Why Every Fishing Guide Needs Liability Insurance

Fishing guide liability insurance protects professional guides from financial losses due to client injuries, property damage, or lawsuits. It’s the essential coverage that keeps your business afloat when accidents happen on the water.

Quick Answer: What You Need to Know

- What it covers: Bodily injury to clients, property damage, legal defense costs, and medical expenses

- Who needs it: Any guide taking paying clients fishing, whether full-time or part-time

- Starting cost: Around $395 annually for basic coverage

- Legal requirement: Often mandatory for permits in National Parks, National Forests, and marinas

- What it protects: Your business assets, personal finances, and professional reputation

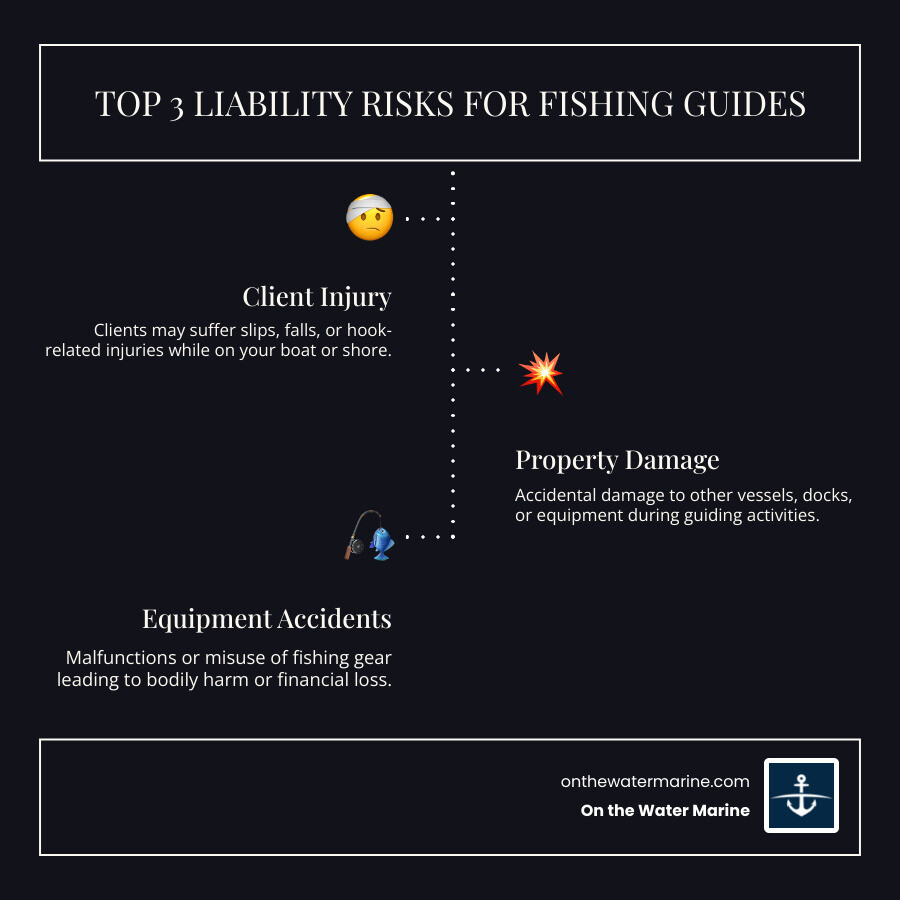

As a guide, your clients trust your expertise. But no matter how cautious you are, accidents happen. A client could slip on a wet deck, a hook could cause an injury, or your boat could collide with another vessel. Without proper insurance, a single incident could wipe out everything you’ve built.

The stakes are high. Regulations in places like Canada and across the United States require commercial boat operators to carry significant liability coverage. For example, Transport Canada requires at least $250,000 of coverage multiplied by the vessel’s passenger capacity.

But liability insurance isn’t just about meeting legal requirements; it’s about protecting your livelihood. Even frivolous claims can cost thousands in legal fees. With the right coverage, you can focus on creating unforgettable fishing experiences, knowing your business is protected.

Why Fishing Guide Liability Insurance is Your Most Important Gear

You’ve spent years building your reputation and investing in gear. Don’t let one unforeseen accident jeopardize it all. For fishing guides, the blend of adventure and nature creates unique risks. Fishing guide liability insurance is your most important piece of gear, safeguarding your passion and profession.

At On The Water Marine, we help you steer these waters with confidence. We understand your challenges and provide the comprehensive protection you need for peace of mind. It’s about protecting your clients, your business, and your livelihood. Explore more about how we protect marine businesses: More info about Marine Business Insurance.

