Protecting Your Passion on Texas Waters

Texas fishing guide insurance is specialized commercial coverage protecting professional guides from liability claims, equipment damage, and other business risks. Key coverages include:

| Coverage Type | What It Protects | Starting Cost |

|---|---|---|

| General Liability | Client injuries, third-party property damage | $395-$500/year |

| P&I (Protection & Indemnity) | Broadest marine liability, passenger injuries, vessel damage | Included in packages |

| Hull & Equipment | Boat, motor, trailer, fishing gear (Agreed Value) | Varies by boat value |

| Dockside Liability | Injuries before boarding/after disstarting | Often included |

| Professional Angler Liability | Seminars, shows, non-guiding activities | Optional add-on |

Running a guide service in Texas, from the Gulf Coast to Lake Fork, involves unique risks. A single client injury or equipment loss can threaten your entire operation. With a thriving guide industry across 600 miles of coastline and countless lakes, the potential for accidents is high. From severe weather and hook injuries to trailering accidents, standard boat insurance simply doesn’t cover the commercial exposures you face with paying clients.

As Eric Fisher, founder of On The Water Marine Insurance, I’ve spent over a decade in marine insurance, including managing national yacht insurance divisions, before launching my independent brokerage in 2022. I specialize in helping fishing guides in Texas and across the country find comprehensive Texas fishing guide insurance to protect their business and passion.

Why Standard Insurance Isn’t Enough for Texas Guides

Operating a fishing guide business in Texas requires more than personal boat insurance. When you have paying clients, your personal policy won’t cover you due to “for hire” exclusions. Specialized Texas fishing guide insurance is essential to secure your financial future, protect your assets, and provide peace of mind. An accident with a client could lead to substantial legal and medical costs that could devastate your business. We believe your passion shouldn’t come at the cost of your security. Find more info about marine business insurance services.

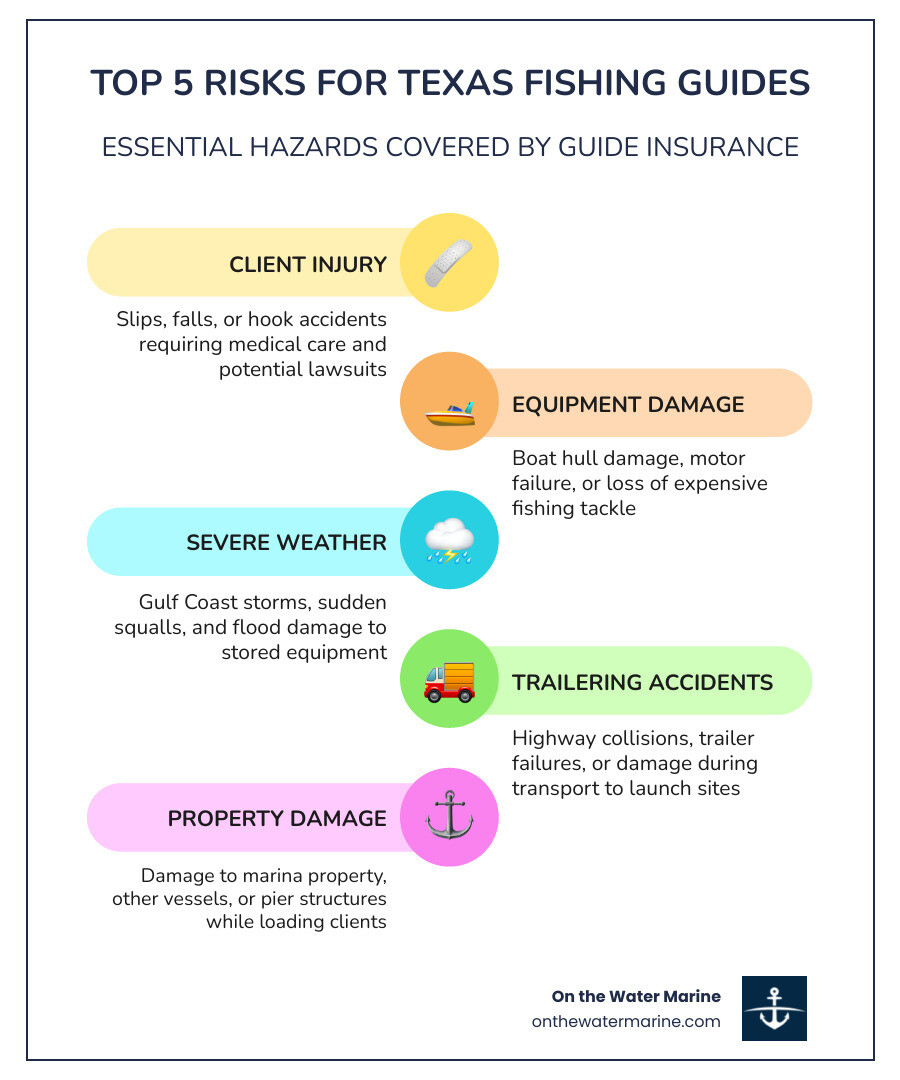

The Specific Risks You Face in the Lone Star State

Texas’s diverse fishing environments, from the Gulf Coast to freshwater lakes, present unique hazards that specialized Texas fishing guide insurance addresses.

