Why Canal Cruiser Insurance Matters for Every Boat Owner

Canal cruiser insurance is specialist coverage designed to protect narrowboats, barges, widebeams, and other inland waterway vessels from damage, theft, liability claims, and other risks associated with canal and river navigation. Whether you’re a weekend cruiser or a full-time liveaboard, the right insurance provides essential financial protection and peace of mind on the water.

Quick Answer: What You Need to Know About Canal Cruiser Insurance

- Third-party liability cover of at least £2 million is required to obtain a Canal & River Trust licence in the UK

- Comprehensive policies cover your vessel, contents, and liability to others

- Premiums vary based on boat value, age, mooring location, cruising range, and your experience

- Liveaboard coverage requires specialized extensions for contents and alternative accommodation

- Surveys are typically required for boats over 20-30 years old or high-value vessels

When you enjoy cruising between iconic architecture or scenes of rural beauty on the UK’s 4,000+ miles of canals and rivers, insurance is often the last thing on your mind. But even on a leisurely day trip, anything can crop up—from accidentally damaging another boat to finding your narrowboat has been vandalized overnight.

The truth is, while boat insurance is often cheaper than car insurance, finding the right coverage can feel like a chore. You need protection that fits your specific cruising lifestyle, whether that’s seasonal weekend trips, continuous cruising, or using your canal boat as your permanent home.

Most marinas and mooring providers won’t even let you berth without proof of adequate insurance. And if the worst happens—a sinking, fire, or serious accident—recovery and salvage costs alone can run into thousands of pounds. Not all policies cover these expenses, which is why reading the small print matters.

