Why Understanding Boat Rental Insurance Coverage Matters

Boat rental insurance coverage typically includes liability protection, damage to the vessel, medical payments, and fuel spill liability, with specific protection packages offering varying limits and deductibles. It is designed to protect both the renter from financial liability and the rental company from asset loss during the rental period.

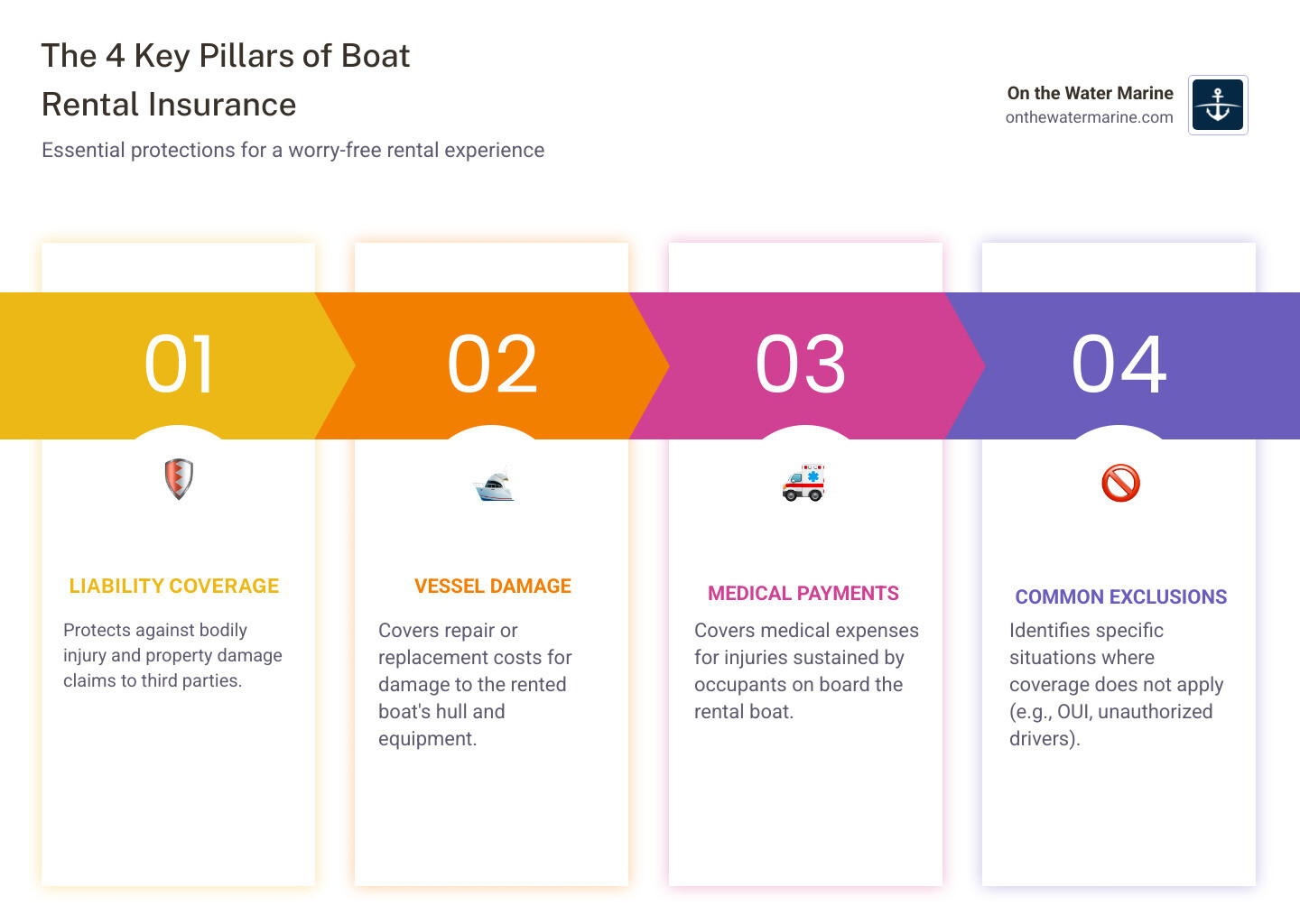

Key components of boat rental insurance coverage:

