Why Yacht-Based Fishing Guide Services Need Specialized Marine Insurance

Kayak fishing guide insurance may be a common search term, but if you operate a professional fishing guide service from a vessel 35 feet or larger, you’re operating in a completely different risk category. Small craft coverage doesn’t apply to yacht-based charter operations—and the insurance you need is far more specialized.

What you need to know about insurance for professional yacht-based fishing guide services:

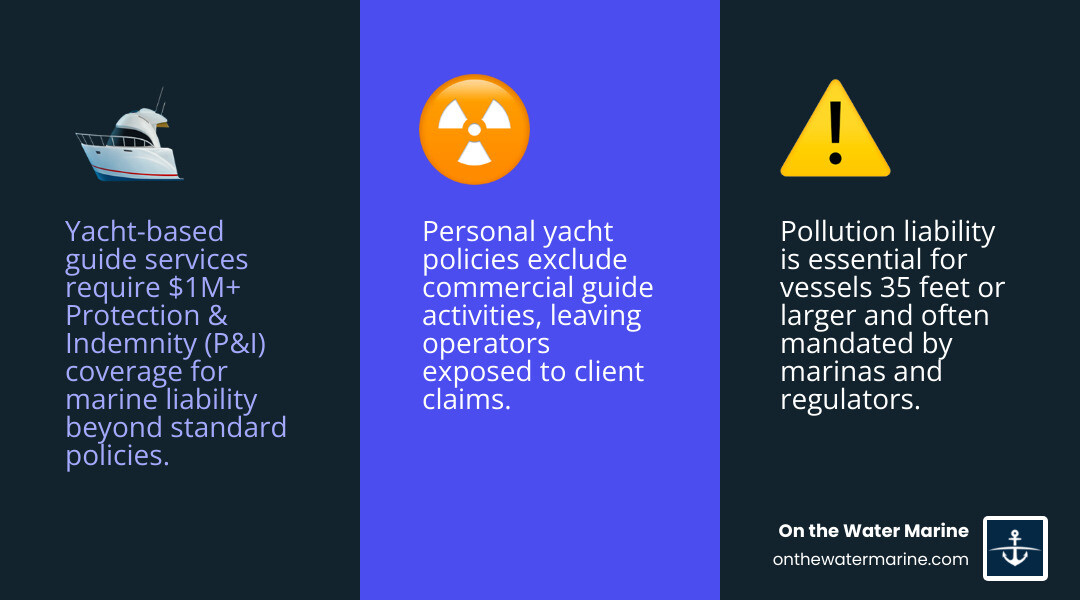

- General liability coverage protects against third-party bodily injury and property damage claims during guided trips

- Protection & Indemnity (P&I) provides broader marine liability than standard policies, often with $1M+ per occurrence limits

- Commercial use endorsements are required when your yacht is used for paid guide services—personal policies exclude this entirely

- Pollution liability is critical for larger vessels and often required by marinas or regulatory bodies

- Equipment and tackle coverage protects high-value fishing gear, electronics, and professional-grade tackle

- Premiums vary based on vessel value, navigation area, captain credentials, and gross receipts

Most yacht owners who transition into professional guide services don’t realize their personal marine policy excludes commercial activity. That gap can leave you completely unprotected during a client trip—even if you’ve been paying premiums for years.

I’m Eric Fisher, and after more than a decade in marine insurance sales and risk management, I’ve worked with yacht owners navigating the complexities of commercial endorsements and professional guide coverage. Whether you’re operating a sportfishing yacht or offering eco-tourism charters, understanding the distinction between recreational and commercial marine insurance is essential.

How Professional Guide Insurance Has Evolved for Yacht-Based Operations

The landscape of professional guiding has shifted significantly as more owners of large cruising vessels and sportfishing yachts enter the charter market. In the past, a simple “occasional charter” endorsement might have sufficed for a weekend trip. Today, the litigious environment and the high value of modern 35’+ vessels require a more robust approach to risk management.

When moving beyond basic kayak fishing guide insurance concepts into large-scale yacht operations, the primary shift is from simple “accident” coverage to comprehensive commercial liability. A standard yacht insurance policy is designed for private pleasure use. The moment a fee is exchanged for a guided trip, that recreational contract may be voided unless a commercial endorsement or a standalone professional guide policy is in place.

