Why Marine Repair Business Insurance is the Foundation of Your Operation

Marine repair business insurance is specialized coverage designed to protect boat repair shops, shipyards, and marine service businesses from the unique risks of working with high-value customer vessels in maritime environments. Here’s what you need to know:

Key Coverage Components:

- Ship Repairer’s Legal Liability (SRLL) – Protects against damage to customer boats in your care

- Marine General Liability (MGL) – Covers third-party injuries and property damage

- Workers’ Compensation + USL&H – Required for employees working on or near navigable waters

- Bailee’s Coverage – Protects customer property while stored at your facility

- Inland Marine Insurance – Covers your specialized tools and equipment

- Pollution Liability – Essential for fuel, paint, and solvent-related incidents

As a boat repair shop owner, you’re responsible for protecting your client’s expensive property. You handle vessels worth tens or hundreds of thousands of dollars, where one accident during haul-out, a workshop fire, or a faulty part could lead to devastating financial liability.

Standard business insurance simply doesn’t cut it. The maritime industry operates under specialized federal laws (Jones Act, USL&H) and involves unique hazards like environmental spills and machinery failures. Furthermore, clients and marinas increasingly require proof of specific marine coverages before contracting with you.

Comprehensive marine repair business insurance is designed to address these challenges. The right policy protects your assets, covers your legal liabilities, ensures compliance, and gives customers confidence that their vessels are in safe hands.

This guide will walk you through what marine repair business insurance covers, which policies are essential, how to manage costs, and why working with a marine insurance specialist is crucial.