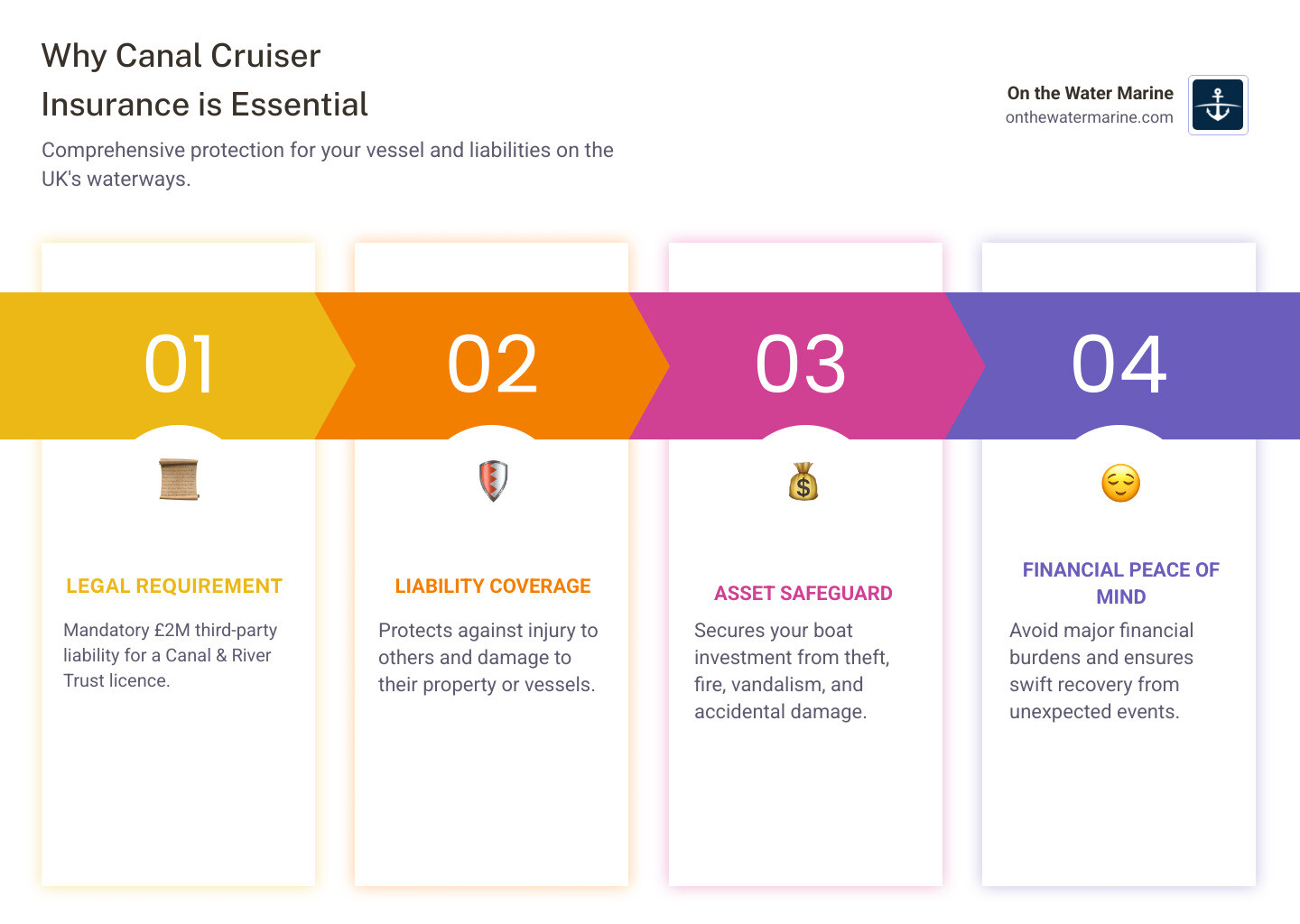

Why Canal Cruiser Insurance is Non-Negotiable

Cruising the waterways in your narrowboat, widebeam, or Dutch barge is a unique pleasure, but it also comes with unique responsibilities. That’s why canal cruiser insurance isn’t just a good idea; it’s a fundamental part of responsible boat ownership. It provides crucial financial security, protecting your significant investment and safeguarding you from unforeseen circumstances.

Think about it: your canal cruiser is a floating asset. Just like your home or car, it’s exposed to risks. From accidental damage in a lock to theft from a mooring, the potential costs of repairs, replacement, or liability claims can be substantial. Insurance helps you handle these situations without financial stress.

Beyond personal peace of mind, navigational authorities and mooring providers often mandate specific insurance coverage. For example, in the UK, while canal cruiser insurance itself isn’t a legal requirement, you cannot obtain a boat licence from the Canal & River Trust without valid third-party canal boat insurance. This ensures that if you cause damage or injury to others, there’s financial protection in place. Similarly, most marinas require proof of public liability cover before they’ll allow you to moor your vessel.

Understanding Your Core Coverage Options

When we talk about canal cruiser insurance, there are generally two main types of policies available:

- Third-Party Only Insurance: This is the minimum level of cover you’ll typically need. It safeguards you, the owner or person in charge of the boat, from claims made against you for injury or damage to other people or their property. This means if you accidentally steer into another boat, damage a lock gate, or injure a pedestrian on the towpath, your policy will cover the costs. Importantly, third-party liability also often includes cover for wreck removal costs, which can be astronomical if your boat sinks and needs to be salvaged. This type of cover does not protect your own vessel from damage or loss.

- Comprehensive Insurance: This is the most extensive coverage and usually what we recommend for most canal cruiser owners. A comprehensive policy goes beyond third-party liability to cover your own boat, its contents, and sometimes even the crew. It offers financial protection against a wide range of perils, including:

- Accidental damage to your boat (e.g., collision, grounding, fire, explosion, storm damage).

- Theft of your vessel or its equipment.

- Vandalism or malicious damage.

- Salvage charges and costs incurred to prevent or minimise a loss.

For more detailed information on general boat insurance coverage, you can explore our guide on more info about boat insurance.

Is Insurance a Legal Requirement?

This is a key question for many boat owners, and the answer can depend on where you’re cruising.