Professional indemnity also plays a larger role here. As a yacht-based guide, you aren’t just providing a platform to fish; you are providing professional instruction and navigation. If a client alleges that your professional negligence led to an injury or financial loss, standard general liability might not be enough to address the claim.

Key Elements of Yacht-Based Guide Insurance

For owners of vessels 35 feet and larger, the “core” of a policy usually revolves around three pillars: bodily injury, property damage, and commercial liability.

- Bodily Injury: This covers medical expenses and legal fees if a guest is injured while boarding, fishing, or moving about the yacht.

- Property Damage: This protects you if your vessel causes damage to another boat, a dock, or underwater infrastructure while on a guided trip.

- Commercial Liability: This is the overarching umbrella that acknowledges the “for-hire” nature of the business, ensuring that the insurance carrier is aware of and accepts the increased risk of having paying passengers aboard.

For a deeper dive into these fundamentals, you can review our guide insurance resource.

Distinctions Between Yacht Guide Policies and Standard Charter Coverage

It is often misunderstood that all “charter” insurance is the same. However, there are stark differences between a bareboat charter (where the renter operates the boat) and a guided sportfishing charter (where you or a hired captain provides the service).

Vessel size and value are the primary drivers of these differences. A 45-foot sportfish yacht represents a significantly higher capital risk than a smaller craft. Furthermore, navigation limits on yacht-based policies are often much broader, potentially covering offshore canyons or international waters, whereas standard boat insurance might restrict you to coastal boundaries. Passenger capacity is also a factor; while many guides operate under U.S. Coast Guard “six-pack” licenses, the liability limits required for a yacht often start at $1,000,000 to $2,000,000 to satisfy marina and tournament requirements.

Core Coverage Considerations for High-Value Guide Services

Operating a high-value vessel for commercial purposes introduces exposures that many owners overlook until a survey or a contract requirement brings them to light.

Protection and Indemnity (P&I)

In the marine world, P&I is the gold standard for liability. Unlike standard general liability, which might have an aggregate limit (a “cap” on what the policy pays in a year), many P&I policies for professional guides are written on an “occurrence” basis. This means the full limit is available for every separate incident. This is particularly important for commercial fishing insurance where a single event could involve multiple injured parties.

Pollution Liability and Agreed Value

Larger yachts carry significant amounts of fuel and oil. A mechanical failure that leads to a spill can result in staggering fines and cleanup costs. Broad pollution liability—often up to $1 million—is a standard expectation for professional yacht guides.

Additionally, we always emphasize the importance of “Agreed Value” coverage. In the event of a total loss, you want to know exactly what the payout will be, rather than haggling over “Actual Cash Value” or depreciation. This is a cornerstone of any quality fishing guide insurance policy for significant assets.

Specialized Endorsements for Yacht-Based Angling

While the yacht is your primary place of business, your liability doesn’t always end at the gunwale.

- Shore-side Liability: This may cover incidents that occur while clients are on the dock or at a marina facility under your guidance.

- Tournament and Event Coverage: Many prestigious fishing tournaments require guides to show proof of specific liability limits and may need to be named as “Additional Insured” on the policy.

Equipment and Tackle Protection for Professional Operations

The “fishing gear” sub-limits on a standard recreational policy are usually insufficient for a professional sportfishing operation. When you have a dozen custom offshore rods, electric reels, and high-end sonar systems, you need specialized equipment coverage.

Inland Marine endorsements can be used to protect this gear both on the boat and while in transit or storage. Many professional policies offer replacement cost coverage for tackle, ensuring that a single “bad day” or a theft incident doesn’t sideline your business. For more on these specifics, see our guide insurance FAQ.

Risk Management and Eligibility for Professional Yacht Guides

Securing a policy for a 50-foot sportfishing yacht used for commercial purposes is not as simple as clicking a button online. Underwriters look at the “human element” just as closely as the vessel itself.

Underwriting Criteria for Commercial Yacht Operations

To qualify for the most competitive professional programs, guides typically need to demonstrate a track record of safety and experience.

| Feature | Standard Recreational Policy | Specialized Yacht Guide Policy |

|---|---|---|

| Experience | Often minimal requirements | 3-5 years experience or 1 year in business |

| Licensing | Not required for owners | USCG Captain’s License (OUPV or Master) |

| Survey | Every 5-10 years | Often required every 3 years for commercial use |

| Gross Receipts | N/A | Typically capped (e.g., under $750k for small programs) |

| Navigation | Local/Coastal | Offshore/Canyon/International options |

Underwriters will also review your fishing guide insurance blog or website to ensure the activities you are advertising match the risks they are willing to cover.