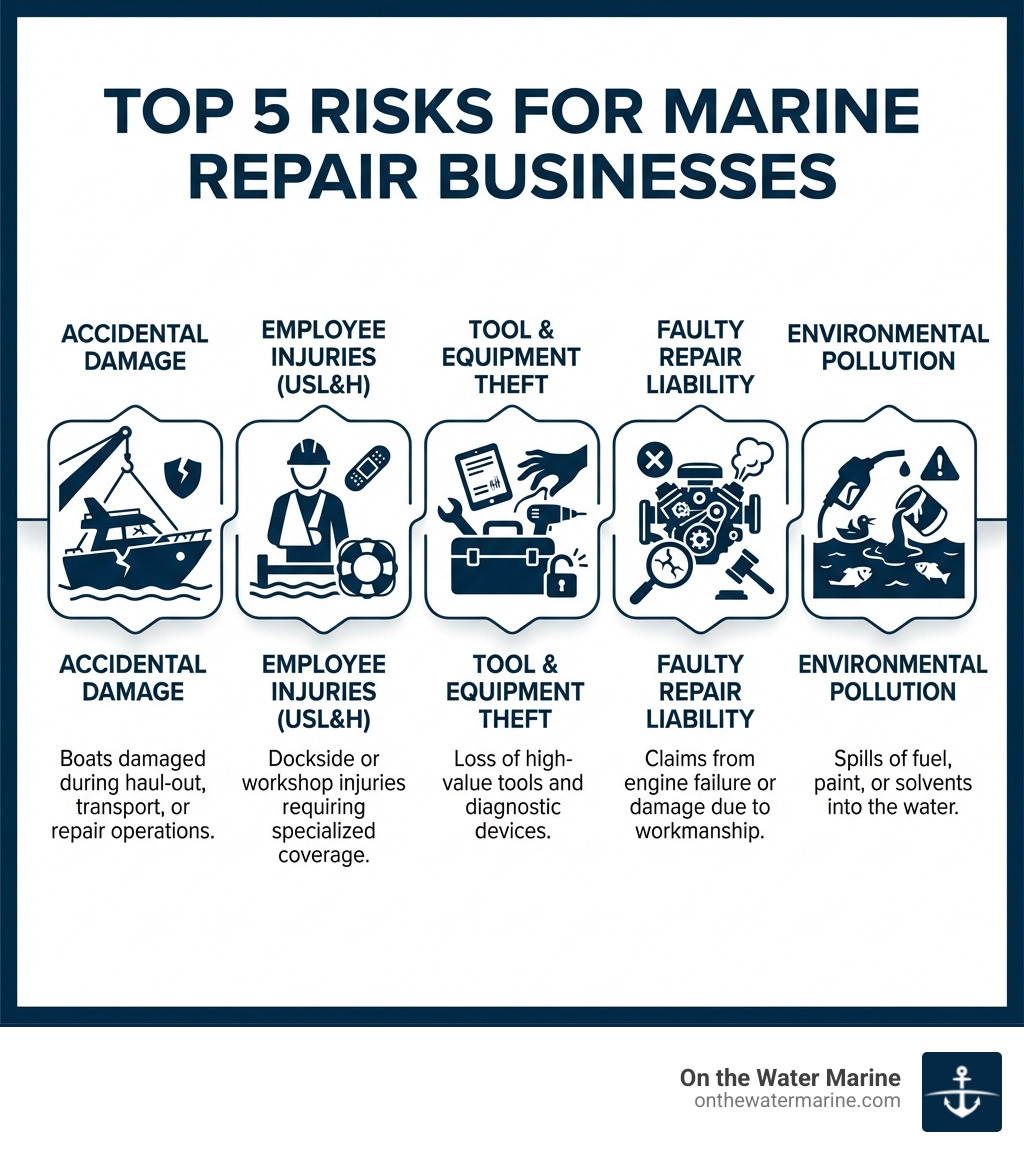

Understanding the Unique Risks of Marine Repair Operations

Operating a marine repair business involves a dynamic environment of unique challenges. From the moment a customer’s vessel enters your care, you face a complex web of responsibilities and risks, including handling high-value assets, ensuring employee safety, and mitigating environmental damage. For more information about our specific marine business insurance solutions, please visit our dedicated page: More info about our marine business insurance solutions.

Why Standard Business Insurance Isn’t Enough

A general business liability policy is often insufficient for marine repair work, leaving dangerous gaps in your coverage. Standard policies typically exclude damage to customer property in your “care, custody, or control,” a primary risk when you’re working on high-value boats. Specialized coverage like Bailee’s insurance is critical to address this.

Furthermore, the maritime industry operates under a distinct legal framework. Federal laws like the Jones Act and the U.S. Longshore and Harbor Workers’ Compensation Act (USL&H) often supersede state-level workers’ compensation, requiring specific coverages for employees working near navigable waters. Many marinas and clients will require proof of these policies before allowing you to work, meaning a lack of proper insurance can lead to lost business opportunities.

Key Exposures for Repair Shops

Marine repair shops regularly face common risks that highlight the need for specialized insurance:

- Accidental Damage to Customer Boats: A forklift mishap, dropped tool, or shop fire can damage a customer’s vessel, leaving you responsible for a significant financial loss.

- Slips and Falls: Workshops, docks, and marinas are inherently hazardous. A customer or visitor tripping or slipping can lead to costly premises liability claims.

- Fire in the Workshop: Flammable materials like paints, solvents, and fuel, combined with welding operations, create a constant fire threat that could destroy your facility and customer boats.

- Spills of Fuel or Solvents: An accidental spill of chemicals can result in extensive cleanup costs, regulatory fines, and pollution liability.

- Faulty Parts or Repairs: If a repair or part fails after the boat leaves your shop and causes further damage, you could face a products-completed operations liability claim.

- Theft of Specialized Tools and Equipment: Your diagnostic tools and heavy-duty hoists are a significant investment. Theft or damage can halt operations and be costly to replace.

- Cyber Incidents: Ransomware attacks and data breaches are a growing threat to maritime operations, and losing customer data can be devastating.

These examples show why a general business policy is inadequate. You need specialized marine repair business insurance designed for these high-stakes scenarios.

Core Components of a Marine Repair Business Insurance Policy

This section defines the essential coverages that form the foundation of a robust policy, protecting your assets, operations, and employees. These are the non-negotiable components of your business’s financial security.