Protecting Your Business from Financial Ruin

One of the primary reasons to carry robust fishing guide liability insurance is to shield your business from financial ruin. Accidents are an inherent part of outdoor activities. Should an incident lead to injury or property damage, you could face substantial legal challenges. Even if a lawsuit is baseless, defense costs can escalate into thousands of dollars, threatening your savings and assets.

Consider these scenarios where liability insurance helps:

- Bodily injury claims: A client is seriously injured and sues for medical expenses and lost wages. Your policy covers these costs and your legal defense.

- Property damage claims: Your boat damages another vessel or a client’s equipment. Your insurance can cover the repair or replacement costs.

- Lawsuit settlements: If you’re found liable, your policy covers the settlement or judgment amount up to your policy limits, protecting your personal assets.

- Asset protection: Adequate insurance creates a critical barrier between your business’s liabilities and your personal wealth—your home, savings, and other assets.

Meeting Legal, Permit, and Marina Requirements

Beyond financial protection, fishing guide liability insurance is often a non-negotiable requirement for operating legally.

- Permits: To operate in National Parks or National Forests, you’ll need to provide proof of adequate liability insurance, often with limits of $1 million per occurrence.

- State Licensing: Many states have specific licensing and insurance requirements for commercial fishing guides. It’s crucial to know the regulations where you operate.

- Marina Mandates: Marinas invariably require you to carry liability insurance to protect them from claims arising from incidents involving your vessel on their property.

- Regulatory Compliance: In Canada, Transport Canada requires operators carrying passengers to maintain significant liability coverage (at least $250,000 multiplied by passenger capacity). Failure to comply can result in heavy fines and vessel detention. These rules ensure passengers are compensated in case of an accident.

Ensuring compliance is fundamental to running a legitimate business. If you’re wondering about general legal requirements, we have more information here: Is boat insurance required by law?.

Navigating the Waters: Core Coverages for Common Guiding Risks

Guiding clients on the water is an adventure, but it’s also fraught with risks that demand custom insurance. From the moment clients step aboard, you are responsible for their safety. Fishing guide liability insurance is designed to cover the most common perils of your operations.

Think about everyday risks: a client slipping on a wet deck, a stray hook causing an eye injury, or your boat bumping another vessel. A comprehensive liability policy is built to address these incidents, ensuring you’re protected when the unexpected happens.

What is Covered by a Standard Liability Policy?

A standard fishing guide liability insurance policy is built on Commercial General Liability (CGL), adapted for marine risks. It generally includes:

- Bodily Injury: Covers claims from physical injury, sickness, or death sustained by a third party (like your clients) during your operations.

- Property Damage: Covers claims for damage to property belonging to others, such as a dock, another vessel, or a client’s expensive camera.

- Products-Completed Operations: Applies if you sell products or if a claim arises from your completed guiding service, such as an injury from faulty equipment you provided.

- Personal & Advertising Injury: Covers non-physical claims like libel, slander, or copyright infringement.

- Medical Expense: Provides limited, no-fault coverage for initial medical bills for minor injuries, which can help prevent a larger lawsuit.

To dive deeper into what liability coverage entails, read our detailed guide: What does liability boat insurance cover?.

Understanding Common Policy Exclusions

It’s also crucial to understand what your policy doesn’t cover. Knowing these standard exclusions helps you identify gaps that might require additional coverage.

Common exclusions include:

- Watercraft over 26 feet: Standard policies often have a size limit; larger boats require specialized marine insurance.

- High-risk whitewater operations: Extreme whitewater activities (e.g., over Class III) are typically excluded.

- Lodging or retail operations: These activities require separate property and business liability policies.

- Intentional acts: Insurance covers accidents, not deliberate harm.

- Commercial use on a personal policy: Your personal boat policy will not cover commercial guiding. Using it for business will lead to a denied claim. Learn more: Is my boat covered under my homeowners policy?.

- Equine or ATV guiding: These activities require separate, specialized liability coverages.

- Fishing over 5 miles from shore: Some policies have geographical limits and may require different coverage for offshore guiding.

- Private/pleasure use: Your guide policy is for commercial operations and does not cover personal fishing trips.

- Auto liability: Your guide policy doesn’t cover transporting clients in your vehicle. You need a commercial auto policy or a “business use” endorsement on your personal auto policy.

- Unlawful fishing: Any liability arising from illegal activities is excluded.

Beyond the Basics: Essential Add-Ons for Complete Protection

While core liability coverage is the bedrock of your protection, a comprehensive insurance strategy extends beyond the basics. Just as you need a full tackle box, your business needs a full suite of coverages custom to your unique risks.

We provide custom policies that offer truly comprehensive protection, allowing you to manage risks effectively by layering additional coverages onto your primary liability policy.