Managing Operational Risks on the Water

Insurance is your “Plan B,” but risk management is your “Plan A.” For large yacht operations, this includes:

- Rigorous Equipment Inspections: Beyond just the fishing gear, the vessel’s fire suppression systems, life rafts, and bilge pumps must be maintained to commercial standards.

- Weather Monitoring: Larger vessels can handle more, but the responsibility to stay within safe operating windows for clients is paramount.

- Client Briefings: Documenting that you provided a safety briefing to all guests before departure can be a powerful defense in a liability claim.

Factors That Influence Premiums for Professional Yacht Guide Policies

It is often asked why one 40-foot yacht costs more to insure than another of the same age. In the commercial world, the “how” and “where” matter as much as the “what.”

Navigation Area and Claims History

Where you fish is a primary cost driver. For example, in Florida—often considered the most expensive state for marine insurance—premiums may range from 1% to 4% of the hull value. This is due to the increased risk of named storms and the density of boat traffic. Conversely, a guide operating in the protected waters of the Chesapeake Bay may see different considerations.

Your claims history is your “marine credit score.” Even small “nuisance” claims can lead to higher premiums or a non-renewal in the commercial sector. Maintaining a clean record is the best way to keep fishing guide insurance costs manageable over the long term.

The Role of Vessel Value and Size in Underwriting

At On the Water Marine, we focus on vessels 35 feet and larger. At this size, the hull material (fiberglass vs. aluminum) and the age of the machinery become critical. If your yacht has older engines, underwriters may require a mechanical survey to ensure the risk of a “dead ship” scenario—which often leads to towing or liability claims—is minimized.

Impact of Specialized Activities on Coverage

Standard guiding is one thing; specialized niches are another. If your business includes multi-day “live-aboard” charters or remote navigation to areas with limited rescue resources, the premium will reflect that increased exposure. Similarly, eco-tourism where clients might leave the yacht to wade-fish or shell on remote beaches requires specific shoreside liability endorsements.

Frequently Asked Questions About Professional Guide Insurance

What liability limits are typical for professional yacht guides?

Most professional operations carry a minimum of $1,000,000 in liability coverage. Many high-end marinas and government-managed tournament docks now require a $2,000,000 aggregate limit. In today’s litigious environment, a lower limit like $300,000 is often viewed as insufficient for a serious yacht-based business.

How does commercial use affect a standard yacht policy?

In most cases, a standard recreational policy has a “Commercial Use Exclusion.” If you accept even a small fee for a guided trip without a commercial endorsement, the carrier may deny any claim that occurs during that trip—even if the accident had nothing to do with the fishing itself.

Are crew members included under professional guide policies?

This depends heavily on the policy language. Standard recreational policies often exclude “Jones Act” or maritime employer liability. If you hire a mate or a co-captain, you may need a specific endorsement to cover their injuries while working aboard your vessel.

Conclusion

Navigating the transition from a private yacht owner to a professional fishing guide requires more than just a captain’s license and a passion for the sport. It requires a fundamental shift in how you view risk. While kayak fishing guide insurance might be a starting point for some, the complexities of a 35’+ vessel demand the expertise of an independent brokerage that understands the nuances of the commercial marine market.

At On the Water Marine, we specialize in shopping multiple top-rated carriers to find the specific coverage that fits your unique operation. We don’t just look for a policy; we look for the right policy that protects your asset, your clients, and your professional reputation.

If you are operating or purchasing a vessel 35 feet or larger and want to ensure your professional guide service is correctly protected, requesting a professional review is a prudent next step. For complex or high-value marine risks, working with a specialist can help clarify your options and prevent costly gaps in coverage.

Related Articles

Why Professional Marine Rental Insurance Is More Complex Than Most Operators Realize Most marine insurance problems don’t appear when a policy is bound — they appear [...]

Introduction: The Misconception of “Standard” Coverage Boat insurance Fort Myers is not a single product. It’s a collection of policy structures, coverage limits, and exclusions that [...]

The Misconception of Automatic Coverage One of the most frequent conversations we have with clients involves the assumption that existing insurance umbrellas will naturally extend to [...]