Essential Liability Coverages

Liability policies protect you when you’re legally responsible for injuries to others or damage to their property.

- Ship Repairer’s Legal Liability (SRLL): This is the most critical coverage for your business. SRLL protects you against damage to a customer’s vessel and its equipment while in your care, custody, or control for service or repair. It specifically addresses the unique risks of working on vessels, which standard policies exclude.

- Marine General Liability (MGL): Similar to a standard Commercial General Liability (CGL) policy, MGL is custom for the marine environment. It covers third-party bodily injury and property damage arising from your premises, operations, and products.

- Protection & Indemnity (P&I): Essential for businesses that own or operate vessels, P&I is a broad marine liability insurance. It covers third-party claims for bodily injury (to crew, passengers, etc.), damage to other vessels or marine structures, and pollution.

- Bailee’s Coverage: While SRLL is specific to vessel repair, Bailee’s coverage more broadly protects any customer property you hold in your care, custody, or control, such as engines or personal effects.

- Products-Completed Operations Liability: This protects your business from claims of injury or damage that arise from your completed work or products after the customer has left your premises.

Essential Property Coverages

Protecting your own business assets is equally vital.

- Commercial Property: Covers the physical structure of your repair shop, offices, and other buildings against perils like fire, theft, and vandalism.

- Business Personal Property (BPP): Insures your business’s contents, including office furniture, computers, diagnostic equipment, tools, and inventory.

- Inland Marine Insurance: This broad coverage is crucial for property that is mobile. For marine repair businesses, it’s particularly important for contractors’ equipment.

- Tools & Equipment Floater: A specific type of Inland Marine coverage, this policy protects your valuable tools and equipment whether they are at your shop, in transit, or at a job site.

- Business Income and Extra Expense: If a covered peril forces a temporary shutdown, this coverage replaces lost profits and covers ongoing operating expenses (like rent and payroll). Extra Expense helps pay for temporary relocation costs to get you back in business faster.

Essential Employee-Related Coverages

Protecting your employees is a legal and ethical requirement.

- Workers’ Compensation: This mandatory coverage provides medical benefits and wage replacement for employees with work-related injuries or illnesses.

- U.S. Longshore and Harbor Workers’ Compensation Act (USL&H): If your employees work on, near, or over navigable waters (docks, piers, etc.), you are likely required by federal law to carry USL&H coverage in addition to state workers’ compensation.

- Jones Act coverage: For employees who qualify as “seamen” (working on a vessel in navigation), the Jones Act provides a remedy for employer negligence. This is distinct from workers’ comp and often requires specialized P&I coverage.

- Employment Practices Liability (EPLI): This protects your business against claims from employees alleging discrimination, wrongful termination, harassment, and other employment-related issues.

Tailoring Your Policy: Additional Coverage Options to Consider

While core coverages are essential, a comprehensive policy often requires additional, specialized options to protect every facet of your business. We can help customize your policy to fit your exact needs. Contact us to discuss your needs.

Specialized Liability and Property Add-ons

- Pollution Liability: This is critical for marine repair due to the use of fuels, oils, and solvents. It covers cleanup costs, fines, and third-party claims resulting from pollution incidents. For context on how pollution incidents are regulated in the U.S., you can review the Oil Pollution Act.

- Commercial Auto Insurance: If your business owns or leases vehicles for hauling boats, transporting equipment, or service calls, this policy covers liability and physical damage to your vehicles.

- Cyber Liability Insurance: The marine industry is increasingly targeted by cyber attacks. This insurance protects your business from the financial fallout of data breaches and ransomware, covering costs like notification, legal fees, and fines.

- Equipment Breakdown Coverage: This protects against losses from mechanical or electrical failures of essential machinery like hoists and diagnostic tools, which are typically excluded from standard property policies.

