Why Professional Marine Rental Insurance Is More Complex Than Most Operators Realize

Most marine insurance problems don’t appear when a policy is bound — they appear when something goes wrong. While kayak rental business insurance cost is a frequent search term, the reality is that most serious marine rental operators are managing fleets of high-value watercraft like center consoles, performance boats, and small cruisers. The insurance considerations for these operations are significantly more complex than basic liability coverage for paddlesports.

Most marine rental operators find that cost is driven by several critical factors:

- Fleet composition (the type and value of boats being rented)

- Operational geography (calm inland lakes versus coastal storm zones)

- Policy structure (whether buying standalone policies or bundling coverage)

- Claims history and documented safety protocols

Actual premiums depend on fleet size, location, water conditions, and specific policy language. Florida operations, for example, often face different premium structures due to coastal exposure and storm risks. The larger issue isn’t just the cost—it’s what that cost actually buys you. Many operators assume general liability covers all customer incidents, but policy language around pre-rental waivers, equipment damage, and third-party property claims can vary significantly by carrier.

I’m Eric Fisher, and I’ve spent over a decade in marine risk management. Understanding the cost of insuring any marine rental operation requires looking beyond premiums to the actual risk transfer and coverage gaps that most operators don’t discover until a claim is denied.

Understanding the Variables of Marine Rental Risk and Cost

When evaluating the factors that influence marine rental insurance, it is essential to view the premium not as a fixed fee, but as a reflection of a specific risk profile. In the marine industry, underwriters assess several variables to determine the likelihood of a loss. For an operation managing a fleet of vessels—whether they are non-motorized units or high-performance motor yachts—the scale of the business often dictates the depth of the required coverage.

Premium variables often include the experience level of the business owners, the safety protocols in place, and the specific types of water bodies where the vessels are utilized. A business operating in high-traffic coastal areas may see different rates due to the increased probability of collisions or third-party property damage compared to a secluded inland lake. Furthermore, marine business insurance needs to be tailored to the specific activities of the company, such as whether you offer guided tours, lessons, or simple hourly rentals.

Why General Liability is the Foundation of Marine Rental Protection

General liability is often the cornerstone of any marine rental operation. This coverage is designed to address third-party claims, which are among the most common risks in the rental industry. If a customer sustains a bodily injury while using equipment or if a rental vessel causes damage to another person’s property, general liability may provide for legal defense and settlement costs, depending on the policy language.

The cost of this foundation is typically influenced by gross receipts and coverage limits. Many professional organizations, such as America Outdoors, emphasize that even with robust liability waivers, the legal fees required to defend a business against a lawsuit can be significant without a solid liability policy in place. Your inventory size and the total valuation of your assets also play a role in premium calculations, as underwriters look at the age, condition, and replacement value of each unit.

