Fisher, founder and Agency President of On The Water Marine Insurance, and I’ve spent over a decade managing marine risk and structuring yacht insurance for vessel owners navigating complex coverage decisions like those common in boat insurance Miami Florida. This guide walks through the core components, location-specific risks, and policy structures that matter most for serious yacht owners in South Florida.

Understanding Core Coverage Components

When considering boat insurance Miami Florida, it is essential to understand the fundamental building blocks of a marine insurance policy. These core components are designed to protect you from various liabilities that can arise from operating your vessel. Many policies, for instance, offer personal liability coverage similar to car insurance. This coverage may provide protection to other boaters and boat owners if you are found at fault for an accident on the water.

This liability coverage often helps repair or replace another party’s property, and may also contribute to their medical care, lost wages, and other costs incurred due to a boating accident where you are deemed at fault. Limits for this coverage can vary significantly, often starting around $15,000 and potentially increasing to $300,000 or more, depending on the policy and your needs.

Medical Payments coverage is another vital component. This coverage may help pay for the cost of necessary medical care resulting from a boating accident. Depending on the policy, this coverage may extend to you, your passengers, and even those engaged in water sports activities like skiing or tubing, regardless of who is at fault. Limits for medical payments can range, for example, from $500 to $10,000.

Given that boat insurance is not always mandatory, some boaters may choose not to carry it. This is where Uninsured/Underinsured Watercraft Bodily Injury coverage can become particularly important. If you are involved in an accident with an uninsured or underinsured boater and you sustain injuries, this type of coverage may help pay for your medical treatment, lost wages, and other associated costs.

Finally, Guest Passenger Liability is often included to address potential claims from passengers on your vessel who may be injured during an incident. Each of these components plays a distinct role in creating a comprehensive marine insurance strategy for your vessel. For a deeper dive into these options, you can explore our Florida Boat Insurance Guide.

Protecting Your Vessel: Agreed Value vs. Actual Cash Value

A critical distinction for owners of high-value vessels, especially when discussing boat insurance Miami Florida, lies in how your boat’s physical damage is valued in the event of a total loss. This distinction primarily revolves around Physical Damage coverage and the difference between Agreed Value and Actual Cash Value policies.

Physical damage coverage is designed to help repair or replace your watercraft, its motor, any permanently attached equipment, and your trailer if it is stolen or damaged. However, the method of valuation can significantly impact your financial outcome.

Agreed Value coverage means that if your boat is declared a total loss, the insurance company may pay you the value you insured it for, minus any applicable deductible. This approach can be particularly beneficial because watercraft, much like cars, tend to depreciate over time. An Agreed Value policy helps to account for this depreciation, providing a more predictable payout that may align with your initial investment or the agreed-upon value at the time the policy was issued.

Actual Cash Value (ACV) coverage, in contrast, may pay the replacement cost of your boat minus depreciation. This means the payout would reflect the boat’s market value at the time of the loss, which could be substantially less than what you originally paid or what it might cost to replace. For older vessels, or those that have seen significant use, an ACV policy could result in a lower settlement.

The impact of depreciation on a total loss scenario is a key consideration. While an Agreed Value policy might involve a slightly higher premium, it often provides greater peace of mind and financial security for owners of newer or high-value yachts. The choice between these two valuation methods is a significant decision that should align with your vessel’s value, age, and your personal risk tolerance.

| Feature | Agreed Value | Actual Cash Value (ACV) |

|---|---|---|

| Payout at Total Loss | Fixed amount, agreed upon at policy inception, minus deductible. | Replacement cost minus depreciation at the time of loss, minus deductible. |

| Premium Considerations | May be slightly higher due to guaranteed payout. | Generally lower premiums. |

| Suitability | Ideal for newer, high-value, or custom vessels where depreciation is a concern. | Often used for older vessels or those where market value is readily determined. |

| Predictability | High predictability of payout. | Payout can be less predictable and may not cover full replacement cost. |

Understanding these differences is crucial for ensuring your vessel is adequately protected. For more detailed guidance, you can refer to our Best Florida Boat Insurance Guide.

Navigating Specific Risks for Boat Insurance in Miami, Florida

Miami’s unique marine environment presents specific risks and liabilities that must be considered when structuring your boat insurance Miami Florida policy. From busy waterways to the proximity of international waters, these factors can significantly impact the type and extent of coverage you may need.

One often-overlooked aspect is Wreckage Removal liability. Should your vessel sink or become seriously damaged, you, as the boat owner, may be legally responsible for its removal. This can be a time-consuming and expensive undertaking, and a robust policy may include coverage for these costs. Similarly, Fuel Spill liability is a crucial consideration. If your boat leaks oil or fuel into the water following an incident, you are typically required by law to have this cleaned up. This environmental cleanup can incur substantial costs, and proper insurance coverage may help mitigate this financial burden.

Navigational Limits are also a key policy detail. Many standard policies have specific geographical areas where your vessel is covered. For Miami boaters, this might mean understanding coverage up to a certain distance from the U.S. coastline. If you plan on venturing further, for instance, to the Bahamas, you may need specific Bahamas cruising endorsements to ensure your policy extends to these international waters. Some insurance companies may offer protection up to 75 miles from the U.S. coastline, into Canadian coastal or inland waters, and into the Pacific coastal waters of Mexico. In Florida and Oregon, coverage for additional navigational areas may be purchased.

