Why Marine Guide Insurance Requires a Different Approach Than Personal Yacht Coverage

Marine guide insurance can be specialized commercial coverage designed for professional operators who take paying clients on the water. Unlike personal yacht policies, these policies may address the unique liability exposures that can come with operating a vessel for hire—including passenger injuries, regulatory compliance requirements, and third-party claims that can exceed standard policy limits.

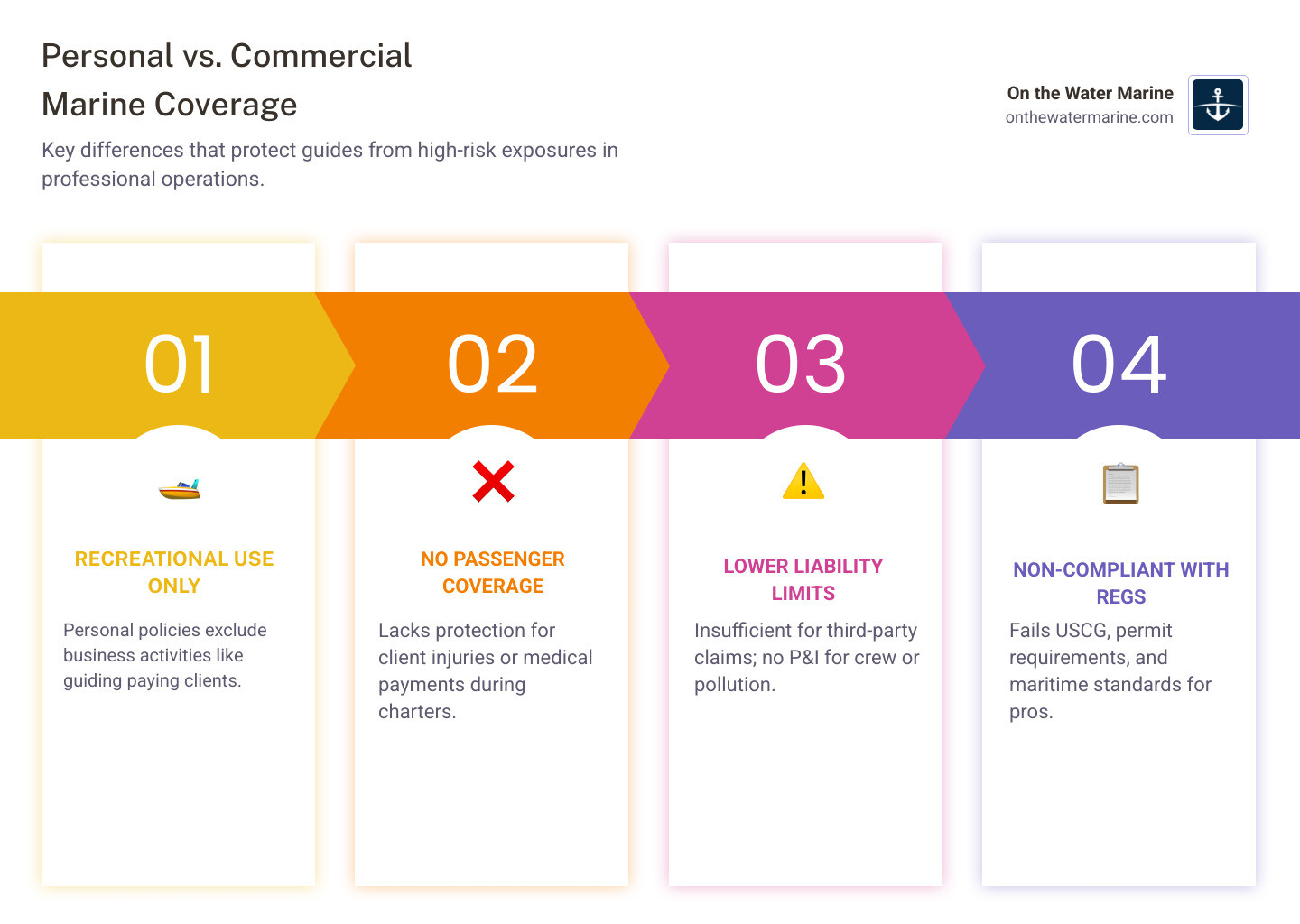

Key Differences Between Personal and Commercial Marine Coverage:

| Personal Yacht Policy | Marine Guide Insurance |

|---|---|

| Typically covers recreational use only | Can cover commercial operations and paying passengers |

| May exclude business activities | May include professional liability and passenger medical payments |

| May not meet USCG or permit requirements | Intended to comply with federal and state regulatory standards |

| Often features lower liability limits | Potentially higher limits with Protection & Indemnity (P&I) options |

| Typically does not cover crew liability | May include coverage for crew and contractors |

Most marine insurance problems don’t appear when a policy is bound—they can appear when something goes wrong. A client injury during a charter, damage to another vessel while maneuvering with passengers aboard, or a pollution incident can all trigger claims that a personal yacht policy might not cover. Many operators assume their existing coverage extends to guide activities, only to potentially discover the exclusion when they file a claim.

Commercial marine policies typically include:

- General liability for third-party bodily injury and property damage

- Protection & Indemnity (P&I) for crew and passenger claims

- Pollution liability and legal defense costs

- Coverage for specialized equipment and fishing tackle

- Certificates of Insurance (COI) for permit applications

Marine guide operations face risks that personal boating does not. Carrying paying passengers changes the liability profile entirely, and most personal policies explicitly exclude commercial use. Understanding the difference between recreational and commercial coverage can be critical for any operator running a guide business.

I’m Eric Fisher, and my background is in yacht and marine insurance. Whether you’re operating a charter fishing vessel or guiding clients on coastal waters, the right policy structure often depends on how the vessel is used and what U.S. Coast Guard requirements apply.

Navigating the Complexities of Marine Guide Insurance

Professional marine operations are fundamentally different from recreational boating. When you transition from a private owner to a guide or outfitter, your risk exposure may increase significantly. This is where marine guide insurance can serve as a foundation of your business’s financial security.

Standard general liability might cover a slip-and-fall on a dock, but it may not address the professional liability inherent in guiding. If a client follows your instruction and sustains an injury, or if a navigational error leads to a significant property damage claim, the policy language in a commercial contract can be what stands between your assets and a lawsuit. Depending on the policy language, commercial use coverage may include “Protection and Indemnity” (P&I), which can be considered the maritime equivalent of broad-form liability, specifically tailored for the unique legal environment of the water.

Why Marine Guide Insurance Often Requires Specialized Underwriting

Carriers view commercial vessels through a different lens than recreational ones. Underwriting criteria for a guide policy often focus on the operator’s experience level, the vessel’s value, and the specific geographic areas of operation.

In many cases, a carrier’s appetite for risk can be dictated by the “loss runs” or the safety record of the operation. For vessels over 35 feet, underwriters may require a current marine survey to assess the vessel’s seaworthiness for commercial use. This specialized underwriting helps ensure that the policy is rated for the risks you actually face, rather than a generic “one-size-fits-all” approach.

How Marine Guide Insurance May Help Protect High-Value Assets

For owners of high-end center consoles or motor yachts, the vessel itself can be the business’s largest asset. Marine guide insurance typically offers “Agreed Value” hull coverage. This can mean that in the event of a total loss, the policy may pay the amount agreed upon when the policy was bound, rather than a depreciated “Actual Cash Value.”

Beyond the hull, professional policies often include:

- Specialized Gear and Tackle: Coverage for high-end electronics, outriggers, and fishing equipment that can be lost or damaged during a charter.

- Protection and Indemnity (P&I): This is intended to provide broad liability coverage for bodily injury or property damage to third parties.

- Wreck Removal: If a vessel sinks in a navigable waterway, the cost of removal can be significant; commercial policies often include specific limits for this requirement.

Essential Coverage Components for Professional Marine Operations

When protecting a professional marine operation, the details can matter. A gap in coverage for a pollution event or a crew member injury can be devastating to a business.