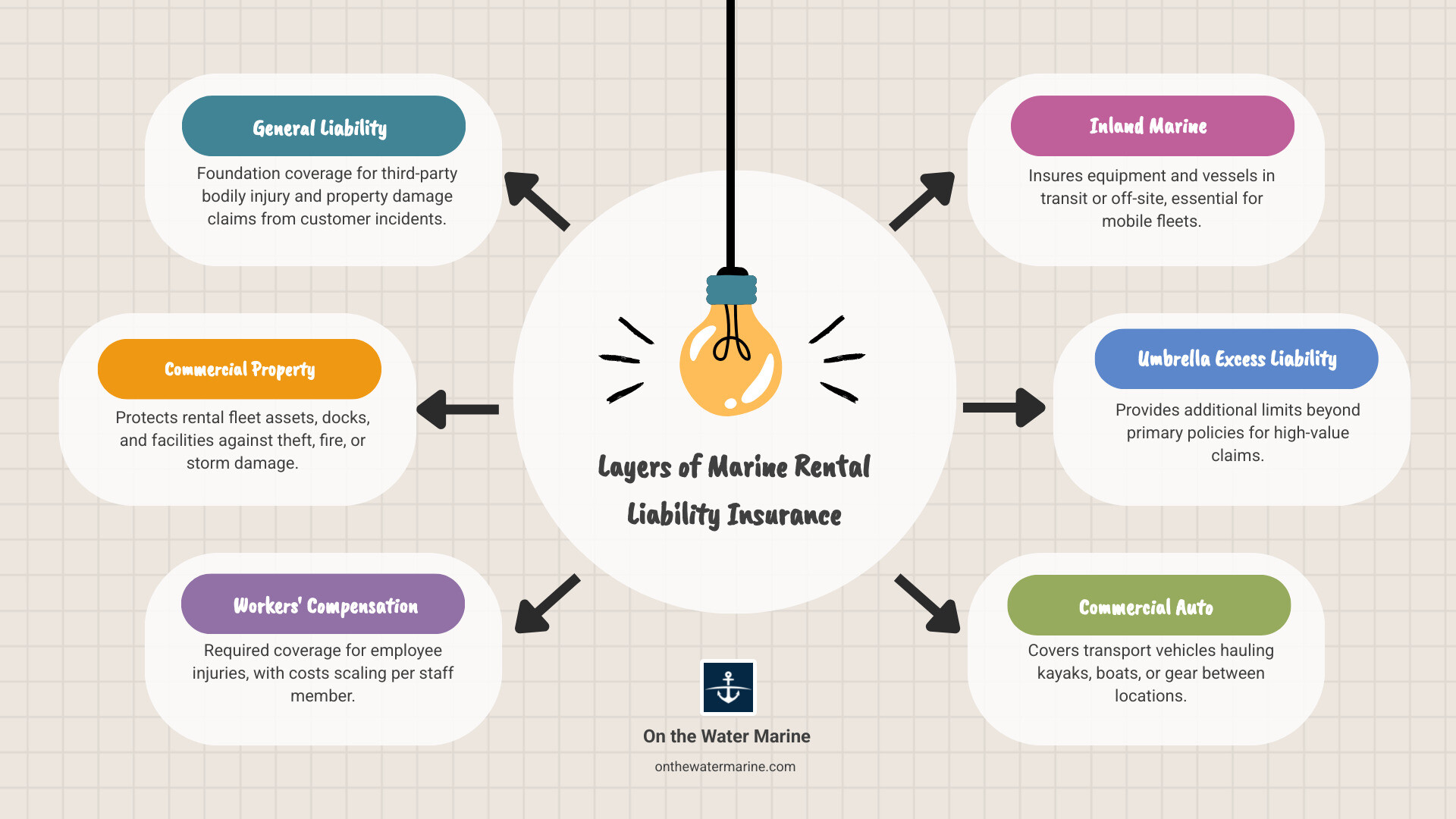

Essential Coverage Layers for Professional Marine Rental Operations

A professional marine rental business often requires more than just a basic liability policy. To truly mitigate risk, owners must look at specialized layers of protection that address the unique challenges of the water. This involves carefully reviewing policy language to ensure there are no “silent” exclusions that could leave the business vulnerable.

Understanding boat rental insurance coverage is about risk transfer. By paying a premium, you are transferring the financial burden of potential accidents to the insurance carrier. However, the effectiveness of that transfer depends on the specific endorsements and exclusions within your contract.

The Role of a Business Owner’s Policy (BOP)

For many small to medium-sized rental businesses, a Business Owner’s Policy (BOP) may offer a streamlined way to secure essential coverages. A BOP typically bundles general liability with commercial property insurance. This means that not only are you protected against certain lawsuits, but physical assets—such as an office, docks, and stored equipment—may also be covered against perils like fire, theft, or vandalism, depending on the policy terms.

The cost for a BOP in the marine rental sector is influenced by the value of the property being insured. While a BOP provides a solid baseline, it is important to verify that the policy includes specialized marine endorsements, as standard “main street” BOPs may not adequately cover water-borne risks.

Factors Influencing Premium Structures for Watercraft Rentals

The geographic location of your business is often a significant external factor influencing marine insurance premiums. In regions where the risk of hurricanes and high-density boating traffic is prevalent, premiums may reflect the increased exposure. Beyond geography, the specific water conditions of your operation—such as whitewater rapids versus a calm bay—will influence the underwriter’s risk assessment.