Protecting Your Physical Assets

Your boat and gear are the tools of your trade and significant investments. Protecting them is paramount.

- Commercial Boat Insurance: This is distinct from personal boat insurance and covers physical damage to your vessel.

- Hull & Machinery coverage: Protects the structure of your boat and its engines from perils like collision, fire, theft, and natural disasters.

- Equipment & Gear coverage: Protects your expensive rods, reels, tackle, and electronics from loss, theft, or damage. Some policies cover gear based on the value lost in a single accident, not the total value you own.

- Trailer coverage: You may need specific property coverage for your trailer if it’s not covered for physical damage under your auto policy.

Understanding what your boat insurance actually covers is key. We’ve got a comprehensive article on this: What does boat insurance actually cover?.

Other Important Coverages to Consider

Depending on your business, several other types of insurance can provide vital protection:

- Commercial Auto Insurance: If you use your vehicle to transport clients, your personal auto policy likely won’t cover you. A commercial policy is necessary.

- Workers’ Compensation: Often legally required if you have employees, this covers employee injuries on the job.

- Umbrella Liability: Provides an extra layer of liability protection above the limits of your primary policies, covering catastrophic claims.

- Fuel Spill Liability Coverage: This specialized coverage protects you from the massive cleanup costs and fines associated with fuel spills. Learn more: Fuel spill liability coverage.

- Trip Cancellation Insurance: Can protect you against lost income if you are forced to cancel trips.

- Cyber Liability Insurance: Critical if you handle client data online, this covers costs associated with data breaches and cyberattacks.

- Professional Liability Insurance (Errors & Omissions): Covers claims of negligence in your professional advice or services.

Decoding the Policy: Factors that Influence the Cost of Fishing Guide Liability Insurance

Understanding what influences the cost of your fishing guide liability insurance is key to finding an affordable, comprehensive policy. Insurance premiums vary based on the unique risks of your operation.

When we work with you, we review these factors to get you the best possible rates from our network of top-rated carriers.

How Premiums Are Calculated

Premiums are determined by assessing your business’s level of risk. Key factors include:

- Type of Guiding Operations: The inherent risks of your specific guiding style (e.g., calm river fly fishing vs. deep-sea charters) directly influence your premium.

- Location of Operations: Operating in certain areas might come with higher premiums due to environmental factors (like hurricane risk) or specific state regulations.

- Number of Guides and Employees: More guides mean higher exposure to risk. Policies often have a base rate plus additional charges per employee or contractor.

- Gross Annual Revenue: Higher revenue often correlates with more activity and thus potentially higher risk, though some programs base pricing on the number of guides instead.

- Claims History: A history of claims indicates higher risk and can increase premiums, while a clean record helps keep costs down.

- Coverage Limits and Deductibles: Higher liability limits increase your premium but offer more protection. A lower deductible also results in a higher premium.

As a rough guide, liability insurance for fishing guides can start around $395 for basic coverage, but policies with higher minimums can be significantly more.

For a broader understanding of boat insurance costs, review our guide: How much does boat insurance typically cost?.

How to Potentially Lower Your Insurance Costs

While some factors are fixed, you can take proactive steps to potentially reduce your premiums:

- Maintain an Excellent Safety Record: A consistent history of no claims is the best way to demonstrate a low-risk profile.

- Professional Certifications and Training: Completing safety courses (e.g., CPR, First Aid) can sometimes qualify you for discounts.

- Association Memberships: Being a member of a professional guiding association might offer access to group insurance programs or discounts.

- Choose a Higher Deductible: Opting for a higher deductible can lower your annual premium, but means you pay more out-of-pocket for a claim.

- Bundle Policies: Combining coverages like commercial auto or property insurance with the same provider can sometimes lead to discounts.

- Implement Waivers: Using well-drafted liability waivers shows a commitment to risk management and can be viewed favorably by insurers.

How to Get a Quote and Purchase Your Policy

Securing fishing guide liability insurance can be a straightforward process with the right guidance. As an independent marine insurance broker, our role is to simplify this for you, ensuring you get comprehensive coverage without the hassle.

The Step-by-Step Process to Get Insured

Here’s our typical process to get you a policy:

- Gather Business Information: We’ll start by collecting details about your operation, including business name, guiding types, locations, number of guides, revenue, loss history, and boat details.

- Complete an Application: We help you complete a detailed application, which can often be done online in minutes.

- Review the Proposal: Our team shops our network of over 50 providers to find you options. We’ll email you a proposal, typically within two business days, and review it with you to answer any questions.

- Make a Payment: Once you accept a proposal, you’ll make the payment. Flexible options are often available.