A Marine Business Owner’s Policy (BOP) can bundle several coverages, offering a streamlined solution for some businesses. However, it’s crucial to ensure it fully addresses your unique risks.

| Feature | Standalone Policies | Business Owner’s Policy (BOP) |

|---|---|---|

| Customization | Highly customizable, allowing precise tailoring of limits and specific coverages for unique risks. | Offers a package of common coverages, less flexible for highly specialized needs. |

| Cost | Can be more expensive if purchased individually, but allows for specific risk mitigation without unnecessary add-ons. | Often more cost-effective for small to mid-sized businesses due to bundled pricing. |

| Complexity | Managing multiple policies can be more complex. | Simplifies insurance management with fewer policies to track. |

| Suitability | Ideal for larger, more complex marine repair operations with unique and extensive risk profiles. | Best for smaller, less complex marine repair businesses with more standardized risks. |

| Coverage Gaps | Reduced risk of gaps if managed by an expert, but requires careful coordination. | Potential for coverage gaps if your unique risks aren’t fully addressed by the standard BOP package. |

Advanced Marine Repair Business Insurance Protections

- Umbrella or Bumbershoot Liability: A “Bumbershoot” policy provides an additional layer of liability protection above your primary policies. It is vital for protecting your business from major lawsuits that could exceed your underlying limits.

- Hull and Machinery Insurance: If your business owns or operates its own vessels (workboats, tugs, etc.), this policy covers physical damage to those vessels, their engines, and equipment.

- Piers, Wharfs, and Docks Coverage: If your business owns or is responsible for these structures, this specialized property coverage protects them from damage due to collision, storms, or other perils.

- Support for Marine Safety and Training: Many marine businesses value supporting organizations that advance seamanship skills and safety for veterans and civilians alike. Markel proudly supports Warrior Sailing, a program focused on maritime education and empowerment.

Managing Costs and Ensuring Compliance with Marine Repair Business Insurance

Navigating marine repair business insurance is about both protection and smart financial management. Balancing comprehensive coverage with cost-effectiveness is key to your success.

Factors That Influence Your Insurance Premiums

The cost of your insurance is calculated based on several factors unique to your operation:

- Business Size and Revenue: Larger businesses with higher revenues typically have higher premiums due to greater potential exposure.

- Location Risks: Coastal locations prone to hurricanes, floods, or high crime rates will face higher premiums.

- Services Offered: The risk profile changes based on your services. Hazardous work like welding or engine overhauls can increase rates compared to minor maintenance.

- Claims History: A clean claims record generally results in lower premiums, while a history of frequent or large claims will increase them.

- Coverage Limits and Deductibles: Higher coverage limits increase premiums, while higher deductibles can lower them. This requires balancing risk tolerance and budget.

- Employee Count and Payroll: Your number of employees and total payroll directly influence the cost of Workers’ Compensation and USL&H coverage.

We work with you to understand these factors and find the most competitive rates for your specific situation.

Insurance’s Role in Compliance and Client Contracts

In the marine industry, proper insurance is often a prerequisite for doing business.

- Meeting Marina Insurance Requirements: Marinas and boatyards require contractors to carry specific insurance coverages and limits before allowing them to work on-site. Without the right policy, you can lose access to these jobs.

- Fulfilling Government Contracts: Government and military contracts almost always have stringent insurance requirements, often specifying high liability limits.

- Adhering to Environmental Regulations: Having robust pollution liability insurance demonstrates your commitment to environmental responsibility and helps you maintain good standing with regulators.

- Proving Financial Responsibility to Clients: Comprehensive insurance is a powerful statement to clients that you are a professional, responsible business. This builds trust and provides a competitive advantage.

Ensuring compliance with industry and client requirements is key to securing contracts and building credibility. For more insights on how to stay compliant, Read our blog for more insights.

Finding the Right Partner: How to Secure the Best Coverage

Finding the right marine repair business insurance is a critical investment in your business’s future. Given the complexity of marine risks, expert guidance is invaluable for navigating the market and building a policy that truly fits.

Why Work with an Independent Marine Insurance Specialist?