In the UK, canal cruiser insurance is not legally required by the government for privately used boats. However, it’s almost always a practical necessity. As mentioned, the Canal & River Trust (and other waterway authorities like the Environment Agency or Broads Authority) require valid third-party canal boat insurance to issue a boating licence. Without this licence, you cannot use the UK’s inland waterways.

Furthermore, most marinas, boatyards, and even some private moorings will insist on proof of adequate public liability insurance before they allow you to berth your vessel. This protects them from potential claims if your boat causes damage while on their property.

The minimum third-party liability cover required for a boat licence in the UK is typically £2 million. However, many specialist canal cruiser insurance policies, like those we help arrange, offer £3 million or even £5 million third-party liability cover as standard. We always recommend opting for higher liability limits for greater protection.

In summary: while not a “legal requirement” in the strictest sense for ownership, it is a mandatory requirement to use your boat on most UK waterways and to secure a mooring.

What Your Policy Actually Covers (And What It Doesn’t)

Understanding the specifics of your canal cruiser insurance policy is paramount. While we always aim for clarity, insurance policy wordings can be complex. That’s why we emphasize the importance of reading the “small print” carefully. This is where you’ll find the precise details of what’s included, what’s excluded, and any conditions that apply.

One critical aspect often found in the small print relates to salvage costs. If your boat sinks or suffers a severe fire, the costs to recover it can be thousands of pounds. Not all policies automatically cover these expenses, so check if your chosen policy includes comprehensive salvage cover.

Beyond the hull and machinery, what else might your policy cover? Many comprehensive canal cruiser insurance policies offer additional benefits:

- Personal belongings: Cover for your personal effects and valuables on board, often with a specified limit (e.g., up to £50,000 for contents is common). There might be sub-limits for high-value items, so check this carefully.

- Medical payments: Coverage for medical expenses resulting from accidental injuries sustained on your boat.

- Personal accident cover: Provides a financial benefit in case of death, disappearance, or serious injury to you or your passengers while on board.

For a broader understanding of what boat insurance typically covers, you can refer to our general guide: What does boat insurance typically cover?.

Common Inclusions in a Comprehensive Policy

A robust canal cruiser insurance policy will offer a wide array of inclusions designed to protect you and your vessel:

- Vessel Damage (Hull & Machinery): This is the core of comprehensive cover, protecting your boat against accidental damage (collision, grounding), fire, explosion, theft, vandalism, and storm damage. It often includes cover for your engine and other machinery.

- Liability to Others: As discussed, this covers your legal liability for injury to third parties or damage to their property or other vessels.

- Legal Costs: Many policies include cover for legal expenses, such as pursuing uninsured losses from a third party or defending against prosecution related to your boat’s use.

- Emergency Assistance: This can include cover for breakdown recovery, search and rescue costs, emergency accommodation if your boat becomes uninhabitable, or emergency travel costs to get home if your boat is unseaworthy. Some policies even include River Canal Rescue (RCR) retainer membership as standard.

- Tender Cover: If you have a dinghy or tender, your policy might extend to cover its accidental damage or theft, often up to a specified value.

- Transit by Road: If you ever transport your canal cruiser by road, some policies will cover damage or loss during transit.

Crucial Exclusions to Be Aware Of

Just as important as knowing what’s covered is understanding what isn’t. Common exclusions in canal cruiser insurance policies include:

- Wear and Tear, Lack of Maintenance, Gradual Deterioration: Insurance is for sudden, unforeseen events, not for the natural aging of your boat or damage resulting from neglect. This includes rot, mildew, dampness, osmosis, and barnacle growth.

- Frost Damage: Damage caused by freezing water is often excluded unless you can prove you took all necessary preventative measures (e.g., winterizing your engine, draining water systems).

- Vermin or Insect Damage: Damage caused by pests is typically not covered.

- Wilful Misconduct: Damage caused intentionally by you or someone acting with your permission.

- Use Outside Geographical Limits: Your policy will specify the waterways you are covered to cruise on (e.g., UK inland non-tidal waters). Cruising outside these limits without prior agreement from your insurer will void your cover.