- Receive Policy Documents: After payment, your coverage is bound. We’ll email your Certificate of Insurance (COI) and full policy documents, which you can use to prove coverage to marinas and permit agencies.

Ready to start? Let us help you get the coverage you need. Get a Quote.

Why Waivers Aren’t Enough

Many guides use client waivers, but it’s crucial to understand they are not a substitute for fishing guide liability insurance.

- Waiver Limitations: Waivers are not foolproof. They can be legally challenged and may be thrown out by courts, especially in cases of gross negligence or if they are poorly written.

- Legal Challenges: A client can still sue you even with a signed waiver. The waiver won’t prevent the lawsuit or cover your legal defense costs.

- Gross Negligence: Waivers typically do not protect you from claims of gross negligence or willful misconduct.

- Insurance as a Backstop: Liability insurance is your essential financial backstop. It provides funds for legal defense and settlements, protecting your assets and keeping your business running.

- Required for Permits: Many permits and marina agreements require actual insurance coverage, not just a waiver.

While waivers are a good practice, they are a complement to, not a replacement for, comprehensive liability insurance. You can use software like Adobe Acrobat Reader to manage waiver forms. We recommend keeping all signed waivers for at least three years.

Frequently Asked Questions about Fishing Guide Insurance

Here are answers to some of the most common questions we receive from fishing guides.

What’s the difference between insurance for fishing guides and other outdoor guides?

While there’s overlap, fishing guide liability insurance is specialized due to the marine environment. Key differences include:

- Marine-Specific Risks: Fishing guides face unique water-related hazards like currents, submerged obstacles, and the risks of being on a boat (slips, falls, drowning).

- Watercraft Liability: A significant portion of the risk comes from operating the boat, including collisions and passenger liability, which requires specialized marine coverage.

- Passenger-for-Hire Regulations: Carrying paying passengers on water triggers specific, often higher, insurance requirements not applicable to most land-based guides.

- Specialized Equipment Coverage: Policies can be custom to cover expensive fishing gear and marine electronics against loss or damage in a marine setting.

A policy designed specifically for fishing guides will better address these exposures than a general “outdoor guide” policy.

Does my personal boat insurance cover my guiding business?

Absolutely not. This is a critical misunderstanding. Personal boat insurance is for recreational use and includes a “commercial use exclusion.” If you carry paying clients and an accident occurs, your personal policy will deny the claim, leaving you personally liable for all costs.

You must have a dedicated commercial boat insurance policy that explicitly covers your business operations. Relying on personal insurance is a gamble that could cost you your business and personal assets. Protecting your livelihood with the right commercial coverage is paramount. We believe that your boat and yacht insurance should be your anchor: Why boat and yacht insurance should be your anchor.

Can I add a landowner or marina as an “Additional Insured”?

Yes, absolutely. It’s a common and often required practice to name other entities as “Additional Insureds” on your fishing guide liability insurance policy.

- Why it’s needed: Landowners, fly shops, or marinas may require this for land use permits or access. It protects them from liability arising from your operations on their property.

- How it works: We add the entity to your policy, and you provide them with a Certificate of Insurance (COI) as proof of coverage.

- Cost: Naming governmental bodies (e.g., National Parks) is typically done at no extra charge. Naming private businesses (e.g., a fly shop) may incur a small additional fee.

Always let us know who needs to be named as an Additional Insured, and we will ensure your policy meets all permit and access requirements.

Conclusion: Cast with Confidence and Complete Coverage

As a professional fishing guide, your passion is your profession. But the inherent risks of being on the water, if left unaddressed, can capsize your business and livelihood.

Fishing guide liability insurance is not just another expense; it’s a vital investment in your future. It’s the shield that protects your assets, covers your legal defense, and ensures that an unforeseen accident doesn’t derail your dreams. Comprehensive coverage allows you to focus on what you do best: creating unforgettable fishing experiences.

At On The Water Marine, we are an independent marine insurance broker dedicated to providing personalized service and expert guidance. Our mission is to simplify the insurance process, helping you find the right coverage custom-built for your operations.

Don’t let the fear of the unknown overshadow your passion. Cast your lines with confidence, knowing that your business, clients, and livelihood are comprehensively protected.

Get protected today with a comprehensive Fishing Guide Insurance policy

Related Articles

Why Understanding Boat Rental Insurance Coverage Matters Boat rental insurance coverage typically includes liability protection, damage to the vessel, medical payments, and fuel spill liability, with [...]

Why Standard Policies Often Miss the Mark in Florida Waters Boat insurance coverage Florida is not as straightforward as many vessel owners assume. While Florida law [...]

Understanding What Drives Marine Insurance Costs for Professional Guides How much does fishing guide insurance cost is one of the most common questions from guides starting [...]