Marine Guide Insurance and Regulatory Compliance Considerations

Operating a guide business often involves more than just having the right gear; it can be about meeting federal and state mandates. If you operate on public waters or within specific marine sanctuaries, you may be required to provide a Certificate of Insurance (COI) naming the agency as an “Additional Insured.”

Furthermore, USCG requirements for “vessels for hire” can be strict. Your insurance policy should typically align with your COI and your captain’s license. Maritime law, specifically the Jones Act, may also come into play if you have employees or “crew” working on the vessel. Ensuring your policy includes crew liability can be a critical step that is sometimes misunderstood by part-time operators.

| Coverage Type | General Liability | Protection & Indemnity (P&I) |

|---|---|---|

| Primary Focus | Land-based risks (docks, offices) | Water-based risks (on the vessel) |

| Passenger Injury | May provide limited coverage | Can be primary coverage for guests |

| Legal Defense | May be included for covered perils | Included for maritime claims |

| Pollution | Often excluded | Often included or available as an add-on |

Risk Mitigation and Liability Management for Guides

One way to handle a claim can be to prevent it from happening in the first place. This can be where risk management and insurance intersect to help protect your operation.

Liability waivers are a standard tool in the industry, but they are not a substitute for insurance. While a well-drafted waiver may help in a legal defense, the insurance policy can be what provides the actual defense and settlement funds. Carriers often look favorably on operators who implement formal safety programs and maintain rigorous maintenance logs. Regular vessel surveys by a qualified professional can also help identify potential hazards before they lead to a machinery breakdown or an accident.

Understanding Policy Exclusions and Limitations

It can be equally important to understand what might not be covered. Most marine guide insurance policies contain standard exclusions that every operator should be aware of:

- Gradual Deterioration: Wear and tear, corrosion, and “slow leaks” are generally not covered.

- Mechanical Breakdown: Unless caused by an external peril (like hitting a submerged object), engine failure is typically an out-of-pocket expense.

- Geographic Limits: If you venture outside the “navigational limits” defined in your policy, you may have no coverage.

- Unlawful Use: Operating without the proper licenses or under the influence of alcohol or drugs may void coverage.

Frequently Asked Questions about Marine Guide Insurance

Will my personal yacht policy cover my guiding activities?

In many cases, the answer may be no. Personal policies contain a “commercial use exclusion.” If you accept even a small fee for a guided trip, you may be considered to be operating a business. If an incident occurs during that trip, the carrier might deny the claim entirely based on the change in the vessel’s risk profile.

Does insurance cover my specialized fishing tackle and gear?

Yes, but it often requires a specific endorsement or an “Inland Marine” rider. Standard hull coverage often focuses on the vessel and its built-in components. If you carry significant value in rods, reels, and electronics, you should ensure they are “scheduled” or that your personal effects limit is high enough to cover a potential loss or theft.

Is coverage available for part-time or seasonal guides?

Many operators only run charters during peak seasons. While some carriers offer flexible terms, most professional marine insurance is often written on an annual basis to ensure year-round protection for the vessel, even when it is docked or in storage. Professional standards generally suggest that maintaining continuous coverage can be a safer way to help avoid gaps.

Conclusion

Navigating the waters of professional guiding often requires more than just local knowledge; it can require a sophisticated understanding of risk. As an independent broker, On the Water Marine shops multiple top-rated carriers to find the specific policy language that fits your unique operation. We offer the personalized service and guidance intended to help your business be built on a solid foundation.

If you’re insuring a 35’+ vessel and want to better understand your coverage options, you can request a quote here. For more in-depth information on specialized marine topics, you may find our complete guide to fishing guide insurance or our breakdown of guide insurance costs helpful as you evaluate your business needs.

Related Articles

Why Most Miami Boat Owners Don’t Find Coverage Problems Until It’s Too Late Boat insurance Miami Florida is often misunderstood until the moment a claim is [...]

Protecting Your Passion on Texas Waters Texas fishing guide insurance is specialized commercial coverage protecting professional guides from liability claims, equipment damage, and other business risks. [...]

Introduction: The Misconception of “Standard” Coverage Boat insurance Fort Myers is not a single product. It’s a collection of policy structures, coverage limits, and exclusions that [...]