- Liability Coverage – Protects against bodily injury and property damage claims (typically $100,000 to $500,000 per person, $300,000 to $1,000,000 aggregate)

- Vessel Damage – Covers hull and equipment damage (often the market value of the vessel, with a $2500 typical deductible)

- Medical Payments – Covers medical expenses for injuries on board (usually $25,000)

- Fuel Spill Liability – Protects against pollution incidents ($300,000 to $1,000,000)

Renting a boat offers the perks of time on the water without the down payment, monthly loan bills, or maintenance headaches of ownership. But that carefree experience can turn into a financial nightmare if something goes wrong.

A brand-new boat typically costs between $40,000 and $75,000, with many exceeding $100,000. Any damage could result in high costs pushed back to you as the renter. Potential injury claims could push those costs even higher.

That’s where boat rental insurance coverage becomes crucial. It’s not just a box to check on the rental agreement—it’s a financial shield that protects you from catastrophic liability and helps the rental company safeguard their valuable assets.

Most renters don’t realize they often agree to accept all responsibility for anything that happens to the boat, regardless of cause. Understanding what your coverage includes, what it excludes, and how it works can mean the difference between a minor inconvenience and a lawsuit that follows you for years.

What is Boat Rental Insurance and Why is it Crucial?

Imagine a perfect day out on the water: sun shining, gentle breeze, and the thrill of cruising on a beautiful rental boat. Now, imagine that perfect day takes an unexpected turn—a fender bender with another vessel, an accidental grounding, or someone on board gets injured. Without proper boat rental insurance coverage, that dream day could quickly become a financial headache.

Boat rental insurance is a specialized type of coverage designed to protect individuals who rent boats for recreational purposes. It shields you, the renter, from the significant financial risks associated with operating a boat that isn’t yours. Why is it so important? Simply put, boats are expensive assets, and boating accidents, though rare, can be costly. As we mentioned, a new boat can easily cost $40,000 to over $100,000. Even minor damage can lead to thousands in repair bills, and serious accidents involving other people or property can result in astronomical liability claims.

When you rent a boat, you’re temporarily taking on the responsibility for that vessel. This coverage provides financial protection for potential damages to the rental boat, injuries to passengers or third parties, and even environmental damage like fuel spills. It gives you peace of mind, allowing you to focus on enjoying your time on the water rather than worrying about “what if.”

For more in-depth information about general boat insurance, you can explore our guide: More info about boat insurance

Protecting the Renter and the Rental Company

Boat rental insurance coverage serves a dual purpose: it protects both you, the renter, and the boat rental company.

From the renter’s perspective, this insurance acts as a personal financial shield. Without it, if you cause damage to the boat, injure someone, or damage another vessel, you could be personally responsible for all associated costs. This could mean paying out-of-pocket for expensive repairs, medical bills, or even legal fees if a lawsuit arises. Having coverage means you’re not left holding the bag for an unforeseen incident.

For the boat rental company (often called a livery), this insurance is vital for safeguarding their valuable assets. Their entire business model relies on maintaining a fleet of operational boats. If a renter causes significant damage, the rental company needs a mechanism to cover repair costs or even the replacement of a totaled vessel. This protects their investment and ensures they can continue to offer rentals. Moreover, comprehensive coverage often ensures the livery meets specific state requirements. For instance, in Florida, the Safe Boating Act of 2022 (SB606/401) mandates certain insurance provisions, including admitted coverage, protection for both the renter and livery, and liability limits up to $500,000 per person and $1M per occurrence. This mutual benefit creates a safer and more sustainable rental environment for everyone.

The High Stakes: What Happens Without Insurance?

Operating a rental boat without adequate boat rental insurance coverage is akin to walking a tightrope without a safety net – exhilarating, perhaps, but incredibly risky. The implications of operating a rental boat without insurance can be severe and long-lasting.