- Commercial Use Without Endorsement: If you use your canal cruiser for chartering, hire, or any other commercial purpose, you must inform your insurer. A standard private and pleasure policy will not cover commercial activities.

- Latent Defects: Unless specifically stated, damage arising from a hidden defect in design or construction that existed before the policy began may be excluded.

Always clarify any exclusions with your insurance provider or broker. We, as independent marine insurance consultants, are here to help you steer these complexities.

Calculating Your Premium: Factors and Savings

“How much does canal cruiser insurance cost?” is a question we hear often, and it’s a good one! There’s no one-size-fits-all answer, as premiums are highly personalised. The good news is that boat insurance is often cheaper than car insurance, but several factors will influence your annual premium.

Understanding these factors can help you make informed decisions and potentially save money. We also understand that managing costs is important, which is why we offer expert guidance on this. To get a better handle on general boat insurance costs, you can also check out our guide on how much does boat insurance cost?.

Key Factors That Influence Your Insurance Cost

When we shop for canal cruiser insurance for you, insurers consider a range of details:

- Boat Value and Age: Generally, newer, more valuable boats cost more to insure due to higher repair or replacement costs. Older boats might require surveys, but their lower market value can sometimes translate to lower premiums (though risk factors might increase).

- Type of Boat (Narrowboat, Widebeam, Dutch Barge): While all fall under the “canal cruiser” umbrella, their size, construction, and typical usage can affect premiums. Widebeams and Dutch barges, being larger and sometimes more complex, might have different risk profiles than a standard narrowboat.

- Mooring Location (Marina vs. Towpath): A secure, recognised marina often leads to lower premiums due to reduced risk of theft and vandalism. Mooring on the towpath or in less secure locations can increase the perceived risk and thus the premium.

- Cruising Range: Your intended cruising area is crucial. Are you sticking to UK inland non-tidal waters? Do you occasionally venture onto tidal rivers or even short coastal trips (some policies allow up to 30 days of UK coastal use with prior notice)? The wider your cruising range, the higher the potential risk.

- Owner Experience and Qualifications: Insurers like to see experienced boaters. Having relevant qualifications (like RYA Helmsman courses) or a proven track record of safe boating can positively influence your premium.

- Claims History: A clean claims history, reflected in a no-claims bonus (NCB), is one of the most effective ways to reduce your premium. Conversely, previous claims can increase your costs.

How to Reduce Your Canal Cruiser Insurance Premium

We’re always looking for ways to get you the best coverage at the best price. Here are some actionable steps you can take to reduce your canal cruiser insurance premium:

- Increasing Your Voluntary Excess: Choosing a higher excess (the amount you pay towards a claim) can significantly lower your premium. Just make sure it’s an amount you’re comfortable paying if you need to make a claim.

- Building a No-Claims Discount (NCD): The longer you go without making a claim, the greater your NCD. Some insurers offer up to 25% NCD, and some even offer NCD protection.

- Gaining Qualifications: Demonstrating your competence through recognised qualifications (e.g., RYA courses) can show insurers you’re a lower risk.

- Installing Security and Safety Equipment: Fitting approved alarms, immobilisers, or robust locking systems can reduce the risk of theft and potentially lower your premium.

- Restricting Users: If you only allow experienced individuals to operate your canal cruiser, or limit the number of people who can use it, some insurers may offer a discount. Inform your insurer about anyone who will regularly use your boat.

- Choosing a Secure Mooring: As mentioned, mooring in a reputable, secure marina can lead to discounts. Some policies offer “Marina Benefits” which might waive your excess if a claim occurs within an approved marina.

Getting the Right Policy: Quotes, Valuations, and Surveys

Shopping for canal cruiser insurance can feel overwhelming with so many providers and policy options. That’s where we come in. As independent marine insurance brokers, we shop multiple top-rated carriers, including specialized ones, to find the best coverage and price for you. This is truly the smarter way to shop for boat insurance.