Many marine rental businesses are seasonal, operating heavily in the summer and scaling back during the winter. Some insurance carriers offer “lay-up” periods, where premiums may be adjusted during the months the vessels are out of the water and in secure storage. Revenue-based pricing is another option for some larger operations, where the premium is adjusted based on the actual gross receipts of the business, which can be beneficial during unexpected periods of downtime.

Employee Risks and Workers’ Compensation

If your business has employees, Workers’ Compensation is a legal mandate in almost every state. This insurance covers medical expenses and lost wages for staff members who are injured on the job, such as an employee straining their back while launching a vessel or slipping on a wet dock. Factors such as your “Experience Modifier” and the specific job duties of your staff will often influence these rates. Providing specialized training and maintaining high workplace safety standards can help keep these costs manageable over time.

Risk Mitigation Strategies for High-Volume Watercraft Fleets

Insurance is often best viewed as the last line of defense, not the first. Implementing proactive risk mitigation strategies may not only prevent accidents but can also make a business more attractive to insurance carriers, potentially leading to more favorable terms. A well-documented operation is often a better-insured operation.

Maintaining detailed maintenance logs for every vessel in your fleet and requiring rigorous staff training are essential steps. Carriers often look for specific safety protocols when quoting a policy. These may include mandatory Personal Flotation Device (PFD) usage, documented safety briefings provided to every renter, and regular equipment inspections to identify hull damage or hardware fatigue.

The Impact of Deductibles on Long-Term Costs

Choosing a deductible is a balancing act between short-term premium costs and long-term financial stability. A higher deductible will often lower your annual premium. However, for businesses with a high frequency of minor claims, a high deductible can lead to significant cumulative costs. It is often more beneficial to focus on risk prevention to keep claim frequency low, allowing you to maintain a higher deductible without the constant impact of small repair costs.

Frequently Asked Questions about Marine Rental Insurance

What does general liability insurance cover for kayak rentals?

General liability typically addresses third-party claims for bodily injury and property damage. For example, if a renter sustains an injury due to a perceived equipment failure or if they accidentally collide with and damage a third party’s vessel, this coverage may provide for legal defense fees and medical bills, depending on the policy language. It does not typically cover damage to your own rental fleet; that often requires separate property or hull coverage.

Are there specific legal mandates for rental insurance by state?

While many states do not have a specific “marine rental insurance” law, they do have general business requirements. Workers’ Compensation is mandatory in almost all states for businesses with employees. Furthermore, many local municipalities or park authorities require proof of liability insurance as a condition for granting a business permit or allowing access to public docks and waterways. These requirements often specify certain limits that must be maintained to remain compliant with local regulations.

How can a business owner reduce their annual insurance premiums?

The most effective way to manage premiums is through a combination of bundling and risk management. Bundling multiple coverages into a Business Owner’s Policy (BOP) often results in a more efficient structure. Additionally, maintaining a clean claims history, implementing strict safety protocols, and opting for higher deductibles can influence the overall cost. Working with an independent broker who can shop multiple specialized carriers is often critical to finding competitive options.

Conclusion

Navigating the complexities of marine insurance requires more than just finding a policy. It requires a deep understanding of the unique risks associated with operating a fleet on the water. From general liability and Workers’ Compensation to specialized Inland Marine and Commercial Auto policies, each layer of protection serves a specific purpose in safeguarding a business’s future.

At On The Water Marine, we function as an independent brokerage, which means we aren’t tied to a single insurance company. We have the flexibility to shop multiple top-rated carriers to find the coverage that best fits your operational needs. Our goal is to provide expert guidance and personalized service, ensuring you understand exactly what your policy covers before a claim ever arises.

If you’re insuring a 35’+ vessel and want to better understand your coverage options, you can request a quote here.

Related Articles

Introduction: The Misconception of “Standard” Coverage Boat insurance Fort Myers is not a single product. It’s a collection of policy structures, coverage limits, and exclusions that [...]

Why Yacht-Based Fishing Guide Services Need Specialized Marine Insurance Kayak fishing guide insurance may be a common search term, but if you operate a professional fishing [...]

The Misconception of Automatic Coverage One of the most frequent conversations we have with clients involves the assumption that existing insurance umbrellas will naturally extend to [...]