Firstly, you face unlimited personal liability. If you’re involved in an accident, you could be held solely responsible for all damages and injuries. This includes the cost to repair or replace the rental boat (which, as we’ve noted, can be tens to hundreds of thousands of dollars), medical expenses for anyone injured (including your passengers or occupants of other vessels), and property damage to docks, other boats, or shorelines.

Imagine causing an accident that totals a $75,000 rental boat and injures someone, leading to $50,000 in medical bills. Without insurance, that $125,000 bill lands squarely on your shoulders. This could lead to lawsuits, wage garnishment, and even the loss of personal assets. It’s a financial burden that could take years, if not decades, to overcome. Don’t let a fun day turn into a financial nightmare.

For a deeper understanding of liability in boating, check out: What Does Liability Boat Insurance Cover?

Decoding Your Boat Rental Insurance Coverage

When you’re handed that rental agreement, it’s easy to skim through the fine print, eager to get out on the water. But understanding the specific details of your boat rental insurance coverage is paramount. Policies aren’t one-size-fits-all, and what’s included can vary significantly. This section will help us break down the typical coverage types and protection packages available.

For a general overview of what boat insurance covers, you might find this helpful: What Does Boat Insurance Actually Cover?

Core Coverage Components

Most comprehensive boat rental insurance coverage will include several key components, designed to address the most common risks associated with boating:

- Liability Coverage: This is arguably the most critical part. It protects you financially if you’re deemed responsible for causing bodily injury to another person (whether on your boat, another boat, or in the water) or property damage to someone else’s assets (like another boat, a dock, or a navigational marker). It’s the shield against costly lawsuits and medical bills for third parties.

- Damage to the Vessel (Hull & Equipment): This covers the physical rental boat itself. If you accidentally hit a submerged object, run aground, or collide with something, this coverage helps pay for the repairs to the hull, engine, and other equipment on the boat. Considering the high value of boats, this component is essential.

- Medical Payments: This portion covers medical expenses for injuries sustained by you or your passengers while on the rental boat, regardless of who was at fault. It’s usually a lower limit than liability but can be very helpful for immediate medical costs.

- Fuel Spill Liability: Accidents can sometimes lead to fuel or oil spills, which can cause significant environmental damage and result in hefty cleanup costs and fines. This coverage protects you from the financial burden of such incidents.

Understanding Different Protection Packages

Not all boat rental insurance coverage is created equal. Rental companies often offer different “protection packages,” which are essentially tiered levels of coverage. These packages vary in their limits, deductibles, and sometimes even the types of incidents they cover. We’ve seen examples like “Peace of Mind” and “Premium” packages, each offering different levels of protection.

Let’s look at a typical comparison, drawing from common offerings:

| Coverage Type | Standard Package (e.g., “Peace of Mind”) | Premium Package (e.g., “Premium”) |

|---|---|---|

| Medical Payments (per person) | $25,000 | $25,000 |

| Boating Liability (per person) | $100,000 | $500,000 |

| Boating Liability (aggregate) | $300,000 | $1,000,000 |

| Deductible | $5,000 | $2,500 |

| Fuel Spill Liability | $300,000 | $1,000,000 |

| Hull & Equipment Limit | Market Value | Agreed Value |

As you can see, while the Medical Payments and Deductible might remain similar, the liability and hull coverage limits can increase significantly with a premium package. A higher liability limit means more protection if you cause serious injury or damage, and a higher hull limit means more of the boat’s value is covered. Always review these options carefully to choose the level of protection that makes you feel most comfortable. The peace of mind is priceless!

Is it Insurance or a Damage Waiver?

This is a crucial distinction that often confuses renters. While both aim to limit your financial exposure, a damage waiver and boat rental insurance coverage are fundamentally different.