Consider these common scenarios:

- Client Slips and Falls: A client could slip on a wet deck, at the dock, or while wading, leading to injury.

- Hook Injuries: An errant cast or a thrashing fish can cause a hook injury to a client.

- Severe Weather: Sudden squalls on the Gulf or thunderstorms on inland lakes can create dangerous situations.

- Equipment Theft: Your boat, motor, and expensive fishing gear are targets for theft at the dock, at home, or during transport.

- Trailering Accidents: Transporting your boat carries the risk of highway collisions and other accidents.

- Damage to Docks or Other Vessels: Maneuvering near marinas can lead to accidental damage to other property.

- Environmental Damage: Saltwater corrosion and submerged freshwater hazards can cause significant damage to your vessel.

These real-world events can become financial nightmares without proper coverage.

General Liability vs. Specialized Guide Insurance

Understanding the difference is crucial for any Texas fishing guide.

- General Liability Insurance: This foundational business insurance covers third-party bodily injury or property damage but typically excludes incidents related to watercraft operation. It might cover a slip-and-fall in your office, but not on your boat.

- Specialized Fishing Guide Insurance: This policy is built for guides. It includes Watercraft Liability for incidents on your boat, and can be endorsed to cover Professional Negligence (faulty advice) and Care, Custody, and Control (damage to client gear). A generic policy is insufficient; you need coverage designed for the marine, “for hire” nature of your business. To dive deeper into how boat insurance works generally, check out our guide on Demystifying Boat Insurance.

The High Cost of Operating Uninsured

Operating without adequate insurance is a massive gamble. The potential consequences are severe:

- Out-of-Pocket Legal Fees: Defending a lawsuit, even a baseless one, can cost tens of thousands of dollars.

- Medical Bill Liability: You could be held responsible for a client’s medical expenses, which can be astronomical.

- Loss of Business Assets: A judgment against you could force the sale of your boat, gear, and personal assets.

- Damaged Reputation: News of an uninsured accident can destroy your professional reputation.

- Limited Access: Many marinas and parks require proof of liability insurance to operate from their facilities.

A general liability minimum premium alone can be $1,500, and for new ventures, it can be $2,000. These figures pale in comparison to the potential costs of an uninsured incident.

Core Coverages for Your Texas Fishing Guide Insurance Policy

A robust Texas fishing guide insurance policy is built on several core coverages to protect your assets and shield you from liability. Our goal is to build a policy that lets you guide with confidence, knowing you’re backed by a solid plan. To understand more about what boat insurance generally covers, visit What does boat insurance actually cover?.

Understanding the Basics of Texas Fishing Guide Insurance

When we talk about the core of Texas fishing guide insurance, we’re typically looking at three main pillars:

- Commercial General Liability (CGL): Covers non-vessel related claims, like a client tripping on land before boarding.

- Commercial Hull and Equipment Coverage: Property insurance for your boat, motor, trailer, and gear against physical damage from collision, fire, theft, and storms.

- Protection & Indemnity (P&I): The broadest marine liability insurance, crucial for any guide. It covers bodily injury to clients and third parties, plus damage to other vessels or docks caused by your boat.

These three components form the backbone of a solid policy.

Key Policy Features for Your Boat and Gear

Your boat and fishing gear are essential business assets. Protecting them properly requires specific policy features.

- Agreed Value vs. Actual Cash Value: We recommend an Agreed Value policy, where the boat’s value is set upfront. In a total loss, you receive that full amount, unlike an Actual Cash Value (ACV) policy which pays a depreciated value.

- Disappearing Deductibles: Rewards safe, claims-free operation by reducing your deductible over time.

- Fishing Equipment Coverage: Specific coverage for your expensive rods, reels, and electronics, even when stored ashore.

- Trailer Coverage: Protects your trailer from damage and theft.

- Personal Property: Covers personal items for you or your clients brought aboard.

For those just getting started or looking to understand boat insurance fundamentals, our guide Your First Boat: Your Guide on Boat Insurance offers excellent insights.