To get an accurate quote, insurers will need detailed information about you and your vessel. This typically includes:

- Boat Details: Make, model, year built, length, beam (width), hull material (e.g., steel, GRP), and stern type (traditional, semi-traditional, cruiser).

- Engine Specifications: Make, model, horsepower, year of manufacture, and whether it’s inboard or outboard.

- Mooring Details: The exact location and type of mooring (e.g., marina berth, private mooring, towpath).

- Intended Use: Whether it’s for private pleasure, liveaboard, or occasional charter.

- Your Experience: Your years of boating experience, any qualifications, and your claims history.

Agreed Value vs. Market Value Explained

When insuring your canal cruiser, you’ll likely encounter “Agreed Value” and “Market Value” options. It’s crucial to understand the difference, as it impacts how much you’d receive in the event of a total loss.

| Feature | Agreed Value | Market Value |

|---|---|---|

| Definition | The amount of money you and the insurer agree upon as the boat’s worth at the start of the policy. | The value of your boat at the time of loss, determined by current market conditions, age, condition, and depreciation. |

| Payout | In case of a total loss, you receive the pre-agreed fixed sum, regardless of its market value at that time. | In case of a total loss, the payout is based on what a similar boat would sell for on the open market immediately before the loss. |

| Pros | Certainty of payout; no disputes over depreciation; often preferred for classic or custom boats where market value is subjective. | Generally lower premiums; reflects current economic conditions. |

| Cons | Higher premiums; requires accurate valuation at policy inception; if over-insured, you’re paying for cover you won’t get. | Payout can be less than expected due to depreciation; potential for dispute if you disagree with the insurer’s market value assessment; less predictable payout. |

| Best For | Newer boats (often up to 2-5 years old), custom-built vessels, or boats where you want guaranteed replacement value. | Older boats, or those where you’re comfortable with a variable payout based on market conditions. |

Many specialist canal cruiser insurance policies, especially for newer vessels, offer an agreed value basis, meaning if your vessel is a total loss, you’ll be paid out the amount you insured it for.

The Role of Surveys and Safety Certificates

For canal cruiser insurance, two important documents often come into play:

- Boat Safety Scheme (BSS) Certificate: This is a key requirement for most boats on the UK’s inland waterways. The BSS is a public safety initiative that sets standards for the design and construction of boats, primarily to prevent accidents like fires, explosions, and carbon monoxide poisoning. Most insurers will require your boat to have a valid BSS certificate.

- Marine Survey: While not always required, a marine survey is often necessary for older or higher-value canal cruisers. Insurers commonly request a full out-of-water survey, including ultrasonic readings for steel hulls, for boats aged 20, 30, or even 50 years or older. This survey, conducted by a qualified marine surveyor, assesses the boat’s condition, seaworthiness, and market value. It helps the insurer (and you!) understand the risks involved. We strongly recommend a survey for any boat purchase, as it can uncover hidden issues. You can learn more in our article, Why every boat owner needs a marine survey.

Ensure your surveyor is independent, knowledgeable about your specific boat type, and carries professional indemnity insurance.

Specialized Coverage for Your Cruising Lifestyle

The beauty of canal cruiser insurance is that it can be custom to your unique cruising lifestyle. Whether your canal boat is your weekend escape or your permanent home, there are specialised coverages to meet your needs and address the unique risks of inland waterway navigation.

While most policies cover UK inland non-tidal waters, some may offer extensions for tidal rivers or even short periods of UK coastal use (e.g., up to 30 days). Always confirm your geographical limits with your insurer.

Liveaboard Canal Cruiser Insurance

For many, a canal boat isn’t just a vessel; it’s a home. If you use your narrowboat, widebeam, or houseboat as your primary residence, you’ll need specialised liveaboard canal cruiser insurance. This type of policy is designed for individuals who use their boat as their permanent home, whether at a long-term mooring or as a continuous cruiser.

Key features of liveaboard coverage often include:

- Primary Residence Coverage: Extends your policy to acknowledge your boat as your home, often with increased liability limits.