- Damage Waiver: A damage waiver is a contractual agreement between you and the rental company. It’s not an insurance policy. By paying for a damage waiver (often a non-refundable fee), the rental company agrees to waive its right to hold you responsible for certain types of damage to the rental boat, up to a specified amount or a reduced deductible. It typically only covers damage to the rental vessel itself. It doesn’t usually cover liability for injuries to others or damage to other people’s property. It’s a direct agreement with the company, not a third-party insurer, and is generally not a regulated insurance product.

- Boat Rental Insurance Coverage: This is a formal insurance policy, usually underwritten by a licensed insurance company. It transfers the risk from you to the insurer. Unlike a damage waiver, it often provides broader protection, including liability coverage for bodily injury and property damage to third parties, medical payments, and sometimes even fuel spill liability, in addition to coverage for the rental boat itself. Because it’s an actual insurance product, it’s regulated by state insurance departments, offering a different level of consumer protection.

A damage waiver limits your financial responsibility to the rental company for their boat, while actual insurance provides broader protection against a wider range of risks, including those involving other people and property. We always recommend understanding which you are purchasing and what precisely it covers.

For more details on policy terms and conditions, you can refer to our Terms of Service.

The Fine Print: Exclusions, Limitations, and Legalities

Just like any other insurance product, boat rental insurance coverage comes with its own set of rules, exclusions, and limitations. Ignoring these can lead to unexpected out-of-pocket expenses, even if you thought you were covered. It’s vital to read your rental agreement and insurance policy thoroughly. Often, these policies are underwritten by a top-rated carrier like Markel, which means they adhere to high industry standards, but specific conditions will always apply.

Common Exclusions in boat rental insurance coverage

While boat rental insurance coverage offers substantial protection, it’s not a blanket solution for every scenario. Here are some common exclusions you should be aware of:

- Operating Under the Influence (OUI): This is a universal exclusion. If you’re operating the boat while intoxicated or impaired, your insurance will almost certainly be voided, leaving you fully liable for any damages or injuries. Just like driving a car, don’t drink and boat.

- Unauthorized Drivers: Typically, only the person who signed the rental agreement and is listed on the insurance policy is covered to operate the boat. If an unnamed driver takes the helm and an accident occurs, coverage may be denied. Some providers are working to support multiple drivers, but for now, it’s generally a one-person show.

- Nighttime Operation: Many rental agreements and insurance policies prohibit or severely restrict operating the boat during nighttime hours due to increased risks.

- Restricted Waterways: There might be specific areas (e.g., shallow waters, strong currents, protected zones) where operating the rental boat is forbidden. Veering into these areas could invalidate your coverage.

- Uncovered Water Sports: Activities like wakeboarding, parasailing, or water-skiing are often excluded unless explicitly stated and purchased as an add-on in your protection package. The same applies to incidents that happen “off the boat,” such as while swimming or scuba diving. Always check if your planned activities are covered!

- Wear and Tear: Insurance covers sudden, accidental damage, not gradual deterioration or maintenance issues.

State-Specific Legal Requirements

Boating regulations and insurance requirements can vary significantly from one region to another. It’s not just about what the rental company offers; it’s also about what the law demands.

For example, in Florida, the Safe Boating Act of 2022 (SB 606/401) sets specific legal requirements for boat rental insurance. Policies must provide “admitted coverage,” protect both the renter and the livery, and meet minimum liability limits, often up to $500,000 per person and $1M per occurrence. This legislation ensures a baseline of protection for everyone involved.

Other regions might have different mandates. In the UK, for instance, if you’re using inland waterways, you’ll usually need “third-party” insurance for at least £1 million. If you’re operating a boat at sea, other statutory certificates might apply, especially for commercial use. It’s always our advice to verify the specific legal requirements for the area where you plan to rent. Don’t assume that what applies in one state or country applies everywhere. Always ask the rental company about local legal requirements and ensure your chosen boat rental insurance coverage complies.

For insights into how boating regulations vary by region, it’s always good to consult official sources.

Costs, Claims, and Safety Prerequisites

Understanding the upfront costs, knowing what to do if an incident occurs, and being prepared with the right safety knowledge and equipment are all integral parts of responsible boat renting. Let’s explore these practical aspects of boat rental insurance coverage.