Essential Liability Coverages on the Water and Off

Beyond the basics, several specific liability coverages are absolutely essential for a Texas fishing guide:

- Protection and Indemnity (P&I): As highlighted, this is your primary marine liability coverage. It covers injuries to clients, wreck removal, and legal defense costs. Many facilities now require $1,000,000 or more in P&I limits.

- Pollution Liability: Protects you from the high costs of cleanup and fines from a fuel or oil spill.

- Medical Payments: Covers immediate medical expenses for minor injuries, regardless of fault, helping to prevent larger claims.

- Dockside Liability: Provides protection for injuries that occur on the dock before boarding or after disstarting.

- Non-Owned Vessel Coverage: Extends your liability protection if you guide from a boat you don’t own.

These coverages work in concert to provide a robust safety net. For a general overview of boat insurance, you can also refer to our main Boat Insurance page.

Customizing Your Policy and Understanding Costs

No two guide businesses are identical, so your insurance shouldn’t be either. Customizing your Texas fishing guide insurance with optional endorsements ensures your specific operations are covered. Understanding how these choices affect your premium is key to getting the best value. Our article How much does boat insurance cost? provides a great overview of cost factors.

Optional Coverages for the Modern Guide

The world of fishing guiding is evolving, and so are the necessary insurance coverages. Beyond the core protections, modern guides often benefit from these specialized optional coverages:

- Shoreside & Wade Fishing Liability: Extends liability coverage to incidents that occur when clients are off the boat, such as wading the Gulf Coast flats.

- Professional Angler Liability (for seminars, shows, etc.): Protects you during non-guiding business activities like seminars, sport shows, or promotional events.

- Charter Legal Liability: Provides an extra layer of protection if you book charters for other guides.

- Tournament Fee Reimbursement: Can reimburse your non-refundable entry fees if you’re unable to compete due to a covered event, like a boat breakdown.

These optional coverages ensure that your Texas fishing guide insurance is as comprehensive as your guiding business itself.

Factors That Influence the Cost of Texas Fishing Guide Insurance

The cost of your Texas fishing guide insurance is calculated based on your unique risk profile. While some liability insurance can start as low as $395 or $400 for fishing guides, your final premium will depend on these specifics:

| Factor | Influence on Cost | Description |

|---|---|---|

| Boat Value (Agreed Value) | Higher value = higher premium | The agreed-upon value of your boat, motor, and trailer. Higher value means a higher hull premium. |

| Navigation Area | Coastal > Inland | Coastal guiding (Gulf of Mexico) is typically more expensive than inland due to higher risks like weather and vessel traffic. |

| Liability Limits | Higher limits = higher premium | Higher limits (e.g., $1M vs. $2M) increase the premium. Higher limits are often required by marinas. |

| Guide Experience | More experience = potentially lower premium | More years of safe operation can lead to lower rates. New guides may pay more. |

| Claims History | Clean history = lower premium | A clean claims history results in lower premiums, while past claims will increase costs. |

| Type of Guiding | Higher risk activities = higher premium | Higher-risk activities like offshore or wade fishing can increase rates compared to calm river trips. |

| Number of Boats/Guides | More operations = higher premium | More boats or guides to insure will increase the total policy cost. |

| Safety Equipment & Training | Improved safety = potential discounts | Advanced safety gear (EPIRB) and certifications (CPR) may qualify you for discounts. |

By understanding these factors, we can work together to tailor a policy that offers robust protection without breaking the bank.

How to Find the Best Guide Insurance in Texas

Finding the best Texas fishing guide insurance doesn’t have to be complicated. At On The Water Marine, we simplify the process, connecting you with reliable providers to protect your livelihood. For a smarter way to approach boat insurance shopping, we recommend reading our guide: The Smarter Way to Shop for Boat Insurance.

The Quote Process: What Information You’ll Need

To get a fast and accurate quote for Texas fishing guide insurance, please have the following information ready:

- Personal & Business Details: Name, contact info, business name, and years in business.

- Boat Details: Year, make, model, Hull ID Number (HIN), desired Agreed Value, and engine details.

- Operations Details: Years of guide experience, USCG license or other certifications, desired liability limits, and primary operating waters (e.g., Galveston Bay, Lake Fork).

- Client & Claims Info: Typical number of clients per trip and any past insurance claims.

Gathering this information allows us to accurately assess your risks and shop multiple top-rated carriers to find the best possible coverage and price for your Texas fishing guide insurance.

The Role of an Independent Marine Insurance Agent

In the specialized world of marine insurance, an independent marine insurance agent is your most valuable asset. Unlike captive agents who represent one company, we work for you. We leverage a network of specialized marine insurers to:

- Access to Multiple Carriers: We shop the market to find the best coverage at a competitive price.

- Provide Expert Advice: We understand marine risks and can explain complex policies, identify gaps, and recommend endorsements.