These specific considerations highlight why a generic policy might not be sufficient for the unique demands of boating in South Florida. For custom advice, you can explore our comprehensive Florida Boat Insurance information.

Understanding Hurricane Coverage for boat insurance Miami Florida

Hurricane season is a significant concern for any vessel owner in South Florida. A robust boat insurance Miami Florida policy often includes provisions specifically addressing named storms. Named Storm deductibles are common in these regions, meaning a higher deductible may apply for losses caused by named hurricanes or tropical storms.

It is also important to understand Haul-out agreements. Some policies may offer credits or require you to have a plan in place to remove your vessel from the water if a hurricane warning is issued. Having a well-defined Hurricane preparedness plan can not only protect your vessel but may also influence your policy’s terms. Additionally, understanding Lay-up periods — times when your boat is stored and not in use — can be relevant, as some policies may offer reduced premiums or altered coverage during these periods.

Marina and Lender Requirements for boat insurance Miami Florida

Beyond your personal risk assessment, external parties often impose specific insurance requirements. Marinas, for instance, frequently stipulate minimum liability limit requirements before they will grant you a slip. They may also require you to list them as an Additional Insured on your policy, which provides them with some protection if an incident involving your boat occurs at their facility.

Similarly, if you have financed your vessel, your lender will almost certainly require you to maintain specific insurance coverage. They will typically ask for Proof of insurance and may also require certain endorsements to protect their financial interest in the vessel. Ensuring your policy meets these Contractual compliance obligations is essential for maintaining your slip and your financing.

Factors That Influence Policy Structure and Premiums

When we work to structure a marine insurance policy, especially for boat insurance Miami Florida, we consider various factors that underwriters assess. These elements help determine the scope of coverage and influence the premium. Understanding these factors can help you appreciate why certain policy structures are recommended.

The Vessel type is a primary consideration. A yacht, a high-performance boat, a sailboat, or a personal watercraft each present different risk profiles. For example, a high-performance boat, due to its speed capabilities, may have different underwriting requirements compared to a cruising yacht.

The Vessel value and age are also significant. Newer, higher-value vessels may require more comprehensive coverage, often favoring Agreed Value policies, whereas older vessels might be assessed differently. The Operator experience and history play a crucial role; a seasoned captain with a clean claims record may receive more favorable terms than a less experienced operator.

The Intended use of the vessel is another critical factor. Is it for private recreational use, or will it be used for charter services? Commercial use, such as chartering, typically requires specialized commercial marine insurance which differs significantly from private vessel insurance due to the increased liabilities and operational risks. Florida has one of the largest commercial marine industries in the U.S., highlighting the importance of this distinction.

Finally, the Mooring and storage location (e.g., private dock, marina, dry storage) can influence risk, particularly in hurricane-prone areas like Miami. Underwriters consider how and where your vessel is kept when assessing the overall risk.

For a detailed review of how these factors apply to your vessel, you can request a professional quote.

The Role of an Independent Marine Insurance Specialist

Navigating the complexities of marine insurance, particularly for high-value vessels in a unique environment like Miami, often benefits from the expertise of an independent marine insurance specialist. While direct-to-consumer options exist, they may not always provide the custom solutions required for sophisticated marine risks.

We, as an independent marine insurance broker, have access to specialized carriers that may not be available through standard online platforms or general insurance agencies. These carriers often specialize in niche markets, such as yachts, megayachts, or high-performance vessels, and can offer more comprehensive or flexible coverage options.

Our role involves understanding complex policy language and translating it into clear, actionable information for you. We can explain the nuances of various endorsements, deductibles, and exclusions that might otherwise be overlooked. This insight helps in tailoring coverage to specific risks unique to your vessel and your usage patterns, ensuring your policy truly reflects your needs.

Should an incident occur, we can act as your advocate during a claim. While we cannot guarantee claim outcomes, our experience in the marine insurance industry allows us to help you steer underwriting requirements and the claims process, working with the carrier on your behalf. This includes assisting with essential steps like marine surveys, which are often required for older or high-value vessels to assess their condition and seaworthiness.

Working with specialists like us means you have an experienced partner dedicated to finding the most suitable coverage and price for your specific situation, rather than a one-size-fits-all approach. You can learn more about our approach and services on our About page.

Conclusion

A well-structured marine insurance policy in Miami is fundamentally about understanding and carefully managing risk, rather than simply meeting a minimum requirement. Miami’s unique environment, characterized by its dense waterways, hurricane exposure, and the lure of international cruising, demands a more sophisticated and thoughtful approach to coverage.

For owners of 35’+ vessels, working with a specialist like On The Water Marine can help clarify these complex options. We focus on educating you about the potential risks and the specific policy components that may mitigate them, ensuring you are well-informed. Our goal is to help you understand the precise nature of your coverage, so you can enjoy your time on the water with confidence in your risk management strategy.

To begin a professional review of your marine insurance needs and explore custom solutions, we invite you to learn more about our Florida Boat Insurance services.

Related Articles

Protecting Your Passion on Texas Waters Texas fishing guide insurance is specialized commercial coverage protecting professional guides from liability claims, equipment damage, and other business risks. [...]

Why Marine Guide Insurance Requires a Different Approach Than Personal Yacht Coverage Marine guide insurance can be specialized commercial coverage designed for professional operators who take [...]

Introduction: The Misconception of “Standard” Coverage Boat insurance Fort Myers is not a single product. It’s a collection of policy structures, coverage limits, and exclusions that [...]