Curious about general boat insurance costs? We’ve got a guide for that too: How Much Does Boat Insurance Cost?

How is the cost of boat rental insurance coverage determined?

The cost of boat rental insurance coverage isn’t a fixed price; it’s dynamic and influenced by several factors, much like other types of insurance.

- Rental Duration: Shorter rentals (e.g., a few hours or a single day) will naturally cost less than multi-day or week-long charters.

- Boat Type and Value: The kind of boat you’re renting plays a significant role. A small fishing skiff will have a lower insurance premium than a large, high-powered yacht or a luxury pontoon boat. The higher the boat’s value, the more expensive the coverage will be to protect against potential damage.

- Seasonality: Peak boating seasons (e.g., summer holidays) might see slightly higher premiums due to increased demand and activity on the water.

- Renter’s Age: Younger renters might face higher premiums due to perceived higher risk, similar to car insurance.

- Coverage Limits and Deductibles: Opting for higher liability limits or lower deductibles will increase your premium, as you’re asking the insurer to take on more risk.

Interestingly, on average, boat rental insurance coverage can often be less per rental period than rental car insurance, U-Haul insurance, or RV insurance. This can be a pleasant surprise for many renters, demonstrating that protecting your adventure doesn’t have to break the bank. The exact price will be different based on the specific factors above.

The Claim Process: What to Do After an Incident

Even with the best precautions, accidents can happen. Knowing the claims process for your boat rental insurance coverage is essential. Here’s a general guide on what to do if an incident occurs:

- Ensure Safety First: Your immediate priority is the safety of everyone involved. Assess for injuries and provide first aid if necessary. If there’s a serious injury or significant damage, contact emergency services (e.g., Coast Guard, local marine patrol) immediately.

- Notify the Rental Company: As soon as it’s safe to do so, inform the boat rental company about the incident. They will guide you on next steps, which might include returning to the dock or waiting for assistance.

- Document the Scene: If possible and safe, take photos or videos of the damage to the rental boat, any other involved vessels or property, and the surrounding area. Note the location, time, and weather conditions.

- Gather Information: Collect contact information from any witnesses, other boat operators involved, and law enforcement or marine patrol officers. If another vessel was involved, get their boat registration number and insurance details.

- Initiate the Claim: Once you’re off the water and safe, contact your insurance provider (or the company that provided the damage waiver/insurance) to officially file a claim. You’ll need your policy number and all the documentation you gathered. Be prepared to provide a detailed account of what happened. Don’t admit fault or make promises to others; let the insurance company handle liability assessments.

For more detailed advice on handling insurance claims, our guide on Navigating a Boat Insurance Claim can be a valuable resource.

Safety Certifications and Equipment

Beyond insurance, responsible boat renting also involves adhering to safety standards and understanding operator requirements. This is crucial not only for your safety but also for ensuring your boat rental insurance coverage remains valid.

- Operator Certifications: Many regions require proof of competency to operate a power-driven boat. In Canada, for example, boat operators are required to have a Pleasure Craft Operator Card (PCOC). If you don’t have one, rental companies often provide a temporary boater safety rental checklist that acts as a temporary PCOC after a briefing on how to operate the boat. Always inquire about local requirements and ensure you meet them.

- Boater Safety Checklists: Before you depart, the rental company should provide a comprehensive safety briefing and review a checklist. Pay attention! This covers everything from operating the boat’s controls to understanding navigation rules.

- Required Safety Equipment: All rental boats must be equipped with mandatory safety gear. This typically includes:

- Life Jackets (PFDs): Ensure there are enough for everyone on board, and that they fit correctly. We always advise wearing them, especially for children and non-swimmers.

- Fire Extinguishers: Know its location and how to use it.

- Sound Signaling Devices: A horn or whistle is crucial for communicating on the water.

- Navigation Lights: Essential for operating during low light or at night (if permitted by your rental agreement).

- Bailing Device/Pump: To remove water from the boat.