- Contents Insurance for Houseboats: Standard policies might have lower limits for personal belongings. Liveaboard policies typically offer higher contents cover (e.g., up to £50,000 or more), reflecting the value of possessions kept on board a permanent home. Some even cover items taken away from the boat or kept in student accommodation.

- Alternative Accommodation Cover: If your canal cruiser becomes uninhabitable due to an insured event (like a fire or flood), this cover will contribute towards the cost of alternative accommodation or rent while your vessel is being repaired. Some policies offer up to £2,500 for this.

- Continuous Cruisers vs. Permanent Moorings: Insurers differentiate between continuous cruisers (who move their boat every 14 days as per Canal & River Trust’s guidelines) and those with a long-term residential mooring. If you have a permanent residential mooring, you will need to pay council tax, whereas continuous cruisers typically do not. Your insurance needs to reflect your actual living situation.

Insuring Different Types of Canal Cruisers

The term “canal cruiser” encompasses a variety of vessels, each with its own characteristics and insurance considerations:

- Narrowboat Insurance Specifics: Narrowboats are iconic to the UK’s canal system, specifically designed to be 6 feet 10 inches wide to steer the narrow locks. They are typically constructed of steel, with hull bases often 10mm thick. Insurance for narrowboats accounts for their unique dimensions, construction, and common usage on non-tidal waterways.

- Widebeam and Dutch Barge Considerations: Widebeams are essentially wider versions of narrowboats, offering more living space, while Dutch barges are often larger, heavier, and may be capable of tidal navigation (though many are used solely on inland waterways). These vessels often have different hull materials, engine types, and values, which impact their insurance premiums and coverage needs.

- Hull Materials (Steel, GRP, Wood): While steel is common for narrowboats and barges, some canal cruisers might be made of GRP (Glass Reinforced Plastic) or even wood. The hull material affects durability, repair costs, and thus, insurance premiums.

- Engine Types: Whether your boat has an older, traditional diesel engine or a modern, more efficient one, engine specifications are a key factor. Age, maintenance history, and power all play a role in assessing risk.

No matter the type of canal cruiser you own, we understand the nuances and can help you find a policy that covers its specific needs.

Conclusion

Navigating canal cruiser insurance can seem daunting, but it’s an essential journey for every boat owner. From understanding the legal requirements for a Canal & River Trust licence to protecting your cherished vessel against unforeseen events, the right insurance provides invaluable peace of mind and financial security.

We’ve explored why canal cruiser insurance is non-negotiable, delving into the core coverage options like third-party liability and comprehensive policies. We’ve also highlighted the crucial exclusions to watch out for, such as wear and tear or unapproved commercial use, and discussed the many factors that influence your premium, from your boat’s age and value to your cruising experience.

Remember the importance of personalised coverage. Whether you’re a weekend explorer or a full-time liveaboard, your policy should be custom to your unique lifestyle. This includes considering agreed value versus market value, understanding the role of surveys and safety certificates, and exploring specialised coverages for different types of canal cruisers.

At On The Water Marine, we pride ourselves on being independent marine insurance brokers. We don’t just offer you a single quote; we shop multiple top-rated carriers, including specialised ones, to ensure you get the best canal cruiser insurance coverage and price. Our personalized service, expert guidance, and access to policies not typically available online mean you can cruise with confidence, knowing you’re well-protected.

Don’t let the complexities of insurance dampen your enjoyment of the waterways. Let us handle the details, so you can focus on making memories on your canal cruiser.

Get a personalized boat insurance quote today and start on your next adventure with complete peace of mind.

Related Articles

Florida Has Some of the Highest Boat Insurance Rates in the Country — Here’s What to Expect Boat insurance Florida rates are among the most expensive [...]

Why Personal Watercraft Policies Matter for Marine Asset Protection A personal watercraft policy is a specialized marine insurance contract designed to protect operators and owners of [...]

What Is Commercial Marine Insurance — and Why It Matters for Your Business Commercial marine insurance is a category of specialized coverage designed to protect businesses [...]