For a niche industry like marine repair, a generic agent or online quote generator is insufficient. An independent marine insurance specialist, like us, provides significant advantages:

- Access to Multiple Top-Rated Carriers: We work with a wide array of carriers, including specialized marine underwriters, to shop the market for you and find the best coverage and pricing.

- Deep Expertise in Marine Risks: Our team understands maritime law and the specific perils of your operations. This allows us to identify risks others might miss and recommend essential coverages.

- Custom-Built Policies: We don’t use one-size-fits-all solutions. We work with you to build a policy that addresses your unique risks, from the types of repairs you perform to your location.

- Objective Advice: As independent brokers, our loyalty is to you. We provide unbiased advice and explain complex policy details in simple terms.

- Claims Advocacy and Support: If you need to file a claim, we act as your advocate, guiding you through the process to ensure a fair and timely resolution.

- On The Water Marine’s Personalized Approach: Our personalized service, expert guidance, and access to policies not available online simplify the insurance process, ensuring you get the right coverage at a competitive price.

Steps to Ensure You Have the Right Marine Repair Business Insurance

Follow these steps to ensure your business is adequately protected:

- Provide Detailed Business Operations: Be thorough when describing your services, vessel types you work on, operating area, and equipment so we can tailor your coverage.

- Discuss Industry-Specific Risks: Talk to us about your biggest concerns, whether it’s a new process, a challenging lift, or weather threats, so we can address them in your policy.

- Evaluate Various Coverage Options: We’ll walk you through all essential and additional coverages, explaining the benefits and trade-offs of different limits and deductibles.

- Regularly Review and Update Your Policy: Your business changes, and your insurance should too. We recommend an annual review to ensure your coverage remains adequate as you grow.

- Get a personalized quote today: Don’t leave your business vulnerable. Reach out for a customized solution. Get a personalized quote today.

Frequently Asked Questions about Marine Repair Business Insurance

We understand you likely have questions, and we’re here to provide clear, straightforward answers. See more FAQs on our website.

What is Ship Repairer’s Legal Liability (SRLL) and why is it critical?

Ship Repairer’s Legal Liability (SRLL) is specialized coverage that protects your business against damage to a customer’s vessel while in your care, custody, or control. It’s critical because standard General Liability policies almost always exclude this type of coverage. Without SRLL, you would be personally responsible for repair costs, which could be financially devastating. It covers a primary exposure for your business and is indispensable.

Do I need USL&H coverage for my employees?

Yes, if your employees work on, near, or over navigable waters, you almost certainly need USL&H (U.S. Longshore and Harbor Workers’ Compensation Act) coverage. This federal law provides benefits to maritime workers, as state workers’ compensation policies typically exclude these injuries. USL&H is a mandatory and critical addition to ensure compliance and protect both your employees and your business from significant liability.

Can I get a single policy that covers everything?

While a Marine Business Owner’s Policy (BOP) can conveniently package several key coverages, it’s rare for one policy to cover “everything” for a complex marine repair business. Most businesses with specialized risks benefit from a customized program built by a specialist. This approach avoids dangerous coverage gaps that a standard BOP might miss. An experienced broker can combine a BOP with necessary standalone policies (like SRLL or pollution liability) to create a comprehensive solution.

Conclusion: Secure Your Business with the Right Marine Insurance

In marine repair, where high-value assets and unique risks converge, comprehensive marine repair business insurance is a non-negotiable foundation for success. Specialized coverages protect you from accidental boat damage, employee injuries, environmental hazards, and cyber threats, ensuring your business can weather any storm.

Partnering with an independent marine insurance specialist gives you access to deep expertise, multiple carriers, and customized solutions. This strategic partnership safeguards your financial stability, supports growth, and instills confidence in your clients. Don’t leave your livelihood to chance.

Related Articles

Why Boat Detailing Businesses Need Specialized Insurance Coverage Boat detailing business insurance protects your company from unique risks, from damaging a client’s yacht to liability claims [...]

Why Best Florida Boat Insurance is Essential for Every Boater Best Florida boat insurance provides protection custom to the unique risks of boating in the Sunshine [...]