- First Aid Kit: For minor injuries.

Always familiarize yourself with the location and proper use of all safety equipment before leaving the dock. Some boaters even bring their own life jackets to ensure a perfect fit and familiarity!

Frequently Asked Questions about Boat Rental Insurance

Is my personal boat or home insurance policy enough for a rental?

In most cases, no. While some homeowner’s policies might offer limited coverage for small boats or personal watercraft, they typically exclude or provide very limited coverage for rented boats, especially those over a certain size or horsepower. Your personal boat insurance policy is designed for your owned vessel and often has clauses that exclude coverage when you’re operating a boat you’ve rented from a commercial entity. It is crucial to verify coverage directly with your personal insurance provider and not assume your existing policy will protect you. Always err on the side of caution and consider purchasing specific boat rental insurance coverage or a damage waiver.

Can more than one person drive the rental boat under the insurance?

Generally, no. Most boat rental insurance coverage policies or damage waivers are tied to the single operator who signs the rental and insurance agreement. If someone else takes the helm and an incident occurs, your coverage could be voided, leaving you fully responsible for damages. If you anticipate multiple operators, you must discuss this with the rental company and the insurance provider beforehand. Sometimes, adding other drivers is not permitted at all, or it requires special arrangements, additional fees, and explicit disclosure at the time of rental. Always clarify this point before anyone else takes control of the boat.

What’s the difference between a damage waiver and rental insurance?

This is a common point of confusion! A damage waiver is a contractual agreement directly with the rental company. When you pay for it, the company agrees to waive its right to charge you for certain damages to their boat, usually up to a specific amount or with a reduced deductible. It’s not an insurance policy and typically only covers the physical rental vessel.

Boat rental insurance coverage, on the other hand, is a formal insurance policy issued by a licensed insurance company. It usually offers broader protection, including liability coverage for injuries to others or damage to their property, medical payments, and often fuel spill liability, in addition to covering the rental boat itself. Because it’s a regulated insurance product, it provides a different level of consumer protection than a simple waiver. While both aim to reduce your financial risk, insurance generally offers more comprehensive third-party protection.

Conclusion

We hope this deep dive has shed some light on the often-overlooked world of boat rental insurance coverage. We’ve seen that understanding what’s included in your policy—from liability and vessel damage to medical payments and fuel spill coverage—is not just about ticking a box, but about protecting your financial future. We’ve explored the critical differences between insurance and damage waivers, digd into common exclusions like operating under the influence or unauthorized drivers, and highlighted the importance of complying with state-specific legal requirements such as Florida’s Safe Boating Act.

The cost of this coverage is determined by factors like boat type, rental duration, and your age, and it can often be more affordable than you might think compared to other rental insurances. And should the unexpected happen, knowing the claims process—from ensuring safety to documenting the scene—is your roadmap to navigating an incident smoothly. Finally, never underestimate the value of safety certifications like the PCOC and ensuring your rental boat is equipped with all mandatory safety gear.

At On The Water Marine, we believe that informed boaters are safer and happier boaters. While we specialize in comprehensive coverage for boat owners, we want every boater, renter or owner, to enjoy the water with peace of mind. So, the next time you’re ready to cast off on a rental, take a moment to understand your boat rental insurance coverage. It’s the smartest way to ensure your time on the water remains truly carefree.

For a deeper dive into comprehensive coverage for your own vessel or to get expert advice, explore our complete guide to Boat Insurance.

Related Articles

Why Standard Policies Often Miss the Mark in Florida Waters Boat insurance coverage Florida is not as straightforward as many vessel owners assume. While Florida law [...]

Understanding What Drives Marine Insurance Costs for Professional Guides How much does fishing guide insurance cost is one of the most common questions from guides starting [...]

Why Marine Repair Business Insurance is the Foundation of Your Operation Marine repair business insurance is specialized coverage designed to protect boat repair shops, shipyards, and [...]

_compressed.jpg?alt=media&token=0c86f640-c8f6-4984-a23d-62edb893418d)