- Customize Your Policy: We build a policy that fits your exact needs, so you’re not overpaying or underinsured.

- Assist with Claims: If an incident occurs, we act as your advocate to ensure a fair and prompt resolution.

We’re on your side, committed to finding solutions that protect your business. For more on how we support the outdoor community, you can sometimes find interesting initiatives, like those at Did you win?.

Frequently Asked Questions about Texas Guide Insurance

We often hear similar questions from fishing guides across Texas. Let’s address some of the most common ones to further clarify the complexities of Texas fishing guide insurance.

Are there specific Texas state requirements for fishing guide insurance?

While Texas has no single state law mandating insurance for all guides, it’s often required in practice:

- TPWD & Park Rules: The Texas Parks and Wildlife Department (TPWD), as well as many marinas and parks, require commercial operators to show proof of liability insurance (often $1M or more).

- U.S. Coast Guard (USCG) Licensing: Operating on navigable waters requires a USCG Captain’s License. While the license doesn’t mandate insurance, it implies a higher standard of care, making liability coverage essential to protect your license and assets.

- Practical Necessity: Carrying high liability limits is a practical necessity to protect your business from a potentially devastating lawsuit.

The bottom line is that operational realities make insurance a requirement for any responsible guide business. For general information on whether boat insurance is required, you can check out Is boat insurance required?.

Does this insurance cover all types of fishing guides?

Yes, specialized Texas fishing guide insurance programs are designed to be adaptable and can cover a wide array of fishing guide operations, but it’s important to ensure your specific activities are endorsed on your policy:

- Saltwater Guides: Whether you’re chasing redfish in the bays or heading offshore for snapper and kingfish, policies can be custom for coastal and offshore operations.

- Freshwater Guides: Guides specializing in bass fishing on Texas’s legendary lakes (Fork, Sam Rayburn, Toledo Bend) or catfishing on rivers like the Trinity are fully covered.

- Fly Fishing Guides: These policies can cover the unique risks associated with fly fishing, often including shoreside and wade fishing liability.

- Kayak Fishing Guides: Guiding clients from kayaks presents distinct risks, and policies can be structured to include these operations.

- Wade Fishing Guides: As discussed, specialized endorsements for wade fishing liability are crucial for guides who lead clients off the boat and into the water.

The key is to be completely transparent about all the activities you offer when discussing your needs with your independent marine insurance agent. This allows us to ensure every aspect of your guide service is properly insured.

What is Protection & Indemnity (P&I) and why is it crucial?

Protection & Indemnity (P&I) is arguably the most crucial component of a comprehensive Texas fishing guide insurance policy. It is the broadest form of marine liability insurance, specifically designed for the unique risks of operating a vessel.

Here’s why P&I is so vital:

- Passenger Injury: This is paramount for guides. P&I covers your legal liability for injuries or deaths sustained by your paying passengers (clients).

- Crew Coverage: If you have a first mate or deckhand, P&I can cover their injuries incurred while working on your vessel.

- Damage to Other Vessels or Docks: If your boat collides with another vessel or a dock, P&I covers the damage you are legally liable for.

- Wreck Removal: P&I can cover the substantial costs associated with removing your boat if it sinks and becomes a hazard.

- Legal Defense Costs: P&I policies include coverage for legal defense costs, which can be enormous even if you are ultimately found not liable.

Standard liability policies have significant gaps that P&I is designed to fill, providing the comprehensive protection needed for the unique challenges of guiding on the water.

Secure Your Texas Guiding Business for the Future

Your passion for guiding in Texas deserves to be protected. Texas fishing guide insurance is a fundamental investment in the security of your livelihood. A specialized policy safeguards your boat and gear, shields you from liability, and provides the peace of mind to focus on your clients.

Navigating marine insurance can be complex. As independent marine insurance brokers, we at On The Water Marine simplify the process. We partner with you, using our expertise and access to top-rated carriers to find the most comprehensive coverage at the best price.

Don’t let an unforeseen event put your dream at risk. Secure your Texas fishing guide insurance today to ensure your business thrives for years to come.

Ready to protect your passion and your business? Get a Quote from On The Water Marine and let us help you chart a course to comprehensive coverage.

Related Articles

Why Most Miami Boat Owners Don’t Find Coverage Problems Until It’s Too Late Boat insurance Miami Florida is often misunderstood until the moment a claim is [...]

Why Marine Guide Insurance Requires a Different Approach Than Personal Yacht Coverage Marine guide insurance can be specialized commercial coverage designed for professional operators who take [...]

Introduction: The Misconception of “Standard” Coverage Boat insurance Fort Myers is not a single product. It’s a collection of policy structures, coverage limits, and exclusions that [...]